Region:Europe

Author(s):Shubham

Product Code:KRAB6546

Pages:96

Published On:October 2025

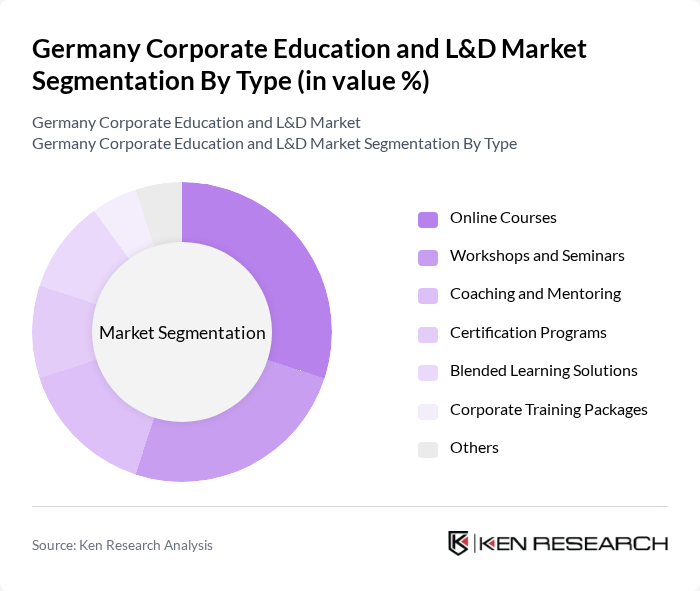

By Type:The market is segmented into various types of educational offerings, including Online Courses, Workshops and Seminars, Coaching and Mentoring, Certification Programs, Blended Learning Solutions, Corporate Training Packages, and Others. Online Courses have gained significant traction due to their flexibility and accessibility, while Workshops and Seminars remain popular for hands-on learning experiences. Certification Programs are increasingly sought after for professional development, and Corporate Training Packages are tailored to meet specific organizational needs.

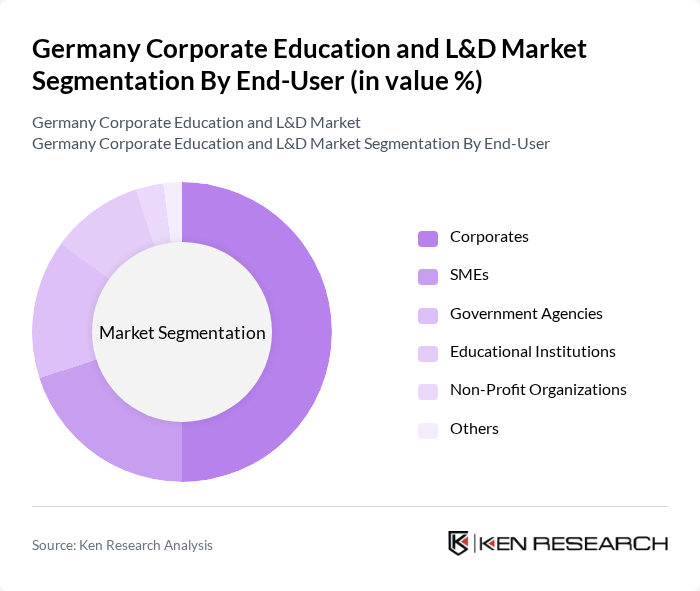

By End-User:The end-user segmentation includes Corporates, SMEs, Government Agencies, Educational Institutions, Non-Profit Organizations, and Others. Corporates are the largest segment, driven by the need for continuous employee development to keep pace with industry changes. SMEs are increasingly recognizing the importance of training, while Government Agencies and Educational Institutions play a crucial role in workforce development through various initiatives.

The Germany Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Akademie für Management, Haufe Akademie, IHK Akademie, WBS TRAINING AG, Comcave College, TÜV Rheinland Akademie, E-Learning Group, Skillsoft, LinkedIn Learning, Udemy for Business, XING E-Learning, Learnship Networks, iversity, Digital Learning Solutions, Corporate Learning Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and L&D market in Germany appears promising, driven by technological advancements and evolving workforce needs. As companies increasingly recognize the importance of continuous learning, investments in digital training solutions are expected to rise. The integration of AI and data analytics will enhance personalized learning experiences, while the focus on soft skills and leadership development will address critical gaps in the workforce. Overall, the market is poised for significant transformation, aligning with global trends in corporate training.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Workshops and Seminars Coaching and Mentoring Certification Programs Blended Learning Solutions Corporate Training Packages Others |

| By End-User | Corporates SMEs Government Agencies Educational Institutions Non-Profit Organizations Others |

| By Delivery Mode | In-Person Training Virtual Training Hybrid Training Self-Paced Learning Others |

| By Industry | IT and Software Manufacturing Healthcare Finance and Banking Retail Others |

| By Training Focus | Technical Skills Soft Skills Leadership Development Compliance Training Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Ongoing Training Programs Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Industry-Specific Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | L&D Managers, Training Coordinators |

| Digital Learning Solutions | 100 | IT Managers, E-learning Specialists |

| Employee Skill Development | 80 | HR Directors, Talent Development Managers |

| Vocational Training Partnerships | 70 | Corporate Partnership Managers, Educational Consultants |

| Workforce Upskilling Initiatives | 90 | Operations Managers, Project Leaders |

The Germany Corporate Education and L&D Market is valued at approximately USD 30 billion, reflecting significant growth driven by the demand for upskilling and reskilling in a rapidly evolving job market, alongside increased investment in employee development by companies.