Region:Asia

Author(s):Geetanshi

Product Code:KRAB2762

Pages:84

Published On:October 2025

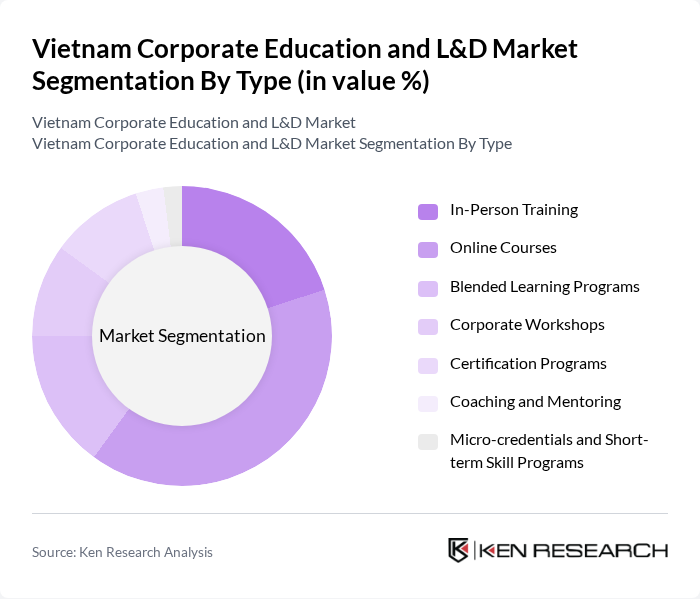

By Type:The market is segmented into various types of educational offerings, including In-Person Training, Online Courses, Blended Learning Programs, Corporate Workshops, Certification Programs, Coaching and Mentoring, and Micro-credentials and Short-term Skill Programs. Each of these sub-segments caters to different learning preferences and organizational needs, with a notable shift toward digital and blended formats driven by increased internet access, smartphone adoption, and employer demand for flexible, scalable solutions .

The Online Courses sub-segment is currently dominating the market due to the increasing preference for flexible learning solutions among employees and organizations. The COVID-19 pandemic accelerated the adoption of digital learning platforms, making online courses a convenient option for many. Companies are leveraging these platforms to provide training that can be accessed anytime and anywhere, catering to the diverse needs of their workforce. This trend is expected to continue as organizations recognize the cost-effectiveness and scalability of online learning solutions. The Vietnam online education market alone is valued at nearly USD 250 million, reflecting the rapid expansion of digital learning .

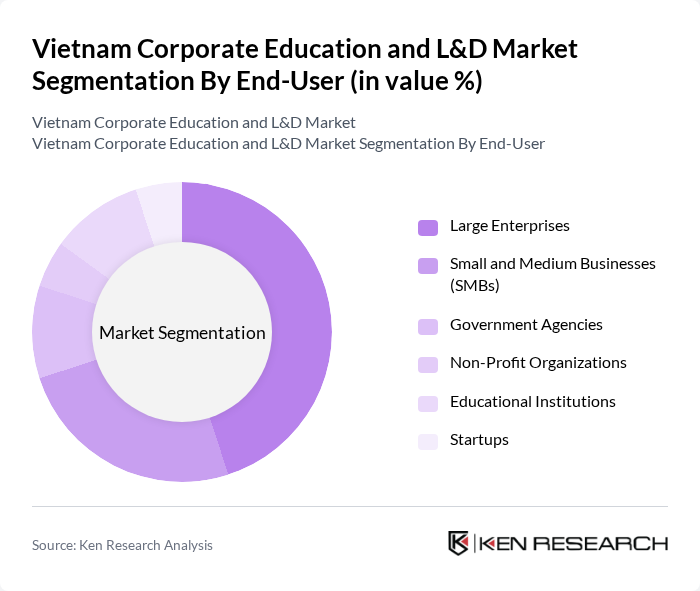

By End-User:The market is segmented by end-users, including Large Enterprises, Small and Medium Businesses (SMBs), Government Agencies, Non-Profit Organizations, Educational Institutions, and Startups. Each segment has unique training needs and budget constraints, influencing their choice of educational programs. Large enterprises and SMBs are the primary drivers of demand, with large enterprises investing heavily in comprehensive L&D programs and SMBs increasingly adopting modular, online, and blended solutions to upskill their workforce .

Large Enterprises are the leading end-user segment in the market, primarily due to their substantial training budgets and the need for comprehensive employee development programs. These organizations often have dedicated L&D departments that focus on upskilling and reskilling their workforce to maintain a competitive edge. The increasing complexity of business operations and the demand for specialized skills further drive the investment in corporate education within this segment. SMBs are rapidly increasing their share, leveraging government incentives and digital platforms to access affordable, scalable training .

The Vietnam Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT Corporation, Viettel Group, TMA Solutions, VTC Academy, Talentnet Corporation, Navigos Group, CMC Corporation, HPT Vietnam, DTT Technology Group, Kyna.vn, Edumall, Topica Edtech Group, VnEdu (by VNPT), MobiFone, VnExpress, RMIT University Vietnam, VTC Online, VUS (Vietnam USA Society English Centers), Apax Leaders, and Teky Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's corporate education and L&D market appears promising, driven by technological advancements and a growing emphasis on continuous learning. As companies increasingly recognize the importance of upskilling their workforce, investments in digital learning solutions are expected to rise. Additionally, the integration of artificial intelligence in training programs will enhance personalized learning experiences, making education more effective. The focus on soft skills and outcome-based training will further align employee development with organizational goals, fostering a more adaptable workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Person Training Online Courses Blended Learning Programs Corporate Workshops Certification Programs Coaching and Mentoring Micro-credentials and Short-term Skill Programs |

| By End-User | Large Enterprises Small and Medium Businesses (SMBs) Government Agencies Non-Profit Organizations Educational Institutions Startups |

| By Industry | Information Technology Manufacturing Healthcare Finance Retail Hospitality and Tourism Others |

| By Delivery Mode | Online Learning Face-to-Face Learning Hybrid Learning Mobile Learning Virtual Classroom Others |

| By Duration | Short Courses (Less than 1 Month) Medium Courses (1-6 Months) Long Courses (More than 6 Months) Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications International Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Freemium/Trial Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | HR Managers, Training Managers |

| Leadership Development Initiatives | 60 | Senior Executives, L&D Directors |

| Technical Skills Training | 50 | Department Heads, Technical Trainers |

| Soft Skills Workshops | 40 | Employee Development Specialists, Coaches |

| Digital Learning Platforms | 45 | IT Managers, E-learning Developers |

The Vietnam Corporate Education and L&D Market is valued at approximately USD 4.5 billion, driven by the increasing demand for skilled labor, digital transformation, and a focus on employee development and retention strategies.