Region:Middle East

Author(s):Rebecca

Product Code:KRAD1366

Pages:81

Published On:November 2025

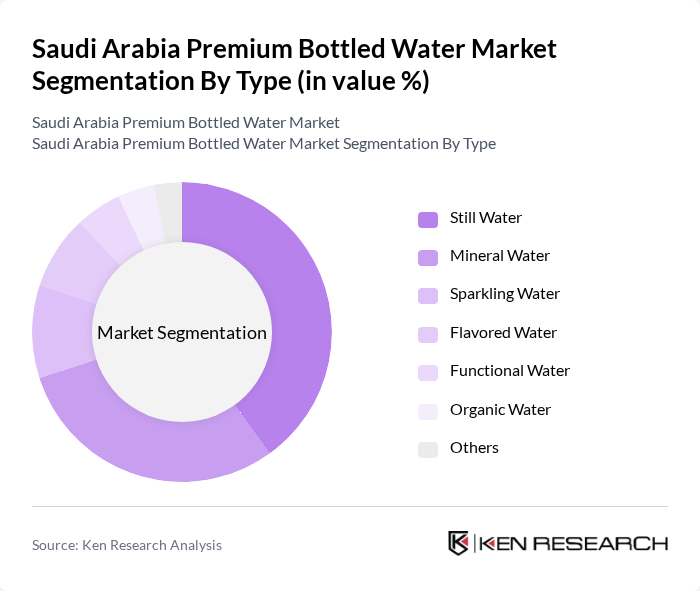

By Type:The market is segmented into various types of bottled water, including Still Water, Mineral Water, Sparkling Water, Flavored Water, Functional Water, Organic Water, and Others. Among these, Still Water and Mineral Water are the most popular choices among consumers due to their perceived health benefits and availability. The demand for Flavored and Functional Water is also on the rise, driven by health trends and consumer preferences for enhanced hydration options. Functional waters infused with electrolytes, vitamins, and natural minerals are becoming increasingly popular among fitness-conscious individuals and wellness-focused consumers.

By End-User:The end-user segmentation includes Residential, HORECA (Hotels, Restaurants, Cafés), Corporate/Offices, Healthcare & Wellness Facilities, and Others. The Residential segment holds a significant share as consumers increasingly prefer bottled water for home consumption. The HORECA sector is also a major contributor, driven by the growing hospitality industry and the demand for premium offerings in restaurants and hotels.

The Saudi Arabia Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nova Water, Nestlé Waters (Nestlé Pure Life, S.Pellegrino, Perrier), Almarai (including Ival, Oska), Maeen Water, Agthia Group (Al Ain Water, Al Bayan), Masafi, Al Jomaih Bottling Plants (Aquafina), Berain Water, Al Safi Danone, Evian, Aqua Panna, Badoit, Oasis, Hana Water, Zain Water contribute to innovation, geographic expansion, and service delivery in this space. Recent consolidation activities, including Almarai's acquisition of Pure Beverages for Saudi Riyal 1.04 billion, exemplify strategic market positioning and portfolio diversification to enhance distribution networks and product offerings.

The Saudi Arabia premium bottled water market is poised for significant growth, driven by evolving consumer preferences and increasing health awareness. As urbanization continues, the demand for convenient, high-quality hydration options will rise. Companies are likely to focus on innovative product offerings, including flavored and functional waters, to capture the attention of health-conscious consumers. Additionally, the expansion of e-commerce platforms will facilitate easier access to premium bottled water, further enhancing market growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Water Mineral Water Sparkling Water Flavored Water Functional Water (e.g., vitamin-enriched, electrolyte, alkaline) Organic Water Others (e.g., artesian, glacier water) |

| By End-User | Residential HORECA (Hotels, Restaurants, Cafés) Corporate/Offices Healthcare & Wellness Facilities Others |

| By Packaging Type | PET Bottles Glass Bottles Cans Cartons Others (e.g., pouches, eco-packaging) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail HORECA Distribution Vending Machines Others |

| By Region | Central Region (Riyadh, Qassim, etc.) Eastern Region (Dammam, Al Khobar, etc.) Western Region (Jeddah, Makkah, Madinah, etc.) Southern Region (Asir, Jazan, etc.) |

| By Price Range | Luxury/Premium Mid-range Economy Others |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche/Functional Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Bottled Water | 150 | Health-conscious Consumers, Regular Bottled Water Buyers |

| Retail Distribution Insights | 100 | Retail Managers, Category Buyers |

| Market Trends in Premium Bottled Water | 80 | Industry Analysts, Market Researchers |

| Brand Perception Studies | 70 | Marketing Executives, Brand Managers |

| Health and Wellness Impact Assessments | 60 | Nutritionists, Fitness Trainers |

The Saudi Arabia Premium Bottled Water Market is valued at approximately USD 615 million, reflecting a significant growth trend driven by health consciousness, rising disposable incomes, and a preference for premium products among consumers.