Region:Asia

Author(s):Geetanshi

Product Code:KRAB2789

Pages:88

Published On:October 2025

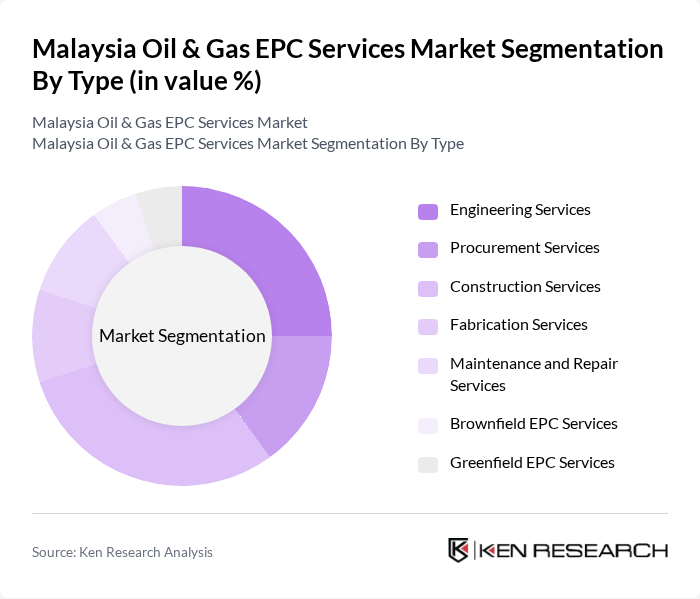

By Type:The market is segmented into various types of services, including Engineering Services, Procurement Services, Construction Services, Fabrication Services, Maintenance and Repair Services, Brownfield EPC Services, and Greenfield EPC Services. Each of these subsegments plays a crucial role in the overall market dynamics, with specific applications and demand drivers. Engineering and construction services are particularly prominent due to the complexity and scale of ongoing refinery, LNG, and petrochemical projects, while maintenance and repair services are increasingly in demand as Malaysia’s infrastructure matures and sustainability becomes a focus .

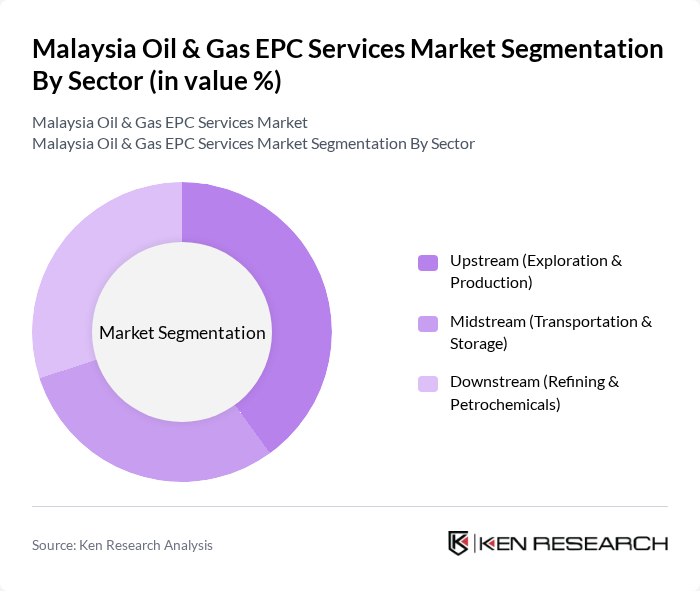

By Sector:The market is further segmented into Upstream (Exploration & Production), Midstream (Transportation & Storage), and Downstream (Refining & Petrochemicals). Each sector has distinct requirements and growth trajectories, influenced by global oil prices, technological advancements, and regulatory frameworks. Downstream projects, including refinery and petrochemical complex expansions, are a major growth driver, while upstream activities remain robust due to ongoing offshore developments and enhanced recovery projects .

The Malaysia Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petronas Carigali Sdn Bhd, Sapura Energy Berhad, UEM Group Berhad, Dialog Group Berhad, Yinson Holdings Berhad, Malaysia Marine and Heavy Engineering Holdings Berhad (MHB), Bumi Armada Berhad, Technip Energies N.V., McDermott International, Ltd., Wood PLC, Aker Solutions ASA, Schlumberger Limited, Halliburton Company, Baker Hughes Company, and Worley Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Malaysia Oil & Gas EPC services market appears promising, driven by increasing energy demands and government investments in infrastructure. As the sector embraces digital transformation and sustainable practices, EPC providers are likely to enhance operational efficiencies and reduce environmental impacts. Additionally, the focus on safety standards and regulatory compliance will shape the industry's landscape, ensuring that companies remain competitive and responsive to market dynamics while fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Engineering Services Procurement Services Construction Services Fabrication Services Maintenance and Repair Services Brownfield EPC Services Greenfield EPC Services |

| By Sector | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Petrochemicals) |

| By Location | Onshore Offshore |

| By End-User | National Oil Companies International Oil Companies Independent Operators Petrochemical Industries Government and Public Sector |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants and Subsidies |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Contract Type | Lump Sum Turnkey (LSTK) Contracts Engineering, Procurement, and Construction Management (EPCM) Contracts Cost-Plus Contracts Time and Material Contracts |

| By Policy Support | Subsidies for Local Content Tax Incentives for R&D Regulatory Support for New Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas EPC Project Management | 100 | Project Managers, Engineering Leads |

| Procurement in Oil & Gas Sector | 80 | Procurement Managers, Supply Chain Analysts |

| Construction Oversight in Oil & Gas | 60 | Construction Managers, Site Supervisors |

| Regulatory Compliance in EPC Services | 50 | Compliance Officers, Legal Advisors |

| Technology Adoption in Oil & Gas EPC | 70 | IT Managers, Innovation Leads |

The Malaysia Oil & Gas EPC Services Market is valued at approximately USD 18 billion, driven by increasing energy demand, significant investments in infrastructure, and technology upgrades across upstream and downstream segments.