Region:Middle East

Author(s):Dev

Product Code:KRAB6528

Pages:83

Published On:October 2025

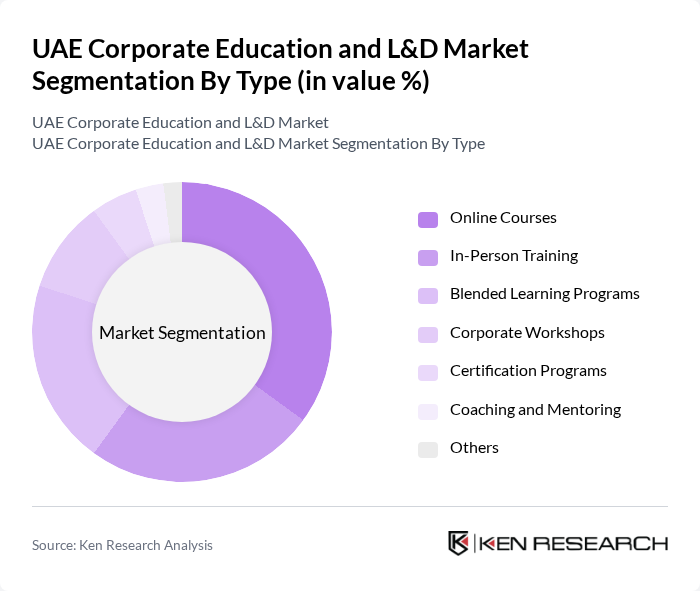

By Type:The market is segmented into various types of educational offerings, including Online Courses, In-Person Training, Blended Learning Programs, Corporate Workshops, Certification Programs, Coaching and Mentoring, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing employees to learn at their own pace. In-Person Training remains popular for hands-on learning experiences, while Blended Learning Programs combine the best of both worlds, catering to diverse learning preferences.

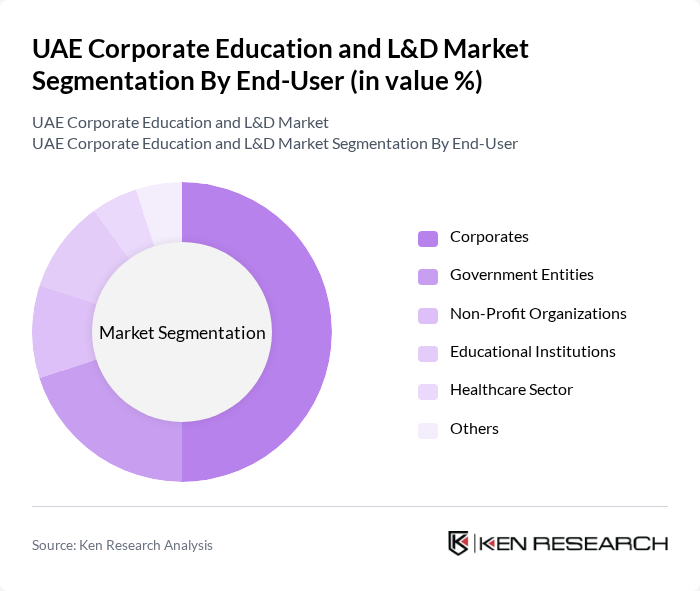

By End-User:The end-users of corporate education and L&D services include Corporates, Government Entities, Non-Profit Organizations, Educational Institutions, Healthcare Sector, and Others. Corporates are the largest segment, driven by the need for continuous employee development to maintain competitiveness. Government Entities also invest significantly in training programs to enhance public sector efficiency, while the Healthcare Sector focuses on specialized training to improve service delivery.

The UAE Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Knowledge Horizon, Al-Futtaim Training, DMC Training, The Knowledge Academy, New Horizons, Skillsoft, LinkedIn Learning, Coursera for Business, Udacity, EdX, Gulf Talent, Hult International Business School, British Council, Pearson, Dubai College of Tourism contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE corporate education and L&D market appears promising, driven by ongoing government support and the increasing integration of technology in learning. As organizations prioritize employee development, the demand for innovative training solutions will rise. The focus on personalized learning experiences and data analytics will enhance training effectiveness, ensuring that employees acquire relevant skills. Additionally, the shift towards a lifelong learning culture will further solidify the importance of continuous education in the corporate sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses In-Person Training Blended Learning Programs Corporate Workshops Certification Programs Coaching and Mentoring Others |

| By End-User | Corporates Government Entities Non-Profit Organizations Educational Institutions Healthcare Sector Others |

| By Delivery Mode | E-Learning Platforms Mobile Learning Virtual Classrooms On-Site Training Others |

| By Industry | Information Technology Finance and Banking Manufacturing Retail Hospitality Others |

| By Training Focus | Technical Skills Soft Skills Leadership Development Compliance Training Others |

| By Duration | Short Courses (Less than 1 month) Medium Courses (1-3 months) Long Courses (More than 3 months) Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, L&D Directors |

| Employee Skill Development | 100 | Training Coordinators, Department Heads |

| Technology Adoption in L&D | 80 | IT Managers, E-learning Specialists |

| Industry-Specific Training Needs | 70 | Sector Experts, Compliance Officers |

| Impact of Government Initiatives | 90 | Policy Makers, Educational Consultants |

The UAE Corporate Education and L&D Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by the demand for skilled labor and the need for continuous employee development in a competitive business environment.