Region:Asia

Author(s):Shubham

Product Code:KRAB6592

Pages:100

Published On:October 2025

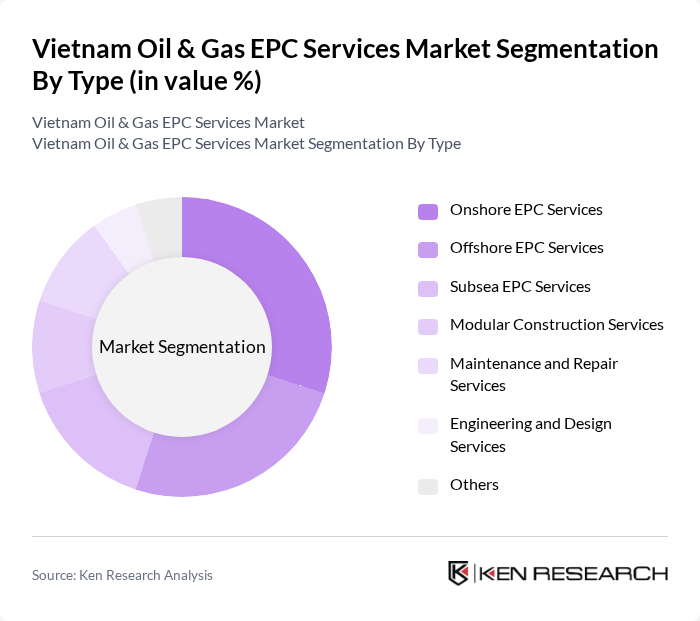

By Type:The market is segmented into various types of EPC services, including Onshore EPC Services, Offshore EPC Services, Subsea EPC Services, Modular Construction Services, Maintenance and Repair Services, Engineering and Design Services, and Others. Each of these segments plays a crucial role in meeting the diverse needs of the oil and gas industry.

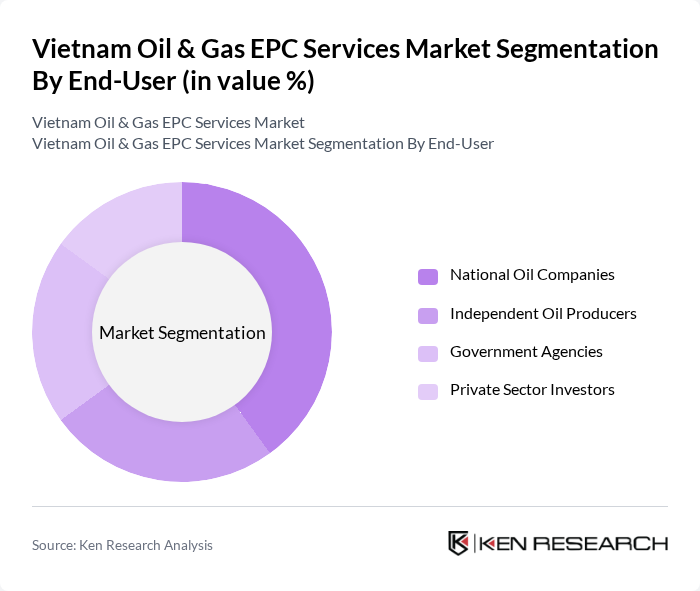

By End-User:The end-user segmentation includes National Oil Companies, Independent Oil Producers, Government Agencies, and Private Sector Investors. Each of these end-users has distinct requirements and influences the demand for EPC services in the oil and gas sector.

The Vietnam Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petrovietnam Engineering Consultancy Corporation (PVECC), TechnipFMC, JGC Corporation, Saipem S.p.A., McDermott International, Inc., Hyundai Engineering & Construction Co., Ltd., Daewoo Engineering & Construction Co., Ltd., Chiyoda Corporation, KBR, Inc., Wood Group, Sumitomo Corporation, Bechtel Corporation, Fluor Corporation, WorleyParsons, Aker Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Oil & Gas EPC services market is poised for significant transformation, driven by increasing energy demands and government initiatives aimed at infrastructure development. As the country transitions towards sustainable energy practices, the integration of renewable energy sources will become crucial. Additionally, the focus on digital transformation and advanced project management tools will enhance operational efficiency. These trends indicate a dynamic market landscape, where adaptability and innovation will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore EPC Services Offshore EPC Services Subsea EPC Services Modular Construction Services Maintenance and Repair Services Engineering and Design Services Others |

| By End-User | National Oil Companies Independent Oil Producers Government Agencies Private Sector Investors |

| By Application | Exploration and Production Refining and Processing Transportation and Storage Decommissioning |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Contract Type | Lump Sum Contracts Cost-Plus Contracts Time and Material Contracts |

| By Policy Support | Subsidies for Local Content Tax Incentives for Investments Regulatory Support for New Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Projects | 100 | Project Managers, Geologists |

| Refinery Construction Projects | 80 | Construction Managers, Safety Officers |

| Pipeline Installation Services | 70 | Operations Managers, Engineering Leads |

| Maintenance & Repair Services | 60 | Maintenance Supervisors, Procurement Officers |

| Environmental Compliance Projects | 50 | Environmental Engineers, Compliance Managers |

The Vietnam Oil & Gas EPC Services Market is valued at approximately USD 5 billion, driven by increased investments in oil and gas exploration, production, and infrastructure development, alongside government initiatives for energy security and sustainability.