Region:Central and South America

Author(s):Shubham

Product Code:KRAB6598

Pages:82

Published On:October 2025

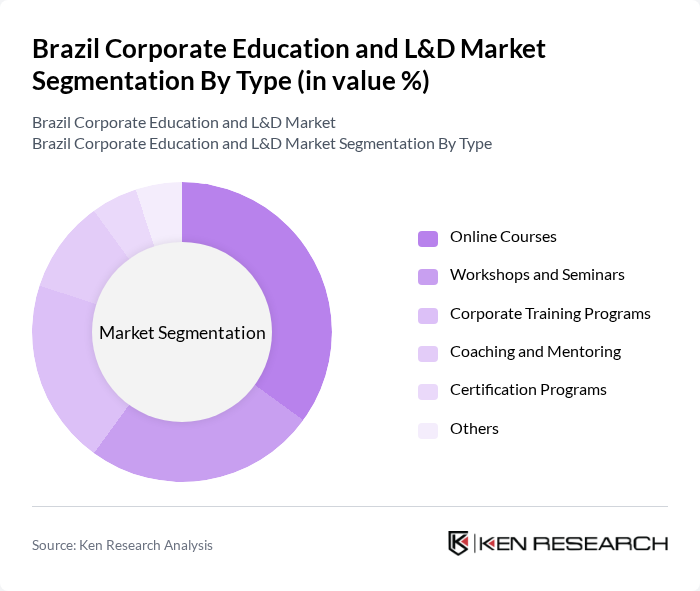

By Type:The market is segmented into various types, including Online Courses, Workshops and Seminars, Corporate Training Programs, Coaching and Mentoring, Certification Programs, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing employees to learn at their own pace. Workshops and Seminars also play a crucial role in providing hands-on experience and networking opportunities.

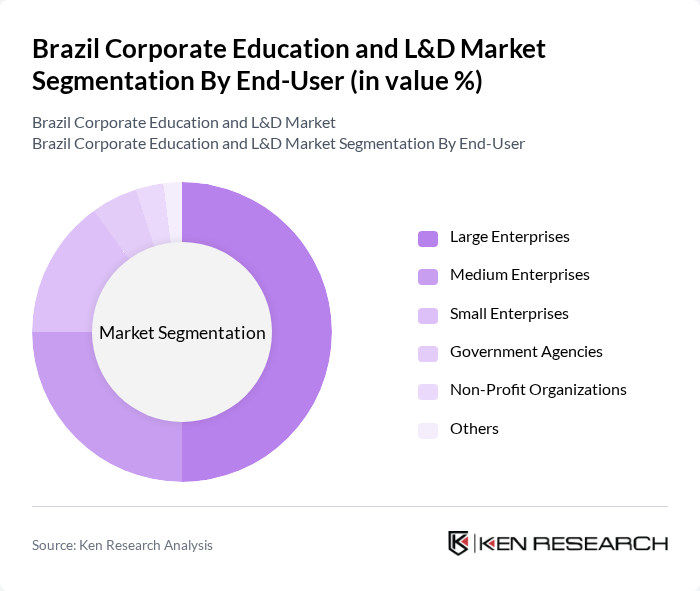

By End-User:The end-user segmentation includes Large Enterprises, Medium Enterprises, Small Enterprises, Government Agencies, Non-Profit Organizations, and Others. Large Enterprises dominate the market due to their substantial training budgets and the need for comprehensive employee development programs to maintain competitive advantage. Medium and Small Enterprises are increasingly recognizing the importance of training, leading to a growing share in the market.

The Brazil Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Kroton, Estácio Participações S.A., Anhanguera Educacional, Senac, Fundação Getulio Vargas (FGV), Sebrae, SkillHub, Udemy for Business, Alura, LinkedIn Learning, Escola Conquer, DIO (Digital Innovation One), Hotmart, Coursera for Business, Pluralsight contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and L&D market in Brazil appears promising, driven by technological advancements and a growing emphasis on employee development. As organizations increasingly recognize the importance of continuous learning, investments in digital platforms and blended learning approaches are expected to rise. Furthermore, the integration of artificial intelligence in training programs will enhance personalization and effectiveness, ensuring that employees acquire relevant skills to meet evolving industry demands. This shift towards a culture of lifelong learning will be pivotal in shaping the workforce of the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Workshops and Seminars Corporate Training Programs Coaching and Mentoring Certification Programs Others |

| By End-User | Large Enterprises Medium Enterprises Small Enterprises Government Agencies Non-Profit Organizations Others |

| By Industry Sector | Technology Healthcare Finance Manufacturing Retail Others |

| By Learning Format | Instructor-Led Training Self-Paced Learning Virtual Classrooms Mobile Learning Others |

| By Duration | Short-Term Courses Long-Term Programs Ongoing Training Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Delivery Method | In-Person Delivery Online Delivery Hybrid Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in Finance | 100 | HR Managers, Training Coordinators |

| Technology Sector Learning & Development | 80 | IT Managers, Learning Specialists |

| Healthcare Employee Training Initiatives | 70 | Training Directors, Compliance Officers |

| Manufacturing Skills Development Programs | 60 | Operations Managers, Safety Trainers |

| Retail Sector Employee Development | 90 | Store Managers, Regional Training Managers |

The Brazil Corporate Education and L&D Market is valued at approximately USD 5 billion, reflecting a significant investment in employee training and development driven by the demand for skilled labor and technological advancements.