Region:Middle East

Author(s):Rebecca

Product Code:KRAC2469

Pages:82

Published On:October 2025

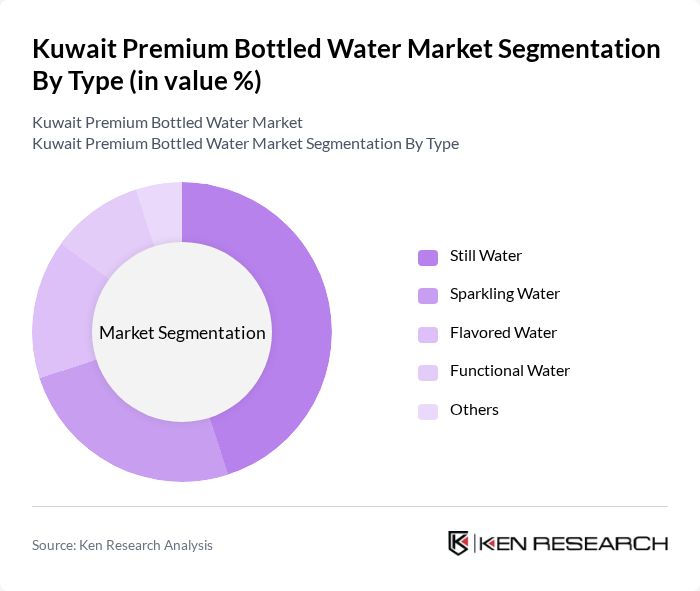

By Type:The market is segmented into various types of bottled water, including Still Water, Sparkling Water, Flavored Water, Functional Water, and Others. Among these, Still Water is the most popular choice among consumers due to its versatility and widespread availability. Sparkling Water has also gained traction, particularly among younger consumers seeking alternatives to sugary beverages. Flavored and Functional Waters are emerging segments, driven by health trends and consumer preferences for enhanced hydration options.

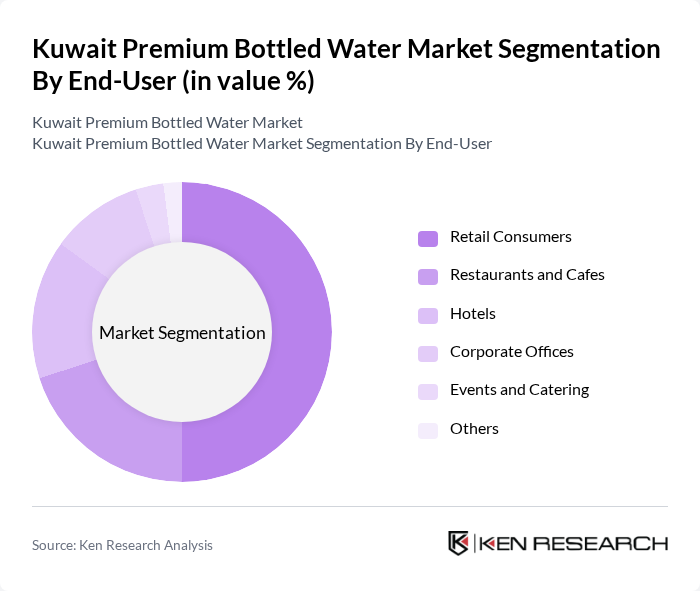

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Hotels, Corporate Offices, Events and Catering, and Others. Retail Consumers dominate the market, driven by the increasing trend of purchasing bottled water for personal use. Restaurants and Cafes are also significant contributors, as they often offer premium bottled water as part of their beverage selections. Hotels and Corporate Offices follow closely, catering to guests and employees who prefer high-quality hydration options.

The Kuwait Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Water, Masafi, Nestlé Waters, Acqua Panna, Evian, Perrier, Al Waha Water, Al Jazeera Water, Al Khaleej Water, Oasis Water, Almarai, Al Sulaimi Group, Al Mufeed Water, Al Qusai Water, Al Badr Water, Al Safi Danone, Al Rawdatain Water Bottling Co., New Technology Bottling Company (NTBC) KSCC, Crystal Mineral Water & Refreshments LLC, Americana Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait premium bottled water market appears promising, driven by increasing health consciousness and urbanization trends. As consumers continue to prioritize health and wellness, the demand for premium bottled water is expected to rise significantly. Additionally, advancements in eco-friendly packaging and innovative product offerings will likely enhance market appeal. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture a larger share of the market in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Water Sparkling Water Flavored Water Functional Water Others |

| By End-User | Retail Consumers Restaurants and Cafes Hotels Corporate Offices Events and Catering Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Vending Machines Direct Sales Foodservice Channels Others |

| By Packaging Type | PET Bottles Glass Bottles Metal Cans Tetra Packs Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands Others |

| By Region | Urban Areas Rural Areas Tourist Destinations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Premium Bottled Water | 100 | Health-conscious Consumers, Young Professionals |

| Retail Distribution Insights | 60 | Retail Managers, Category Buyers |

| Market Trends and Innovations | 50 | Product Development Managers, Marketing Executives |

| Environmental Impact Perceptions | 40 | Sustainability Advocates, Environmental Scientists |

| Health and Wellness Expert Opinions | 40 | Nutritionists, Fitness Trainers |

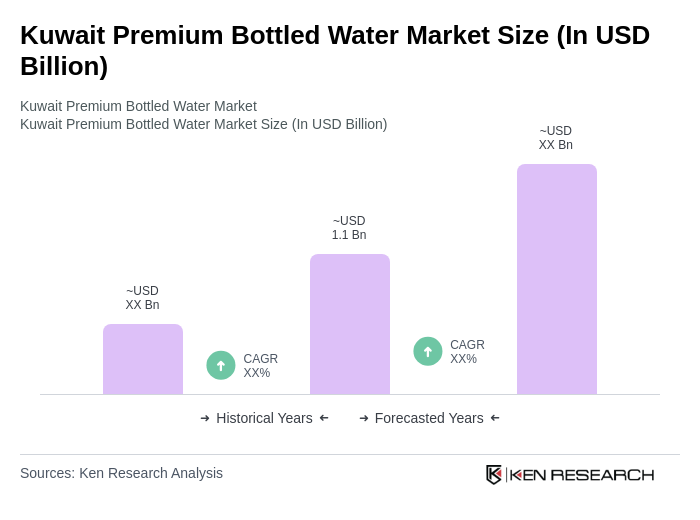

The Kuwait Premium Bottled Water Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by health consciousness, rising disposable incomes, and a preference for premium products among consumers.