Region:Africa

Author(s):Geetanshi

Product Code:KRAB2809

Pages:96

Published On:October 2025

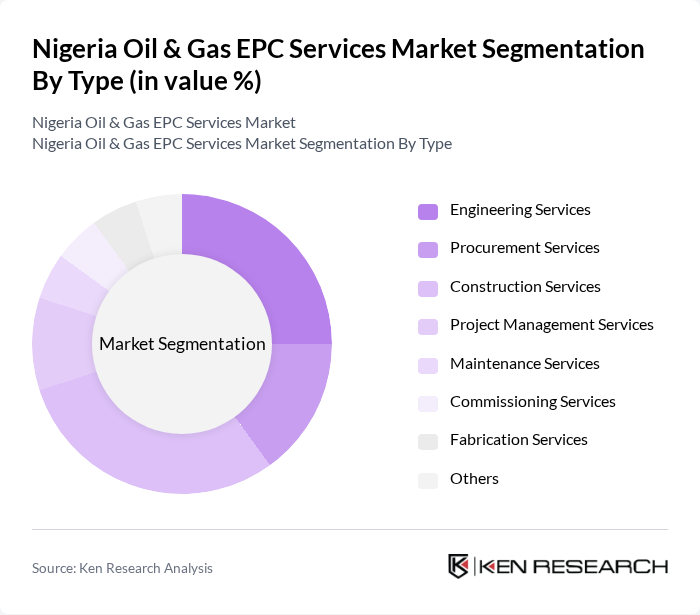

By Type:The market is segmented into Engineering Services, Procurement Services, Construction Services, Project Management Services, Maintenance Services, Commissioning Services, Fabrication Services, and Others. Engineering Services encompass design and feasibility studies; Procurement Services involve sourcing and logistics for equipment and materials; Construction Services cover civil and mechanical works; Project Management Services ensure timely delivery and budget control; Maintenance Services focus on asset integrity; Commissioning Services handle system startup and operational readiness; Fabrication Services provide structural and modular components; Others include specialized consulting and technical support .

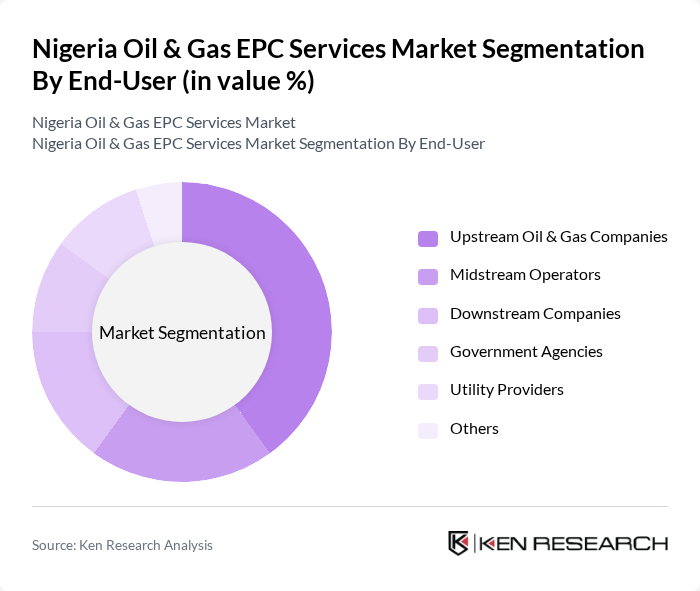

By End-User:The end-user segmentation includes Upstream Oil & Gas Companies, Midstream Operators, Downstream Companies, Government Agencies, Utility Providers, and Others. Upstream Oil & Gas Companies focus on exploration and production; Midstream Operators manage transportation and storage; Downstream Companies handle refining and distribution; Government Agencies oversee policy and regulatory compliance; Utility Providers supply energy infrastructure; Others include service contractors and technical consultants .

The Nigeria Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Julius Berger Nigeria Plc, Saipem Contracting Nigeria Ltd., TechnipFMC Nigeria Ltd., Dorman Long Engineering Ltd., Cappa and D'Alberto Plc, Oilserv Ltd., Nestoil Plc, Eni Nigeria, Shell Nigeria Exploration and Production Company, TotalEnergies Nigeria, ExxonMobil Nigeria, Chevron Nigeria Ltd., AOS Orwell, Matrix Energy Ltd., Sterling Oil Exploration & Energy Production Company Ltd., Nigerian National Petroleum Company Limited (NNPC Ltd.), Daewoo E&C Nigeria, Lekoil Nigeria Limited, Pinnacle Oil and Gas Company Limited, CNOOC International Nigeria Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria Oil & Gas EPC services market appears promising, driven by ongoing investments in production capacity and infrastructure. As the government continues to prioritize energy security, the demand for EPC services is expected to rise. Additionally, the integration of digital technologies and sustainable practices will likely reshape the industry landscape, enhancing operational efficiency and safety standards. Strategic partnerships with global firms may further bolster local capabilities, positioning Nigeria as a competitive player in the EPC services sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Engineering Services Procurement Services Construction Services Project Management Services Maintenance Services Commissioning Services Fabrication Services Others |

| By End-User | Upstream Oil & Gas Companies Midstream Operators Downstream Companies Government Agencies Utility Providers Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects |

| By Contract Type | Lump Sum Turnkey (LSTK) Contracts Engineering, Procurement, and Construction Management (EPCM) Contracts Cost Plus Contracts Time and Material Contracts Others |

| By Geographic Location | Niger Delta Region Offshore Locations Northern Nigeria Western Nigeria Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Policy Support | Subsidies for Local Content Development Tax Incentives for EPC Projects Grants for Renewable Energy Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil & Gas Projects | 100 | Project Managers, Operations Directors |

| Midstream Infrastructure Development | 80 | Engineering Managers, Logistics Coordinators |

| Downstream Refinery Services | 70 | Procurement Managers, Quality Assurance Leads |

| Regulatory Compliance in EPC | 60 | Compliance Officers, Legal Advisors |

| Technology Integration in EPC Services | 90 | IT Managers, Innovation Leads |

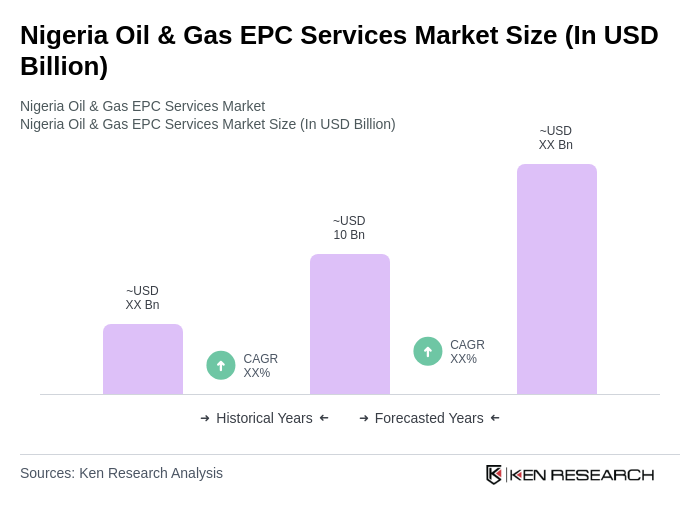

The Nigeria Oil & Gas EPC Services Market is valued at approximately USD 10 billion, reflecting significant growth driven by increased indigenous participation and substantial investments in upstream exploration and infrastructure projects.