Region:Africa

Author(s):Geetanshi

Product Code:KRAB2797

Pages:95

Published On:October 2025

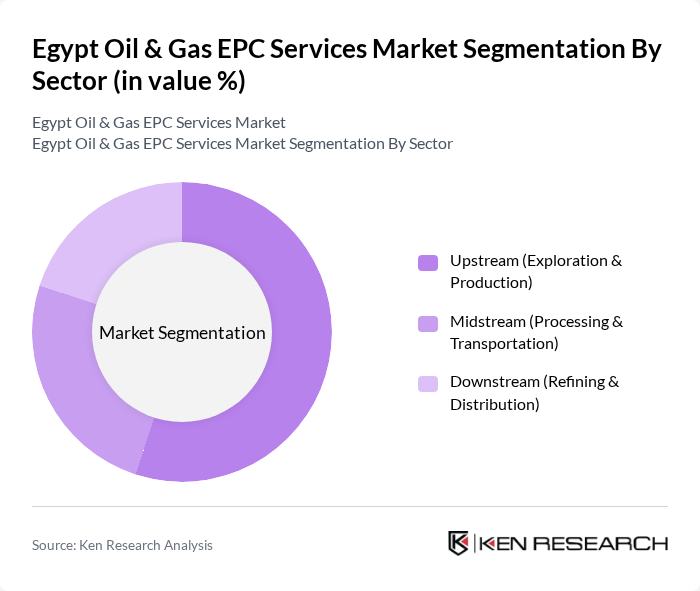

By Sector:The market is segmented into three main sectors: Upstream (Exploration & Production), Midstream (Processing & Transportation), and Downstream (Refining & Distribution). The upstream sector is currently the most dominant, driven by the need for new oil and gas discoveries, enhanced recovery techniques, and the expansion of deepwater and unconventional resource development. The midstream sector is also significant, focusing on the transportation and processing of hydrocarbons, while the downstream sector is essential for refining and distributing petroleum products, supported by ongoing refinery upgrades and expansion projects.

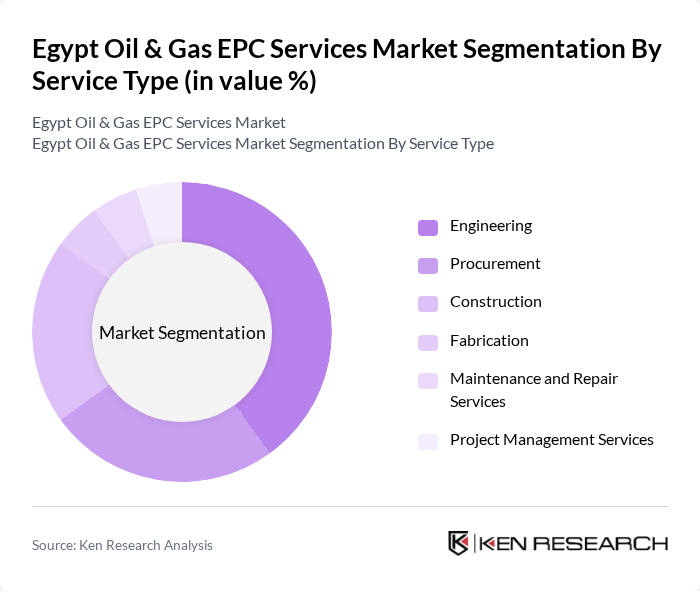

By Service Type:The service types in the market include Engineering, Procurement, Construction, Fabrication, Maintenance and Repair Services, and Project Management Services. Engineering services are leading the market due to the complexity and technical requirements of oil and gas projects, particularly in exploration and field development. Procurement and construction services follow closely, as they are essential for the timely execution of projects, while maintenance and repair services are critical for ensuring operational efficiency and asset longevity.

The Egypt Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petrojet, Enppi, Egyptian General Petroleum Corporation (EGPC), Egyptian Natural Gas Holding Company (EGAS), GUPCO (Gulf of Suez Petroleum Company), Badr Petroleum Company (BAPETCO), BP plc, Eni S.p.A., Shell plc, ExxonMobil Egypt, TechnipFMC, Saipem S.p.A., Schlumberger, Halliburton, Baker Hughes, JGC Corporation, Wood Group, McDermott International, KBR Inc., Sinopec Engineering Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt Oil & Gas EPC services market appears promising, driven by ongoing government initiatives and technological advancements. As the country aims to enhance its energy production capabilities, the demand for EPC services is expected to rise significantly. Additionally, the integration of digital solutions and sustainable practices will likely shape the market landscape, fostering innovation and efficiency. The focus on renewable energy projects will also create new avenues for growth, positioning Egypt as a key player in the regional energy sector.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Processing & Transportation) Downstream (Refining & Distribution) |

| By Service Type | Engineering Procurement Construction Fabrication Maintenance and Repair Services Project Management Services |

| By Project Location | Onshore Offshore |

| By End-User | National Oil Companies (e.g., EGPC, EGAS, GANOPE) International Oil Companies (e.g., BP, Shell, Eni, ExxonMobil) Independent Oil Producers Government Agencies |

| By Application | Exploration and Production Refining Transportation (Pipelines, LNG, etc.) Storage |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Contract Type | Lump Sum Turnkey (LSTK) EPCM (Engineering, Procurement, Construction Management) Cost-Plus Contracts Time and Material Contracts |

| By Region | Western Desert Nile Delta Mediterranean Offshore Gulf of Suez |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Field Development Projects | 100 | Project Managers, Field Engineers |

| Gas Processing Facilities | 70 | Operations Managers, Technical Directors |

| Pipeline Construction Services | 60 | Procurement Managers, Construction Supervisors |

| Refinery Upgrades | 50 | Maintenance Managers, Engineering Leads |

| Environmental Compliance Projects | 40 | Environmental Officers, Compliance Managers |

The Egypt Oil & Gas EPC Services Market is valued at approximately USD 7.5 billion, driven by increasing domestic energy demand, significant investments in oil and gas infrastructure, and government initiatives aimed at modernizing energy production capabilities.