Region:Europe

Author(s):Geetanshi

Product Code:KRAB2736

Pages:92

Published On:October 2025

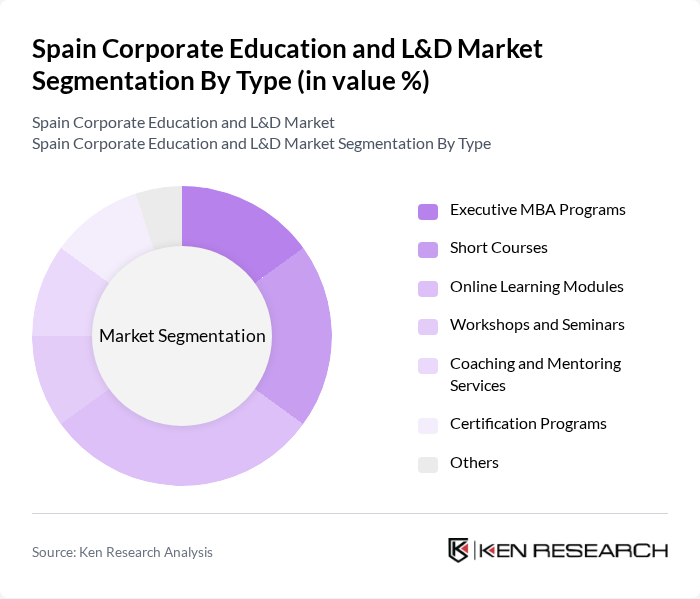

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Short Courses, Online Learning Modules, Workshops and Seminars, Coaching and Mentoring Services, Certification Programs, and Others. Among these, Online Learning Modules have gained significant traction due to their flexibility, accessibility, and ability to support remote and hybrid workforces, meeting the needs of a diverse and geographically dispersed workforce .

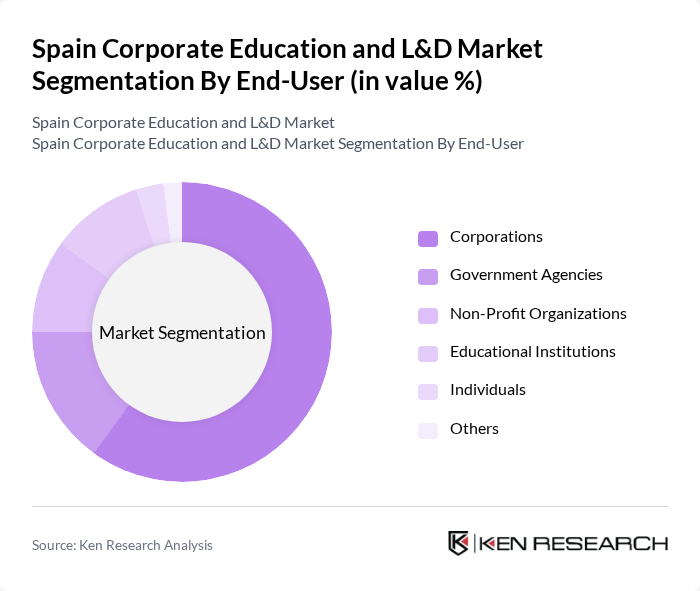

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the leading end-users, as they increasingly recognize the importance of employee training in maintaining competitiveness and adapting to market changes. The adoption of digital training platforms and custom learning solutions is particularly strong among large enterprises .

The Spain Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as IE Business School, ESADE Business School, EADA Business School, Universidad Politécnica de Madrid, Universidad de Barcelona, Instituto de Empresa, Universidad de Navarra, CEU San Pablo University, Universidad Carlos III de Madrid, Accenture, Udemy, and Coursera contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and L&D market in Spain appears promising, driven by technological advancements and a growing emphasis on personalized learning experiences. As organizations increasingly adopt AI and data analytics, training programs will become more tailored to individual employee needs. Furthermore, the integration of mobile learning solutions will enhance accessibility, allowing employees to engage in training anytime, anywhere. This evolution will likely lead to improved employee performance and satisfaction, fostering a culture of continuous learning within organizations.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Short Courses Online Learning Modules Workshops and Seminars Coaching and Mentoring Services Certification Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Industry | Technology Healthcare Finance Manufacturing Services Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Blended Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Professional Certifications Others |

| By Price Range | Low Price (Under €500) Mid Price (€500 - €2000) High Price (Over €2000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | L&D Managers, Training Coordinators |

| Digital Learning Platforms | 100 | HR Directors, E-learning Specialists |

| Employee Skill Development | 80 | Department Heads, Talent Development Managers |

| Compliance Training Initiatives | 70 | Compliance Officers, Risk Management Executives |

| Leadership Development Programs | 90 | Executive Coaches, Senior Management |

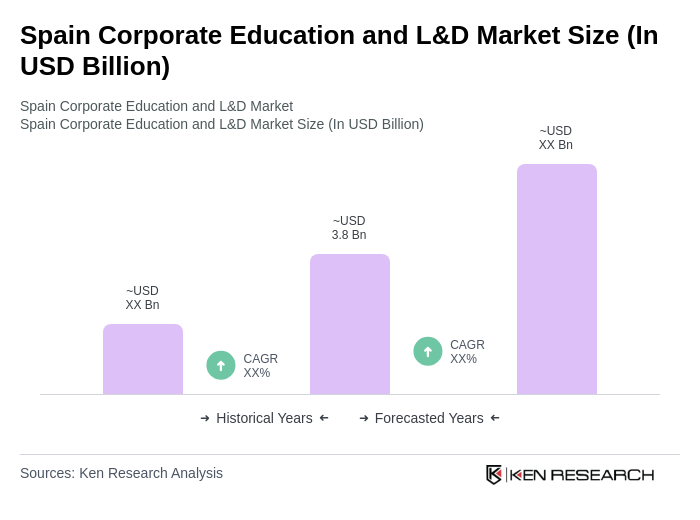

The Spain Corporate Education and L&D Market is valued at approximately USD 3.8 billion, reflecting a significant growth driven by the demand for upskilling and reskilling in the workforce, as well as the rise of digital learning platforms.