Region:Asia

Author(s):Rebecca

Product Code:KRAC2526

Pages:99

Published On:October 2025

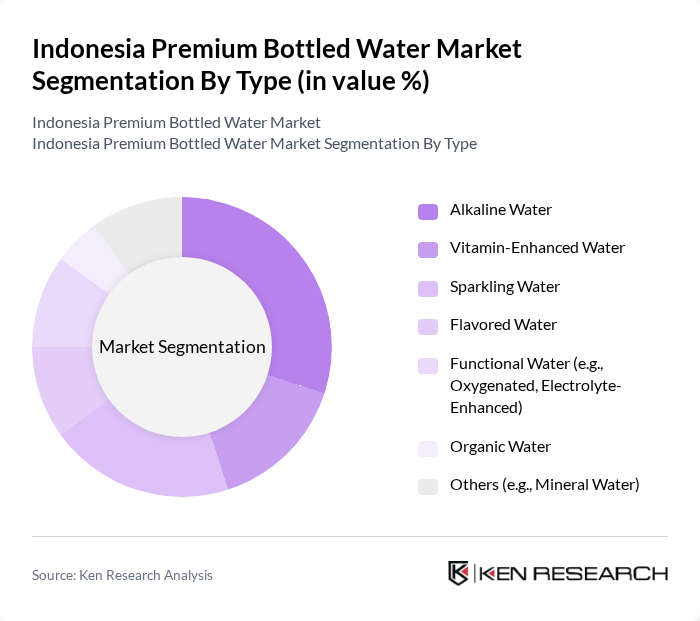

By Type:The market is segmented into various types of bottled water, including Alkaline Water, Vitamin-Enhanced Water, Sparkling Water, Flavored Water, Functional Water (e.g., Oxygenated, Electrolyte-Enhanced), Organic Water, and Others (e.g., Mineral Water). Among these, Alkaline Water has gained significant traction due to its perceived health benefits, while Sparkling Water is popular for its refreshing taste and is often consumed in social settings. The premium and functional water segment has experienced notable growth, with functional waters containing electrolytes, minerals, or vitamins becoming particularly popular in urban areas, representing approximately 10% of bottled water sales in the premium category.

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, and Events and Catering. The Residential segment is the largest due to the increasing trend of health-conscious consumers opting for premium bottled water at home. The Commercial sector is also growing, driven by businesses providing premium water options to employees and clients. The Indonesian bottled water market primarily serves residential, office, commercial, and hospitality sectors, offering clean drinking water solutions across urban and rural areas with extensive distribution networks ensuring widespread availability.

The Indonesia Premium Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Sariguna Primatirta (SuperO2, Vio8+), Pristine 8.6+, Aqua Danone, Nestle Waters Indonesia, Coca-Cola Amatil Indonesia, Sinar Sosro, Tirta Investama, Kangen Water Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the premium bottled water market in Indonesia appears promising, driven by evolving consumer preferences and increasing health awareness. As urbanization continues, the demand for convenient and high-quality hydration options is expected to rise. Additionally, innovations in product offerings, such as flavored and functional waters, will likely attract health-conscious consumers. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Alkaline Water Vitamin-Enhanced Water Sparkling Water Flavored Water Functional Water (e.g., Oxygenated, Electrolyte-Enhanced) Organic Water Others (e.g., Mineral Water) |

| By End-User | Residential Commercial Hospitality Events and Catering |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Vending Machines |

| By Packaging Type | Plastic Bottles Glass Bottles Tetra Packs |

| By Price Range | Premium Mid-range Economy |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Premium Bottled Water | 120 | Health-conscious Consumers, Urban Dwellers |

| Retail Distribution Channels | 60 | Retail Managers, Store Owners |

| Market Trends and Innovations | 50 | Industry Analysts, Product Development Managers |

| Environmental Impact Awareness | 40 | Sustainability Advocates, Eco-conscious Consumers |

| Brand Loyalty and Marketing Effectiveness | 45 | Marketing Professionals, Brand Managers |

The Indonesia Premium Bottled Water Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing health consciousness, urbanization, and a demand for high-quality drinking water among consumers.