Region:Europe

Author(s):Geetanshi

Product Code:KRAB0107

Pages:85

Published On:August 2025

By Type:The market is segmented into various types of pet food, including Dry Food, Wet Food, Treats and Snacks, Veterinary Diets, Pet Nutraceuticals & Supplements, Organic Pet Food, Grain-Free Pet Food, Functional Pet Food, and Others. Each of these subsegments caters to different consumer preferences and dietary needs for pets. Dry food and wet food remain the dominant segments, with growing demand for treats, functional, and organic products as pet owners seek specialized nutrition and health benefits .

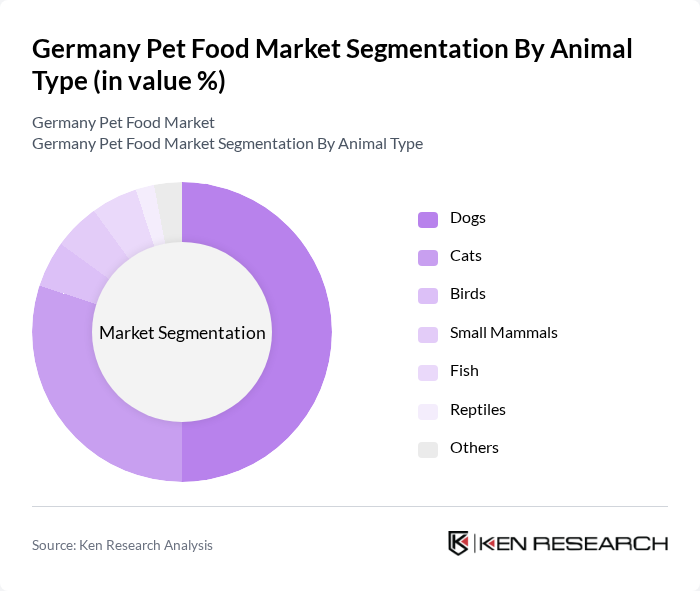

By Animal Type:The market is also segmented by animal type, which includes Dogs, Cats, Birds, Small Mammals, Fish, Reptiles, and Others. This segmentation allows for targeted marketing strategies and product development tailored to the specific needs of different pet owners. Dogs and cats account for the majority of pet food sales, reflecting their high ownership rates in Germany .

The Germany Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare Deutschland GmbH, Mars Petcare Deutschland GmbH, Hill's Pet Nutrition GmbH, Royal Canin Tiernahrung GmbH & Co. KG, Spectrum Brands Holdings Inc. (Tetra GmbH), WellPet LLC, Vitakraft pet care GmbH & Co. KG, Fressnapf Holding SE, Zooplus SE, Trixie Heimtierbedarf GmbH & Co. KG, Bubeck Petfood GmbH, Josera petfood GmbH & Co. KG, Interquell GmbH (Happy Dog/Happy Cat), Deuerer GmbH, Dr. Clauder solutions for pets GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German pet food market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and health-oriented products is expected to shape market dynamics, with brands innovating to meet these demands. Additionally, the rise of subscription-based services and personalized pet diets will likely enhance customer engagement and loyalty. As the market adapts to these trends, companies that prioritize quality and sustainability will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Food Wet Food Treats and Snacks Veterinary Diets Pet Nutraceuticals & Supplements Organic Pet Food Grain-Free Pet Food Functional Pet Food Others |

| By Animal Type | Dogs Cats Birds Small Mammals Fish Reptiles Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pet Specialty Stores Online Retail Convenience Stores Veterinary Clinics Direct-to-Consumer/Subscription Services Others |

| By Price Range | Economy Mid-Range Premium Super Premium |

| By Packaging Type | Bags Cans Pouches Bulk Packaging Sustainable/Eco-Friendly Packaging |

| By Brand Type | National Brands Private Labels International Brands |

| By Nutritional Content | High Protein Grain-Free Low Fat Functional Ingredients Hypoallergenic Breed/Size/Age-Specific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 60 | Store Managers, Category Buyers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 50 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 40 | Product Development Managers, Marketing Directors |

| Pet Supply Distributors | 40 | Distribution Managers, Sales Representatives |

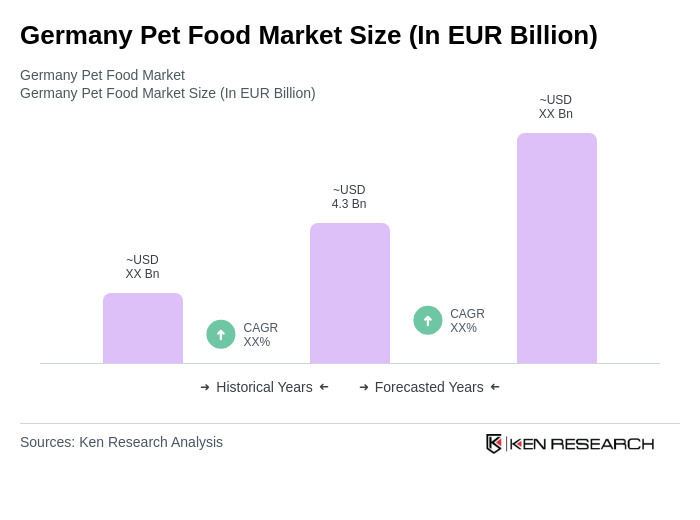

The Germany Pet Food Market is valued at approximately EUR 4.3 billion, reflecting a significant growth trend driven by increasing pet ownership, rising disposable incomes, and a shift towards premium, natural, and organic pet food products.