Region:Europe

Author(s):Geetanshi

Product Code:KRAB2765

Pages:83

Published On:October 2025

By Type:The market is segmented into Onshore EPC Services, Offshore EPC Services, Pipeline Construction, Facility Construction, Maintenance and Repair Services, Project Management Services, Engineering Design Services, Procurement Services, and Fabrication Services. Among these, Onshore EPC Services and Pipeline Construction are particularly prominent, reflecting the ongoing expansion and modernization of oil and gas infrastructure across Germany. The Construction segment, in particular, holds a significant share due to the scale of infrastructure development and maintenance required in the sector .

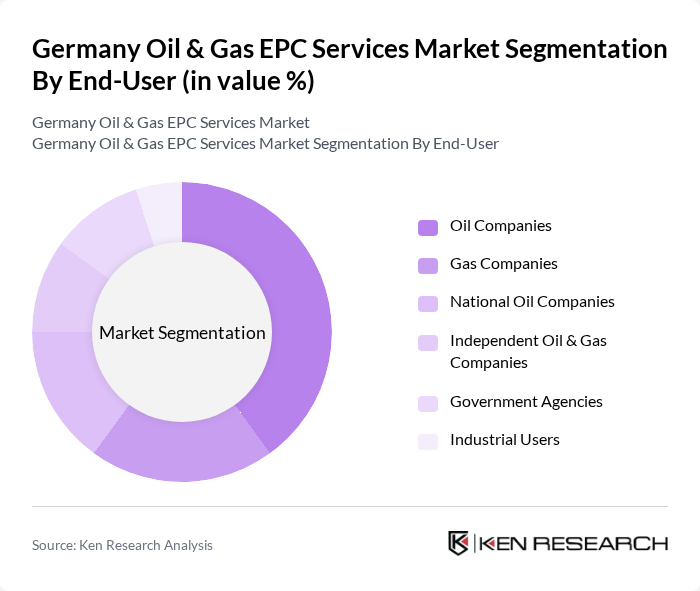

By End-User:The end-user segmentation includes Oil Companies, Gas Companies, National Oil Companies, Independent Oil & Gas Companies, Government Agencies, and Industrial Users. Oil Companies and National Oil Companies are the leading end-users, reflecting their extensive project portfolios and the need for reliable EPC partners to deliver complex infrastructure and modernization projects .

The Germany Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Bilfinger SE, Linde plc, Technip Energies NV, Saipem S.p.A., Aker Solutions ASA, KBR, Inc., Fluor Corporation, Worley Limited, McDermott International, Ltd., Wood Group PLC, Bechtel Corporation, JGC Corporation, Consolidated Contractors Company, and Petrofac Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany Oil & Gas EPC services market appears promising, driven by a combination of technological advancements and a strong push towards sustainability. As the industry adapts to the dual challenge of meeting energy demands while reducing carbon footprints, innovative solutions will emerge. Companies are likely to invest in digital transformation and modular construction techniques, enhancing efficiency and project delivery. Furthermore, strategic partnerships will play a crucial role in navigating regulatory landscapes and expanding market reach, ensuring long-term growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore EPC Services Offshore EPC Services Pipeline Construction Facility Construction Maintenance and Repair Services Project Management Services Engineering Design Services Procurement Services Fabrication Services |

| By End-User | Oil Companies Gas Companies National Oil Companies Independent Oil & Gas Companies Government Agencies Industrial Users |

| By Application | Exploration and Production Refining Transportation Storage Petrochemicals LNG |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies for Renewable Integration Tax Incentives for EPC Projects Regulatory Support for Infrastructure Development Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Project Management | 100 | Project Managers, Engineering Leads |

| Procurement Strategies in EPC | 60 | Procurement Managers, Supply Chain Analysts |

| Construction Execution in Oil & Gas | 50 | Construction Managers, Site Supervisors |

| Regulatory Compliance in EPC Services | 40 | Compliance Officers, Legal Advisors |

| Market Trends and Innovations | 70 | Industry Analysts, R&D Managers |

The Germany Oil & Gas EPC Services Market is valued at approximately EUR 23 billion, reflecting strong demand for engineering, procurement, and construction services driven by investments in energy infrastructure and modernization efforts.