Region:Asia

Author(s):Shubham

Product Code:KRAB6565

Pages:99

Published On:October 2025

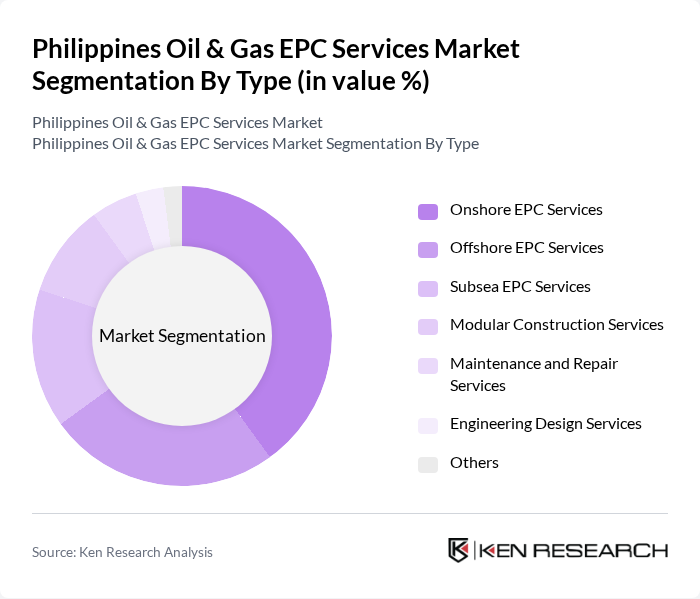

By Type:The market is segmented into various types of EPC services, including Onshore EPC Services, Offshore EPC Services, Subsea EPC Services, Modular Construction Services, Maintenance and Repair Services, Engineering Design Services, and Others. Among these, Onshore EPC Services dominate the market due to the high volume of onshore oil and gas projects in the Philippines, driven by the need for infrastructure development and enhanced production capabilities.

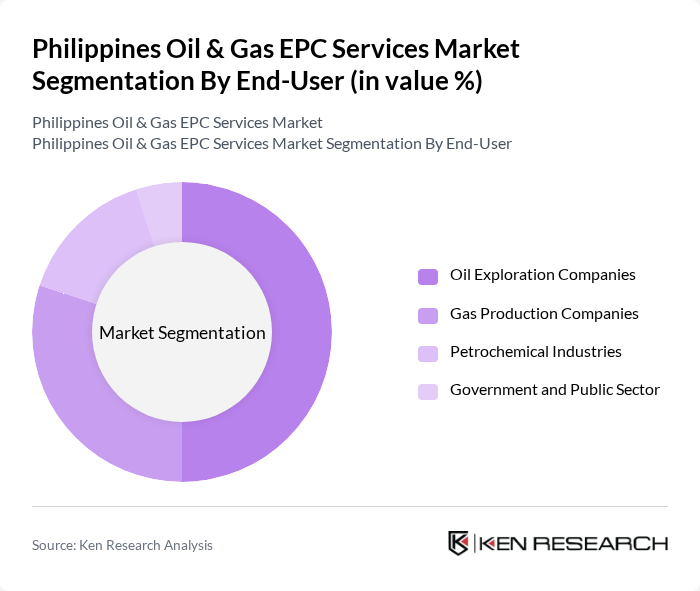

By End-User:The end-user segmentation includes Oil Exploration Companies, Gas Production Companies, Petrochemical Industries, and Government and Public Sector. Oil Exploration Companies are the leading end-users, driven by the increasing exploration activities in the Philippines, which require extensive EPC services to support drilling and production operations.

The Philippines Oil & Gas EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TechnipFMC, Saipem S.p.A., JGC Corporation, KBR, Inc., McDermott International, Inc., Fluor Corporation, WorleyParsons, Samsung Engineering Co., Ltd., Daewoo Engineering & Construction Co., Ltd., Hyundai Engineering & Construction Co., Ltd., AECOM, Chiyoda Corporation, Bechtel Corporation, Petrofac Limited, SAIPEM S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines oil and gas EPC services market is poised for significant transformation as it adapts to evolving energy demands and regulatory landscapes. With a focus on sustainability and technological integration, the sector is likely to see increased collaboration between local and international firms. The government's commitment to infrastructure development and renewable energy projects will further drive innovation, creating a dynamic environment for EPC providers. As the market matures, strategic partnerships and digital advancements will play crucial roles in shaping future growth trajectories.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore EPC Services Offshore EPC Services Subsea EPC Services Modular Construction Services Maintenance and Repair Services Engineering Design Services Others |

| By End-User | Oil Exploration Companies Gas Production Companies Petrochemical Industries Government and Public Sector |

| By Application | Upstream Operations Midstream Operations Downstream Operations Infrastructure Development |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants and Subsidies |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Contract Type | Lump Sum Contracts Cost-Plus Contracts Time and Material Contracts |

| By Policy Support | Tax Incentives Subsidies for Renewable Projects Regulatory Support for Local Content Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Projects | 100 | Project Managers, Geologists |

| Refinery Construction Services | 80 | Construction Managers, Operations Directors |

| Pipeline Installation Services | 70 | Engineering Leads, Safety Officers |

| Maintenance & Repair Services | 60 | Maintenance Supervisors, Procurement Managers |

| Environmental Compliance Services | 50 | Environmental Managers, Compliance Officers |

The Philippines Oil & Gas EPC Services Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased investments in energy infrastructure and rising demand for natural gas, alongside government initiatives for energy independence.