Germany Baby Food and Infant Formula Market Overview

- The Germany Baby Food and Infant Formula Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing awareness among parents regarding the nutritional needs of infants, coupled with a rise in disposable income, which allows families to invest in premium baby food products. The market has also seen a surge in demand for organic and specialty products, reflecting changing consumer preferences.

- Key cities such as Berlin, Munich, and Hamburg dominate the market due to their high population density and affluent consumer base. These urban centers are characterized by a higher concentration of young families and a growing trend towards health-conscious eating, which drives the demand for quality baby food and infant formula. Additionally, the presence of major retailers and distribution networks in these cities facilitates easier access to a variety of products.

- In 2023, the German government implemented stricter regulations on baby food labeling and safety standards to ensure the health and safety of infants. This regulation mandates that all baby food products must clearly list ingredients and nutritional information, and adhere to specific safety protocols during production. Such measures aim to enhance consumer trust and ensure that products meet the highest health standards.

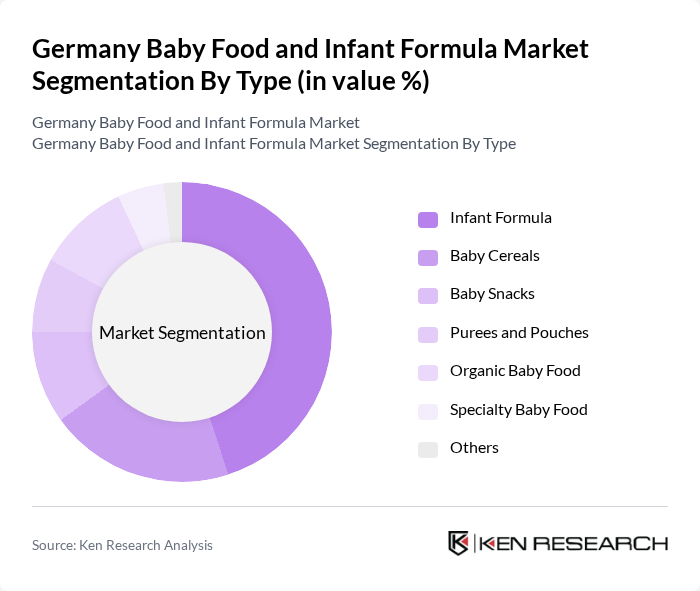

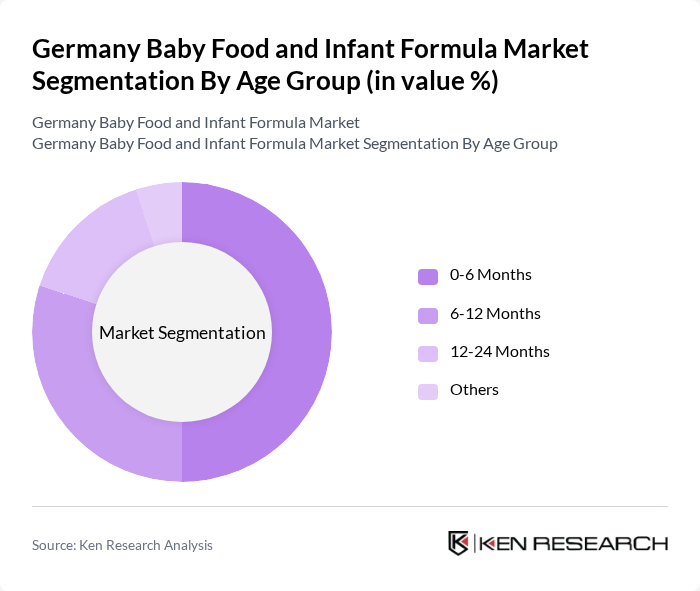

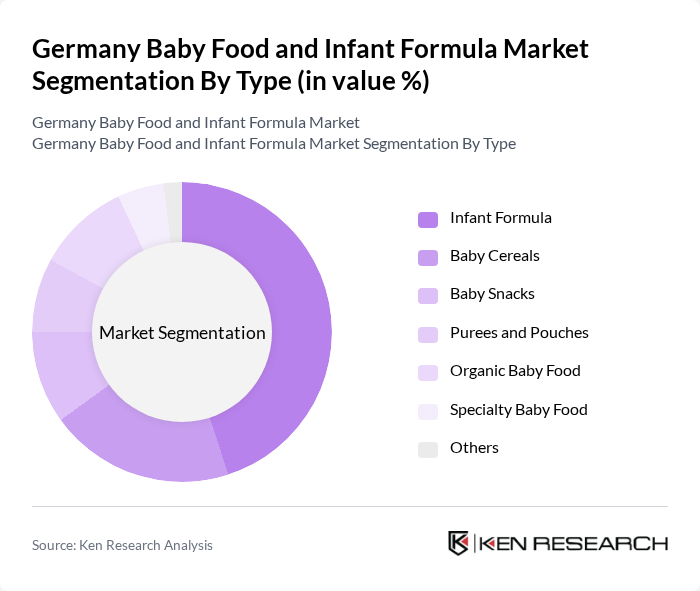

Germany Baby Food and Infant Formula Market Segmentation

By Type:The market is segmented into various types, including Infant Formula, Baby Cereals, Baby Snacks, Purees and Pouches, Organic Baby Food, Specialty Baby Food, and Others. Among these, Infant Formula is the leading segment due to its essential role in infant nutrition, particularly for working parents who may not be able to breastfeed. The increasing trend towards organic and specialty products is also notable, as parents are becoming more health-conscious and seeking high-quality options for their children.

By Age Group:The market is categorized by age groups, including 0-6 Months, 6-12 Months, 12-24 Months, and Others. The 0-6 Months age group holds the largest share, as this is a critical period for infant nutrition where parents often rely on formula feeding. The increasing awareness of the importance of nutrition during the early months of life drives demand in this segment, while the 6-12 Months and 12-24 Months segments are also growing as parents seek to introduce solid foods.

Germany Baby Food and Infant Formula Market Competitive Landscape

The Germany Baby Food and Infant Formula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Hero Group, Mead Johnson Nutrition Company, Hain Celestial Group, Inc., FrieslandCampina, Abbott Laboratories, Beech-Nut Nutrition Company, Organix Brands, Holle Baby Food GmbH, HiPP GmbH & Co. Vertrieb KG, Baby Gourmet, Plum Organics, Little Spoon, Yumi contribute to innovation, geographic expansion, and service delivery in this space.

Germany Baby Food and Infant Formula Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness Among Parents:The trend towards health-conscious parenting is driving the demand for baby food and infant formula in Germany. In future, approximately 70% of parents prioritize nutritional value when selecting baby food, reflecting a significant shift in consumer behavior. This is supported by a 15% increase in organic baby food sales, which reached €300 million recently. Parents are increasingly seeking products that are free from artificial additives, aligning with the growing emphasis on health and wellness.

- Rising Disposable Incomes:Germany's disposable income per capita is projected to reach €24,000 in future, up from €22,500 recently. This increase allows families to allocate more funds towards premium baby food products. As disposable incomes rise, parents are more willing to invest in high-quality, nutritious options for their children. This trend is evident in the 10% growth of the premium baby food segment, which is expected to continue as economic conditions improve and consumer confidence rises.

- Growing Demand for Organic and Natural Products:The organic baby food market in Germany is experiencing robust growth, with sales projected to reach €500 million in future, reflecting a 20% increase from recently. This surge is driven by parents' increasing awareness of the benefits of organic nutrition. The demand for natural ingredients is further supported by a 30% rise in consumer interest in clean-label products, indicating a strong preference for transparency in food sourcing and production methods among German parents.

Market Challenges

- Stringent Regulatory Requirements:The German baby food market faces significant challenges due to stringent EU regulations on food safety and quality. Compliance with these regulations requires substantial investment in quality control and testing, which can be a barrier for smaller brands. In future, the cost of compliance is estimated to exceed €50 million for major players, impacting their pricing strategies and market competitiveness. This regulatory landscape necessitates ongoing adaptation and vigilance from manufacturers.

- High Competition Among Established Brands:The German baby food market is characterized by intense competition, with major brands like Hipp and Nestlé dominating the landscape. In future, these brands hold over 60% market share, making it difficult for new entrants to gain traction. The competitive pressure leads to aggressive marketing strategies and price wars, which can erode profit margins. Smaller companies often struggle to differentiate their products in such a saturated market, limiting their growth potential.

Germany Baby Food and Infant Formula Market Future Outlook

The future of the Germany baby food and infant formula market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly seek personalized nutrition solutions, companies are likely to invest in research and development to create tailored products. Additionally, the rise of e-commerce platforms will facilitate greater accessibility to diverse product offerings, enhancing consumer choice. Sustainability will also play a crucial role, as brands that prioritize eco-friendly practices are expected to resonate more with environmentally conscious consumers.

Market Opportunities

- Introduction of Innovative Product Lines:There is a significant opportunity for brands to introduce innovative product lines, such as fortified baby foods and allergen-free options. With an estimated 10% of infants experiencing food allergies, the demand for specialized products is on the rise. Companies that can effectively address these needs are likely to capture a growing segment of health-conscious parents seeking safe and nutritious alternatives.

- Expansion into E-commerce Platforms:The shift towards online shopping presents a lucrative opportunity for baby food brands. In future, e-commerce sales in the baby food sector are projected to reach €200 million, reflecting a 25% increase from recently. Brands that invest in robust online marketing strategies and user-friendly platforms can significantly enhance their market reach and cater to the growing number of parents preferring the convenience of online purchasing.