Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8272

Pages:89

Published On:November 2025

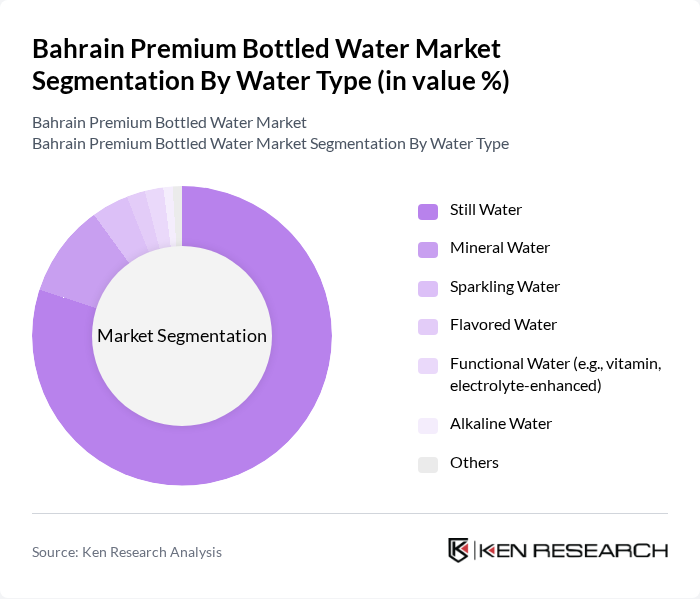

By Water Type:The market is segmented into various water types, including Still Water, Mineral Water, Sparkling Water, Flavored Water, Functional Water, Alkaline Water, and Others. Among these, Still Water is the most dominant segment, accounting for the majority of market volume due to its widespread acceptance and preference among consumers for everyday hydration. Mineral Water follows, appealing to health-conscious individuals seeking natural minerals. The demand for Sparkling and Flavored Water is also rising, particularly among younger consumers seeking variety and taste in their hydration choices.

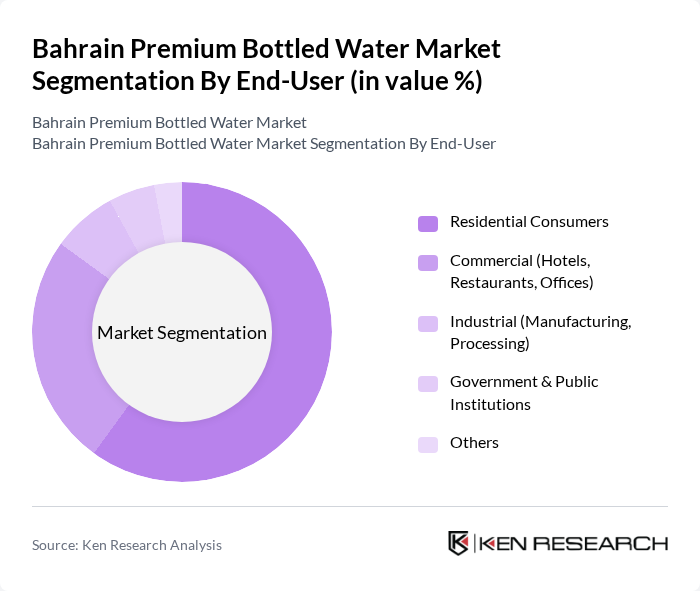

By End-User:The market is categorized into Residential Consumers, Commercial (Hotels, Restaurants, Offices), Industrial (Manufacturing, Processing), Government & Public Institutions, and Others. The Residential Consumers segment leads the market, driven by the increasing trend of home delivery services, heightened concerns about tap water quality, and growing awareness of health and wellness. Commercial establishments also represent a significant portion, as hotels and restaurants seek premium bottled water options to enhance their service offerings.

The Bahrain Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters, Al Ain Water, Bahrain Water Bottling Company, Aqua Cool Bahrain, Almarai Company, Masafi, Perrier, Evian, Fiji Water, Voss Water, San Pellegrino, Dasani (The Coca-Cola Company), Aquafina (PepsiCo), Arwa Water, Blue Water Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain premium bottled water market appears promising, driven by evolving consumer preferences and a focus on sustainability. As health and wellness trends continue to gain traction, brands that emphasize quality and eco-friendly practices are likely to thrive. Additionally, the integration of technology in distribution and marketing strategies will enhance consumer engagement, paving the way for innovative product offerings that cater to the growing demand for premium bottled water in the region.

| Segment | Sub-Segments |

|---|---|

| By Water Type | Still Water Mineral Water Sparkling Water Flavored Water Functional Water (e.g., vitamin, electrolyte-enhanced) Alkaline Water Others |

| By End-User | Residential Consumers Commercial (Hotels, Restaurants, Offices) Industrial (Manufacturing, Processing) Government & Public Institutions Others |

| By Packaging Type | PET Bottles Glass Bottles Cartons (Tetra Pak and similar) Aluminum Cans Composite Materials Others |

| By Packaging Size | Up to 500ml ml – 1L L – 2L Above 2L |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Grocery Shops Online Retail & E-commerce Direct Sales & Home Delivery On-Trade Channels (Restaurants, Cafes) Others |

| By Brand Positioning | Premium Brands Mid-range Brands Budget Brands Niche Brands Others |

| By Packaging Material Composition | Recycled PET (rPET) Virgin PET Glass Composite Materials Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bottled Water Sales | 50 | Store Managers, Category Buyers |

| Consumer Preferences in Bottled Water | 120 | General Consumers, Health-Conscious Shoppers |

| Distribution Channel Insights | 100 | Logistics Coordinators, Supply Chain Managers |

| Brand Loyalty and Marketing Effectiveness | 80 | Marketing Executives, Brand Managers |

| Environmental Impact Awareness | 40 | Sustainability Advocates, Eco-conscious Consumers |

The Bahrain Premium Bottled Water Market is valued at approximately USD 40 million, reflecting a growing trend driven by health consciousness, rising disposable incomes, and urbanization among consumers seeking convenient hydration solutions.