Region:Africa

Author(s):Shubham

Product Code:KRAB6605

Pages:87

Published On:October 2025

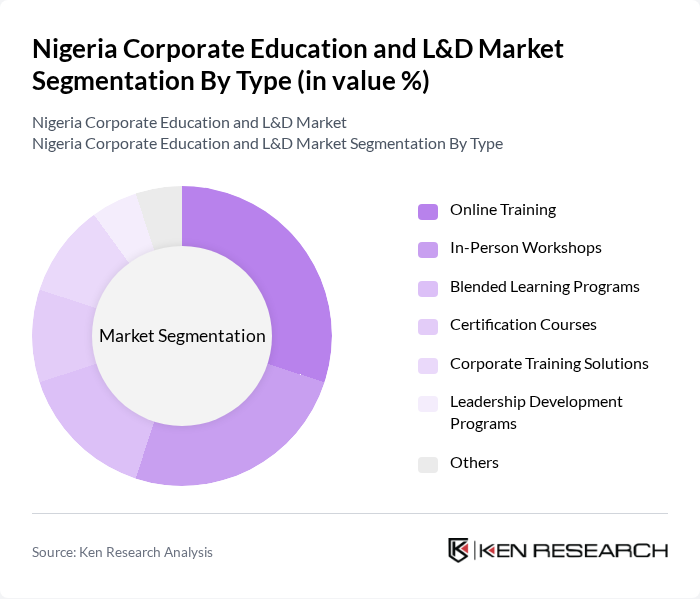

By Type:The market is segmented into various types of training programs that cater to different learning needs. The subsegments include Online Training, In-Person Workshops, Blended Learning Programs, Certification Courses, Corporate Training Solutions, Leadership Development Programs, and Others. Online Training has gained significant traction due to its flexibility and accessibility, while In-Person Workshops remain popular for hands-on learning experiences. Certification Courses are increasingly sought after for professional advancement.

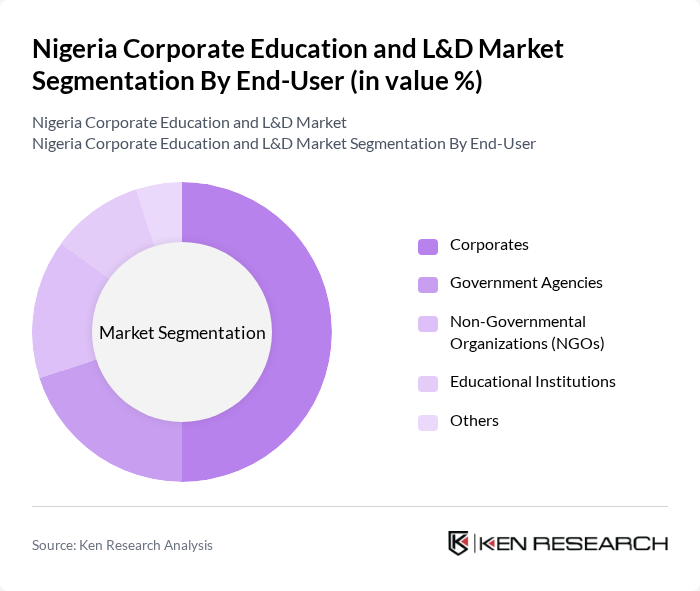

By End-User:The end-users of corporate education and L&D services include Corporates, Government Agencies, Non-Governmental Organizations (NGOs), Educational Institutions, and Others. Corporates are the largest segment, driven by the need for workforce development and compliance with industry standards. Government Agencies also invest in training to enhance public service efficiency, while NGOs focus on capacity building for community development.

The Nigeria Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Andela, Decagon, TalentQL, Learn Africa, Coursera, Udemy, Pluralsight, Skillshare, FutureLearn, LinkedIn Learning, Google Digital Garage, Microsoft Learn, Alison, EdX, and OpenClassrooms contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's corporate education and L&D market appears promising, driven by technological advancements and a growing emphasis on skill development. As companies increasingly adopt blended learning approaches, the integration of AI and analytics will enhance training effectiveness. Furthermore, the government's commitment to education reform and funding initiatives will likely foster a more robust training ecosystem, enabling organizations to better equip their workforce for future challenges and opportunities in the evolving job market.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Programs Certification Courses Corporate Training Solutions Leadership Development Programs Others |

| By End-User | Corporates Government Agencies Non-Governmental Organizations (NGOs) Educational Institutions Others |

| By Industry Sector | Financial Services Telecommunications Manufacturing Healthcare Information Technology Retail Others |

| By Training Delivery Mode | Virtual Classrooms On-the-Job Training Mobile Learning Self-Paced Learning Others |

| By Duration of Training | Short-Term Courses (Less than 1 month) Medium-Term Courses (1-3 months) Long-Term Courses (More than 3 months) Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| Leadership Development Initiatives | 100 | Senior Executives, Learning & Development Heads |

| Technical Skills Training | 80 | Department Heads, Technical Trainers |

| Soft Skills Development | 70 | Employee Engagement Specialists, Coaches |

| Compliance and Regulatory Training | 60 | Compliance Officers, Risk Management Executives |

The Nigeria Corporate Education and L&D Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for skilled labor and the rise of digital learning platforms.