Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8266

Pages:98

Published On:November 2025

By Product Type:The product type segmentation includes various categories such as Still Water, Mineral Water, Sparkling Water, Flavored Water, Functional Water (e.g., Alkaline, Electrolyte-enhanced), Purified Water, and Others. Among these, Still Water and Mineral Water are the most popular due to their widespread availability and consumer preference for natural hydration options. The demand for Functional Water is also rising as consumers seek added health benefits.

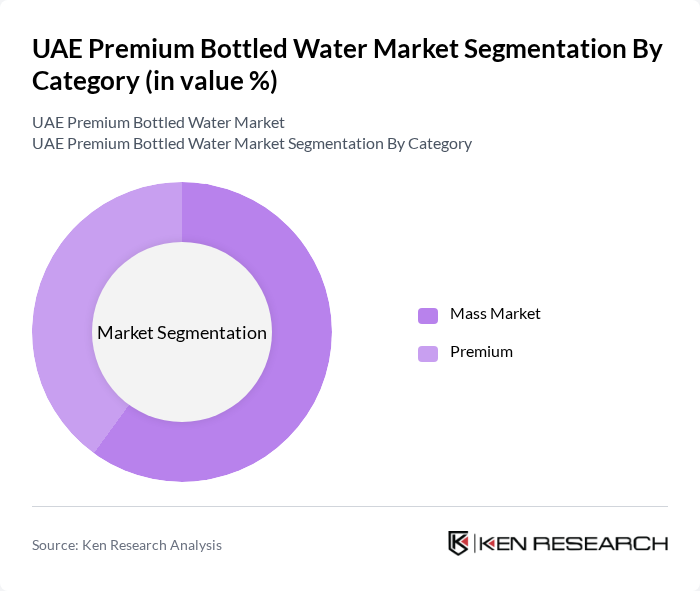

By Category:The market is segmented into Mass Market and Premium categories. The Premium segment is gaining traction as consumers increasingly prioritize quality and health benefits over price. This shift is driven by a growing awareness of the importance of hydration and the perceived value of premium bottled water brands, which often emphasize natural sourcing and health-enhancing properties. Approximately 30 percent of market growth is based on sustainable and high-end versions, with 60 percent of consumers demanding ESG-compliant products.

The UAE Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Pure Life, Al Ain Water (Agthia Group PJSC), Masafi LLC, Mai Dubai LLC, Evian (Danone), Perrier (Nestlé Waters), Voss Water, Fiji Water, San Pellegrino (Nestlé Waters), Volvic (Danone), Icelandic Glacial, Crystal Geyser, Smartwater (The Coca-Cola Company), Dasani (The Coca-Cola Company), Barakat Quality Plus contribute to innovation, geographic expansion, and service delivery in this space.

The UAE premium bottled water market is poised for continued growth, driven by evolving consumer preferences towards health and wellness. As urbanization accelerates, the demand for convenient, high-quality hydration options will rise. Additionally, the integration of technology in distribution and marketing strategies will enhance consumer engagement. Companies that prioritize sustainability and eco-friendly practices are likely to gain a competitive edge, aligning with the increasing consumer focus on environmental responsibility and health-conscious choices.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Still Water Mineral Water Sparkling Water Flavored Water Functional Water (e.g., Alkaline, Electrolyte-enhanced) Purified Water Others |

| By Category | Mass Market Premium |

| By Packaging Format | PET Bottles Glass Bottles Metal Cans Cartons (Tetra Pak, Bioplastics, etc.) Others |

| By Distribution Channel | Hypermarkets & Supermarkets Convenience Stores Home & Office Delivery (HOD) On-Trade (Hotels, Restaurants, Cafés) Online Retail Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Price Range | Premium Mid-range Economy Others |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Premium Bottled Water | 120 | Health-conscious Consumers, Urban Professionals |

| Retail Distribution Insights | 60 | Retail Managers, Category Buyers |

| Market Trends in Bottled Water Consumption | 50 | Market Analysts, Industry Experts |

| Brand Perception Studies | 40 | Brand Managers, Marketing Executives |

| Environmental Impact Awareness | 40 | Sustainability Advocates, Environmental Scientists |

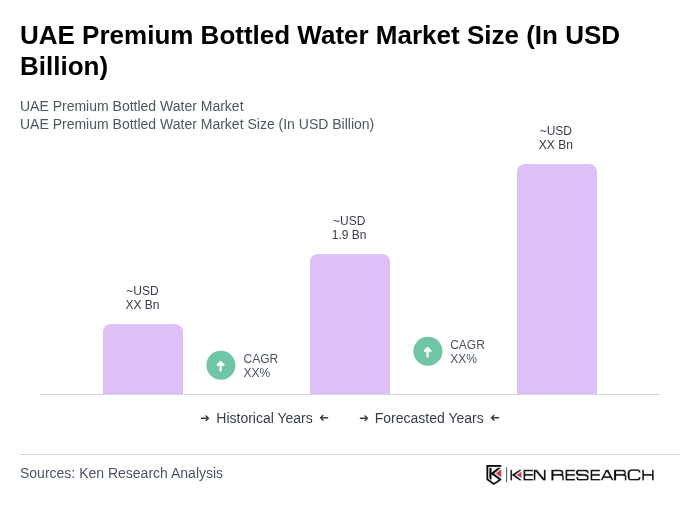

The UAE Premium Bottled Water Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by health consciousness, premiumization trends, and increasing demand for high-quality bottled water products among consumers.