Global Premium Bottled Water Market Overview

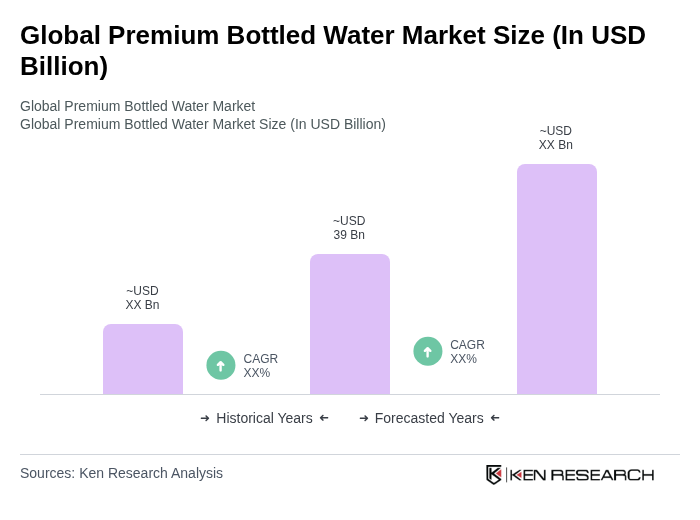

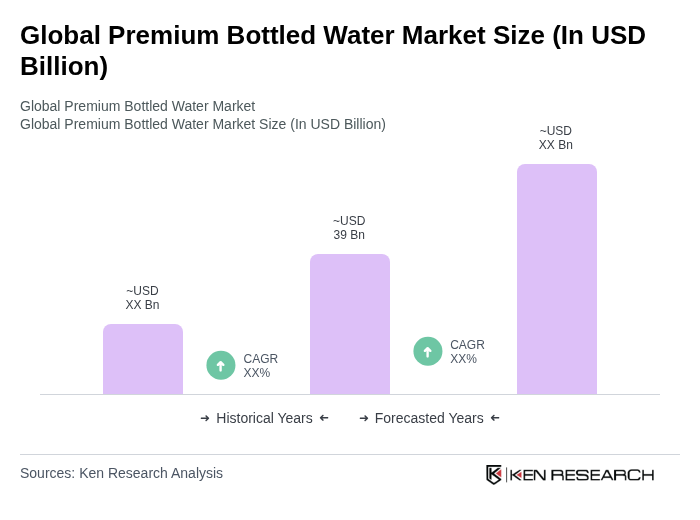

- The Global Premium Bottled Water Market is valued at USD 39 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, rising disposable incomes, and a growing preference for premium products. The demand for high-quality bottled water, particularly in urban areas, has surged as consumers seek healthier hydration options. Innovations in packaging, functional enhancements such as added electrolytes and vitamins, and the expansion of retail and e-commerce channels further accelerate market adoption.

- Key players in this market include the United States, Germany, and Japan, which dominate due to their strong distribution networks, high consumer spending on premium products, and established brands. Europe accounts for over one-third of global consumption, led by France, Italy, and Germany, while North America focuses on functional, vitamin-enriched, and sustainable bottled water. Asia Pacific demonstrates rapid growth in urban centers, driven by rising disposable incomes and lifestyle awareness.

- In 2023, the European Union implemented Directive (EU) 2019/904 on the reduction of the impact of certain plastic products on the environment, issued by the European Parliament and Council. This regulation mandates that all bottled water companies use at least 25% recycled plastic in their PET bottles by 2025, promoting sustainability and reducing environmental impact across the industry. The directive requires operational compliance in sourcing, labeling, and reporting recycled content for all bottled water producers targeting the EU market.

Global Premium Bottled Water Market Segmentation

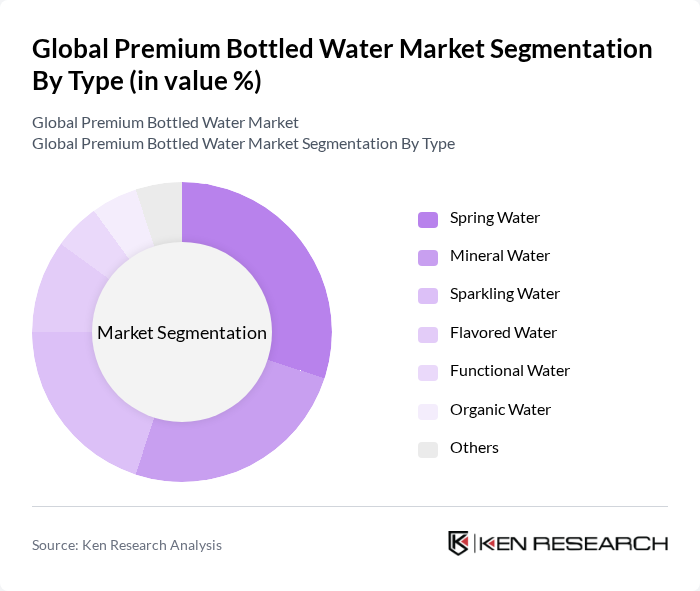

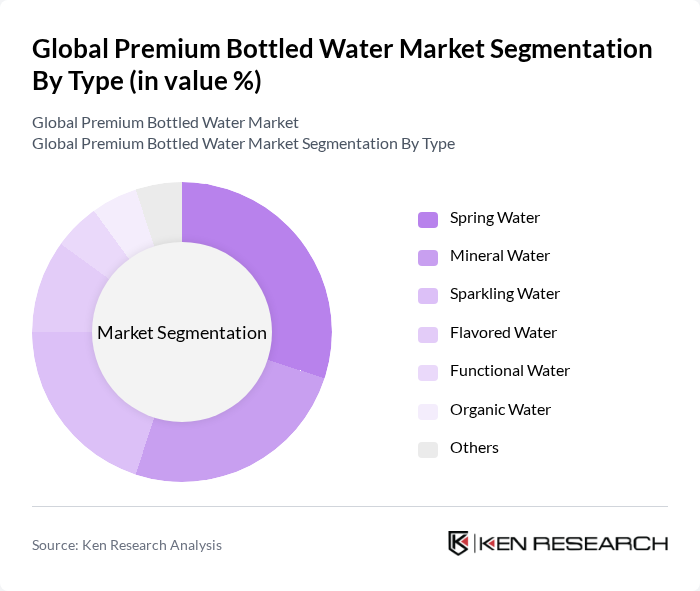

By Type:The premium bottled water market is segmented into Spring Water, Mineral Water, Sparkling Water, Flavored Water, Functional Water, Organic Water, and Others. Spring Water and Mineral Water remain the most popular segments, favored for their natural sourcing and perceived health benefits. Sparkling Water continues to gain traction as consumers seek alternatives to sugary beverages, with functional and flavored water segments expanding due to demand for added health benefits and unique taste profiles.

By End-User:The market is also segmented by end-user categories, including Residential, Commercial, Hospitality, Sports and Fitness, Events and Catering, and Others. The Residential segment leads, driven by increasing health awareness and the convenience of bottled water at home. The Commercial segment is significant, as businesses and hospitality venues prioritize premium hydration options for clients and guests. Sports and Fitness, as well as Events and Catering, are emerging segments due to the growing focus on wellness and premium experiences.

Global Premium Bottled Water Market Competitive Landscape

The Global Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters, The Coca-Cola Company, PepsiCo, Inc., Danone S.A., Fiji Water Company, LLC, Evian (Danone S.A.), Voss of Norway AS, San Pellegrino (Nestlé Waters), Aquafina (PepsiCo, Inc.), Perrier (Nestlé Waters), Smartwater (The Coca-Cola Company), Poland Spring (Nestlé Waters), LaCroix (National Beverage Corp.), Hint, Inc., Spindrift Beverage Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Premium Bottled Water Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The global trend towards health and wellness is driving the premium bottled water market, with consumers increasingly prioritizing hydration. In future, the World Health Organization reported that 60% of adults are actively seeking healthier beverage options. This shift is reflected in the bottled water sector, where sales of premium brands have surged, with a notable increase of 15 million units sold in the last year alone, indicating a robust demand for health-oriented products.

- Rising Demand for Natural and Mineral Water:The preference for natural and mineral water is significantly influencing market dynamics. In future, the global consumption of natural mineral water reached approximately 200 billion liters, with premium brands capturing a substantial share. This trend is supported by a growing awareness of the health benefits associated with mineral-rich water, leading to a 20% increase in sales for premium bottled water brands over the past year, as consumers seek quality and authenticity in their hydration choices.

- Expansion of Distribution Channels:The expansion of distribution channels is facilitating greater access to premium bottled water. In future, e-commerce sales in the beverage sector are projected to exceed $50 billion, with bottled water accounting for a significant portion. Retailers are increasingly adopting multi-channel strategies, including online platforms and subscription services, which have contributed to a 30% increase in market penetration for premium bottled water brands, enhancing consumer accessibility and convenience.

Market Challenges

- Environmental Concerns Regarding Plastic Waste:The bottled water industry faces significant scrutiny over plastic waste, with an estimated 300 million tons of plastic produced annually. In future, environmental organizations reported that only 9% of plastic waste is recycled, leading to increased regulatory pressure on brands to adopt sustainable practices. This challenge is prompting premium bottled water companies to innovate in packaging, yet the transition remains costly and complex, impacting profit margins.

- Intense Competition from Local Brands:The premium bottled water market is characterized by intense competition, particularly from local brands that often offer lower prices. In future, local brands captured approximately 40% of the market share, leveraging regional sourcing and consumer loyalty. This competitive landscape poses challenges for established premium brands, which must differentiate themselves through quality and marketing strategies to maintain their market position amidst rising local alternatives.

Global Premium Bottled Water Market Future Outlook

The future of the premium bottled water market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are expected to innovate with functional beverages that offer added health benefits. Additionally, the shift towards sustainable practices will likely accelerate, with companies investing in eco-friendly packaging solutions. The integration of digital platforms for sales and marketing will further enhance consumer engagement, positioning the market for sustained growth in the coming years.

Market Opportunities

- Growth in E-commerce and Online Sales:The surge in e-commerce presents a significant opportunity for premium bottled water brands. With online sales projected to grow by 25% in future, companies can leverage digital marketing strategies to reach a broader audience. This shift allows brands to enhance customer engagement and streamline distribution, ultimately driving sales and brand loyalty in a competitive market.

- Innovations in Packaging Solutions:Innovations in sustainable packaging are creating new opportunities for premium bottled water brands. In future, the market for biodegradable and recyclable packaging is expected to grow by 15%, driven by consumer demand for environmentally friendly products. Brands that invest in innovative packaging solutions can differentiate themselves, attract eco-conscious consumers, and enhance their market presence while addressing environmental concerns.