Region:Europe

Author(s):Geetanshi

Product Code:KRAB2778

Pages:93

Published On:October 2025

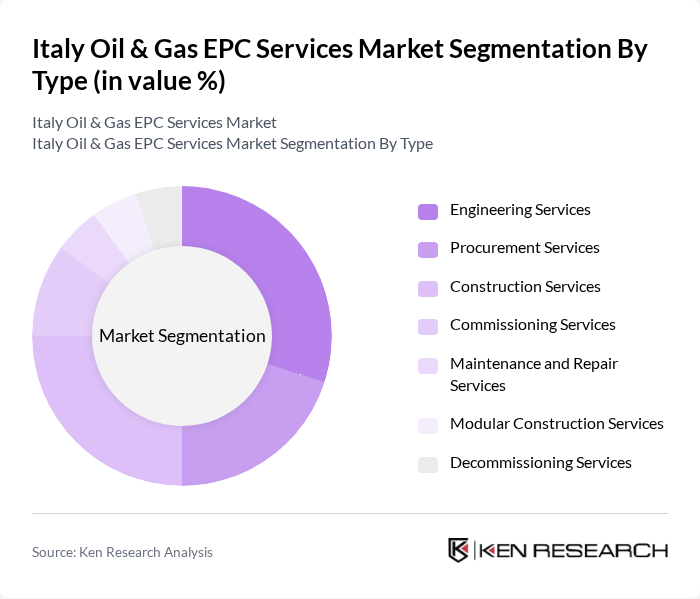

By Type:The market is segmented into Engineering Services, Procurement Services, Construction Services, Commissioning Services, Maintenance and Repair Services, Modular Construction Services, and Decommissioning Services.Engineering Servicescontinue to lead the market, driven by the increasing complexity of oil and gas projects, the need for advanced digital engineering solutions, and a heightened focus on safety and environmental compliance. The demand for customized engineering is further propelled by the integration of automation, remote monitoring, and digital twin technologies in project execution .

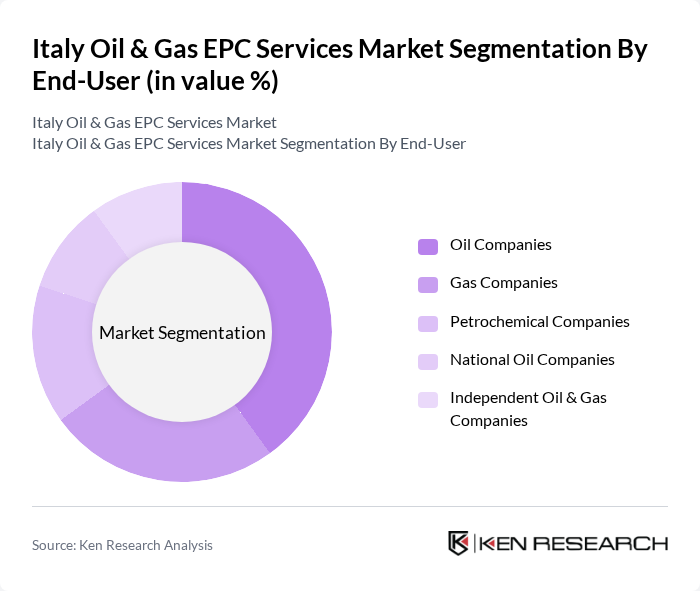

By End-User:End-user segmentation includes Oil Companies, Gas Companies, Petrochemical Companies, National Oil Companies, and Independent Oil & Gas Companies.Oil Companiesremain the dominant segment, supported by ongoing exploration, production, and downstream activities. The need for reliable EPC services is reinforced by Italy’s focus on energy transition projects, refinery upgrades, and the integration of cleaner technologies, which require tailored engineering and construction expertise .

The Italy Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saipem S.p.A., Technip Energies N.V., Snam S.p.A., Eni S.p.A., Maire Tecnimont S.p.A., Bonatti S.p.A., RINA S.p.A., Rosetti Marino S.p.A., KT - Kinetics Technology S.p.A., Tecnimont S.p.A., Wood Group PLC, Fluor Corporation, Aker Solutions ASA, Jacobs Engineering Group Inc., and Petrofac Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy Oil & Gas EPC services market appears promising, driven by a combination of technological advancements and a shift towards sustainable practices. As companies increasingly adopt digital solutions and automation, operational efficiencies are expected to improve significantly. Furthermore, the growing emphasis on renewable energy integration will likely create new avenues for EPC providers, allowing them to diversify their portfolios and enhance their competitive edge in a rapidly evolving energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Engineering Services Procurement Services Construction Services Commissioning Services Maintenance and Repair Services Modular Construction Services Decommissioning Services |

| By End-User | Oil Companies Gas Companies Petrochemical Companies National Oil Companies Independent Oil & Gas Companies |

| By Application | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Petrochemicals) LNG Projects |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants and Subsidies |

| By Project Size | Large Scale Projects Medium Scale Projects Small Scale Projects |

| By Contract Type | Lump Sum Turnkey (LSTK) Contracts Cost-Plus Contracts Time and Material Contracts |

| By Technology | Enhanced Oil Recovery Subsea Technology Automation & Digital Oilfield Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil & Gas Projects | 60 | Project Managers, Operations Directors |

| Midstream Infrastructure Development | 50 | Engineering Managers, Supply Chain Managers |

| Downstream Refinery Services | 40 | Procurement Managers, Technical Directors |

| Renewable Energy Integration in Oil & Gas | 45 | Sustainability Managers, R&D Managers |

| Regulatory Compliance and Safety Standards | 55 | Compliance Officers, Safety Managers |

The Italy Oil & Gas EPC Services Market is valued at approximately USD 11 billion, reflecting strong demand for energy, infrastructure modernization, and advanced technologies in the sector.