Region:Middle East

Author(s):Dev

Product Code:KRAC1272

Pages:87

Published On:December 2025

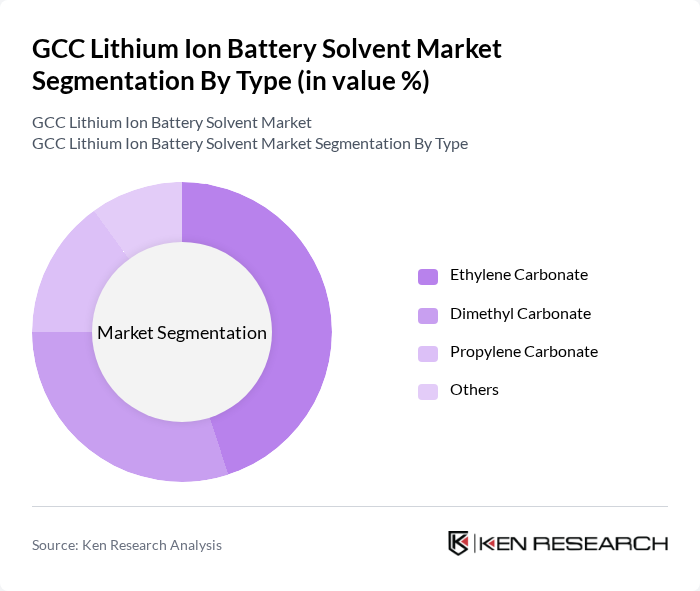

By Type:The market is segmented into various types of solvents used in lithium-ion batteries, including Ethylene Carbonate, Dimethyl Carbonate, Propylene Carbonate, and others. Ethylene Carbonate is currently the leading sub-segment due to its high dielectric constant and ability to dissolve lithium salts effectively, making it essential for battery performance. Dimethyl Carbonate follows closely, favored for its low toxicity and environmental benefits. The demand for these solvents is driven by the increasing production of electric vehicles and energy storage systems.

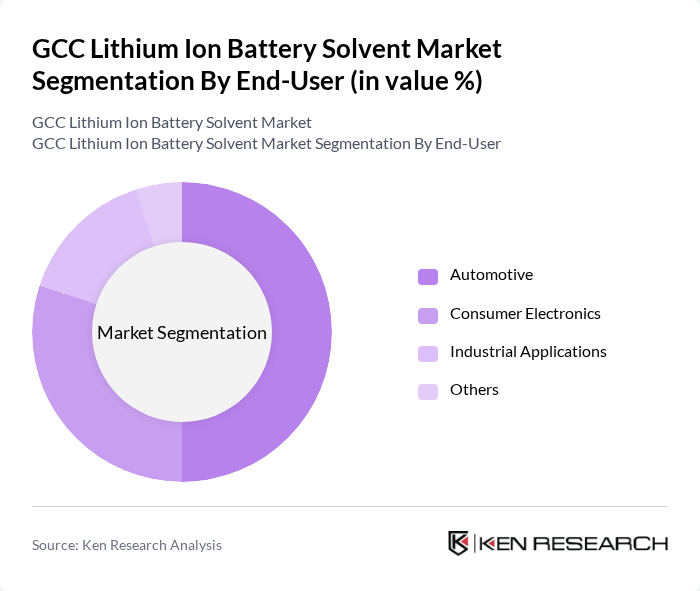

By End-User:The end-user segmentation includes Automotive, Consumer Electronics, Industrial Applications, and others. The automotive sector is the dominant end-user, driven by the rapid adoption of electric vehicles (EVs) and the need for efficient energy storage solutions. Consumer electronics also represent a significant portion of the market, as the demand for portable devices continues to rise. Industrial applications are growing, particularly in sectors requiring reliable energy storage systems.

The GCC Lithium Ion Battery Solvent Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Mitsubishi Chemical Corporation, LG Chem, Solvay S.A., Eastman Chemical Company, Samsung SDI, Dow Chemical Company, Asahi Kasei Corporation, 3M Company, Albemarle Corporation, KMG Chemicals, Jiangsu Jiujiujiu Chemical Co., Ltd., Shandong Dongda Chemical Group, Zhejiang Jianye Chemical Co., Ltd., Yancheng Shunda Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC lithium-ion battery solvent market appears promising, driven by technological innovations and a shift towards sustainable practices. The demand for high-energy-density batteries is expected to increase, with Ethyl Methyl Carbonate (EMC) projected to achieve rapid growth. Additionally, energy storage systems (ESS) are anticipated to account for 20 percent of solvent consumption by future, reflecting the region's commitment to renewable energy and battery storage solutions. This evolving landscape presents significant opportunities for market participants.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Carbonate Dimethyl Carbonate Propylene Carbonate Others |

| By End-User | Automotive Consumer Electronics Industrial Applications Others |

| By Application | Energy Storage Systems Electric Vehicles Portable Electronics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Saudi Arabia UAE Qatar Others |

| By Chemical Composition | Organic Solvents Inorganic Solvents Others |

| By Regulatory Compliance | REACH Compliance OSHA Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 150 | Production Managers, R&D Directors |

| Chemical Suppliers for Battery Solvents | 100 | Procurement Managers, Sales Directors |

| Automotive Industry Stakeholders | 80 | Product Development Engineers, Supply Chain Managers |

| Regulatory Bodies and Compliance Experts | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions and Academia | 70 | Research Scientists, Professors in Chemical Engineering |

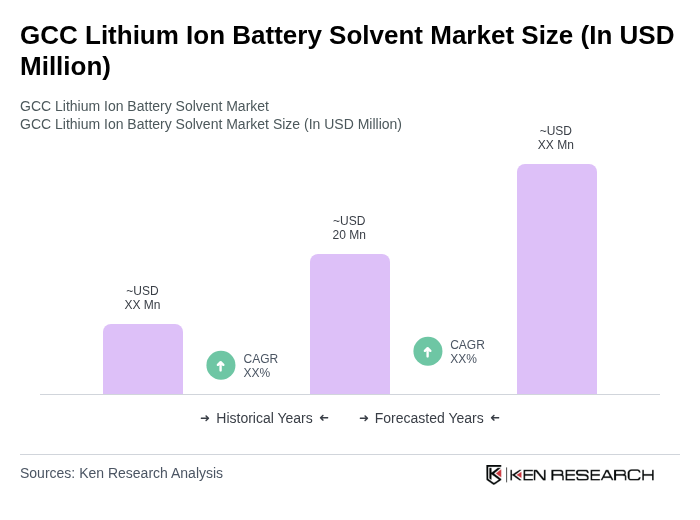

The GCC Lithium Ion Battery Solvent Market is currently valued at approximately USD 20 million, reflecting a robust demand driven by the rapid adoption of electric vehicles and renewable energy storage solutions in the region.