Region:Asia

Author(s):Dev

Product Code:KRAB6495

Pages:81

Published On:October 2025

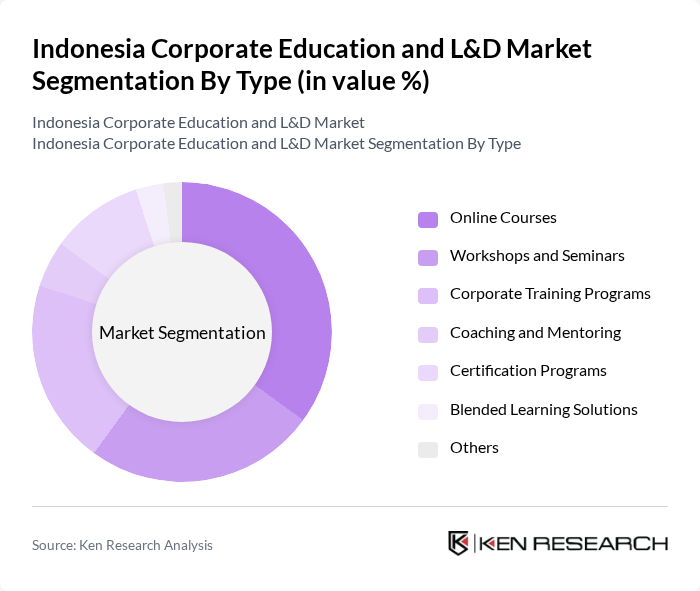

By Type:The market is segmented into various types of educational offerings, including Online Courses, Workshops and Seminars, Corporate Training Programs, Coaching and Mentoring, Certification Programs, Blended Learning Solutions, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing employees to learn at their own pace. Workshops and Seminars also remain popular for their interactive nature and immediate applicability in the workplace.

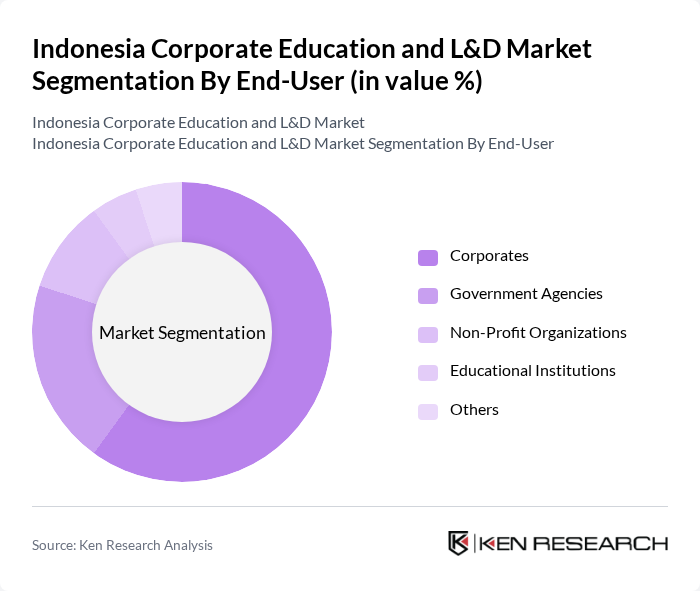

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Corporates are the leading end-users, driven by the need for employee skill enhancement and compliance with industry standards. Government Agencies are also significant users, focusing on workforce development and public sector training initiatives.

The Indonesia Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Edukasi Digital Indonesia, PT. Inovasi Pembelajaran, PT. Sinergi Pendidikan, PT. Sumber Daya Manusia, PT. Pelatihan Profesional, PT. Katalis Inovasi, PT. Solusi Pembelajaran, PT. Cerdas Mandiri, PT. Akses Pendidikan, PT. Maju Bersama, PT. Transformasi Pendidikan, PT. Mitra Pembelajaran, PT. Sukses Bersama, PT. Inovasi Global, PT. Pusat Pelatihan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and L&D market in Indonesia appears promising, driven by technological advancements and a growing emphasis on employee development. As companies increasingly adopt blended learning approaches, the integration of digital tools and traditional methods will enhance training effectiveness. Furthermore, the focus on data-driven learning analytics will enable organizations to tailor programs to specific employee needs, ensuring a more engaged and skilled workforce. This evolution will likely lead to a more competitive labor market, fostering innovation and economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Workshops and Seminars Corporate Training Programs Coaching and Mentoring Certification Programs Blended Learning Solutions Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Industry | IT and Technology Manufacturing Healthcare Finance and Banking Retail Hospitality Others |

| By Delivery Mode | In-Person Training Virtual Training Hybrid Training Self-Paced Learning Others |

| By Duration | Short-Term Courses Long-Term Programs Ongoing Training Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | Training Managers, Business Development Executives |

| HR Departments in Large Corporations | 150 | HR Directors, Learning and Development Managers |

| Employees Participating in L&D Programs | 200 | Mid-level Employees, Team Leaders |

| Government Education Officials | 50 | Policy Makers, Program Coordinators |

| Industry Experts and Consultants | 30 | Education Consultants, Industry Analysts |

The Indonesia Corporate Education and L&D Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the demand for skilled labor, digital learning platforms, and continuous employee development in a competitive business environment.