Region:Middle East

Author(s):Rebecca

Product Code:KRAC2474

Pages:98

Published On:October 2025

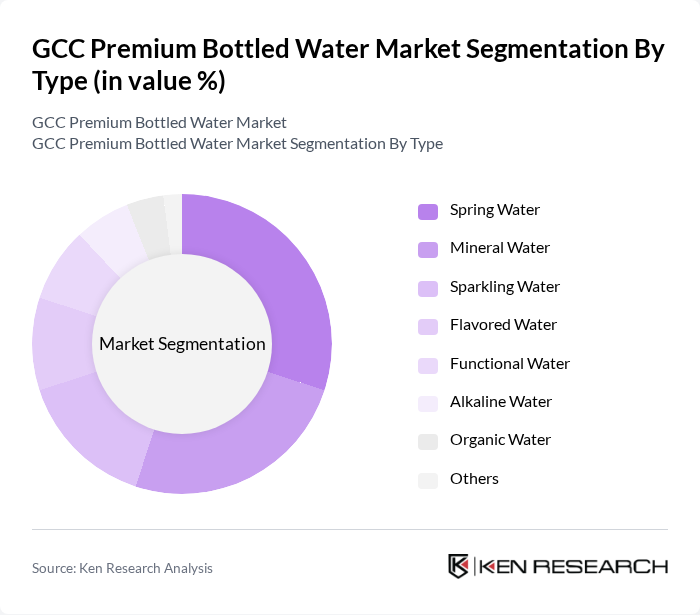

By Type:The market is segmented into various types of bottled water, including Spring Water, Mineral Water, Sparkling Water, Flavored Water, Functional Water, Alkaline Water, Organic Water, and Others. Among these, Spring Water and Mineral Water remain the most popular due to their natural sourcing, mineral content, and perceived health benefits. The demand for Sparkling and Flavored Water is also on the rise, driven by changing consumer preferences for healthier and more diverse beverage options, as well as the influence of Western lifestyle trends and the growing presence of international brands in the region .

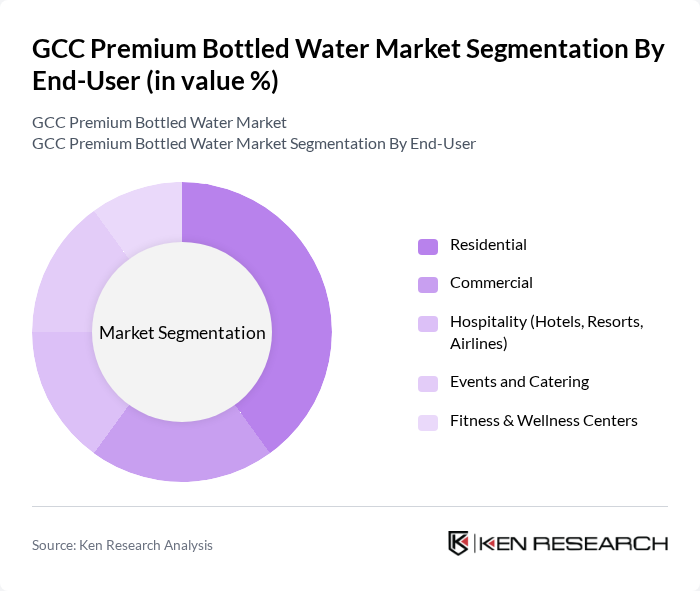

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality (Hotels, Resorts, Airlines), Events and Catering, and Fitness & Wellness Centers. The Residential segment leads the market, driven by increasing health awareness, convenience, and the growing trend of home delivery services for premium bottled water. The Hospitality sector is also significant, as hotels, resorts, and upscale restaurants increasingly offer premium bottled water to enhance guest experiences and align with luxury positioning. Fitness & Wellness Centers are a fast-growing segment, reflecting the region's rising focus on healthy lifestyles and hydration .

The GCC Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters, The Coca-Cola Company, PepsiCo, Inc., Al Ain Water (Agthia Group PJSC), Masafi Co. LLC, Oasis Pure Water LLC, Mai Dubai LLC, Evian (Danone S.A.), Fiji Water Company LLC, Voss of Norway AS, San Pellegrino (Nestlé Waters), Perrier (Nestlé Waters), Acqua Panna (Nestlé Waters), Svalbardi Polar Iceberg Water, Smartwater (The Coca-Cola Company), Al Bayan Water, Nova Water (Health Water Bottling Co. Ltd.), Barakat Quality Plus, Rayyan Mineral Water Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC premium bottled water market is poised for continued growth, driven by evolving consumer preferences and increasing health awareness. As disposable incomes rise, consumers are expected to gravitate towards premium offerings, particularly flavored and functional waters. Additionally, the shift towards sustainable practices will likely influence product development, with brands focusing on eco-friendly packaging solutions. The expansion of e-commerce platforms will further enhance market accessibility, allowing brands to reach a broader audience and capitalize on emerging trends in the beverage sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Spring Water Mineral Water Sparkling Water Flavored Water Functional Water Alkaline Water Organic Water Others |

| By End-User | Residential Commercial Hospitality (Hotels, Resorts, Airlines) Events and Catering Fitness & Wellness Centers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Home Delivery On-Trade (Hotels, Restaurants, Cafés) Vending Machines |

| By Packaging Type | Plastic Bottles Glass Bottles Tetra Packs Cans |

| By Price Range | Premium Mid-Range Economy |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Premium Bottled Water | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Channels Analysis | 60 | Retail Managers, Category Buyers |

| Market Trends in Eco-friendly Packaging | 50 | Sustainability Officers, Product Managers |

| Impact of Pricing Strategies on Consumer Choices | 70 | Marketing Executives, Brand Managers |

| Health and Wellness Influences on Bottled Water Consumption | 40 | Nutritionists, Wellness Coaches |

The GCC Premium Bottled Water Market is valued at approximately USD 3.7 billion, driven by increasing health consciousness, rising disposable incomes, and a growing preference for premium hydration options among consumers in the region.