Region:Global

Author(s):Rebecca

Product Code:KRAA2947

Pages:99

Published On:August 2025

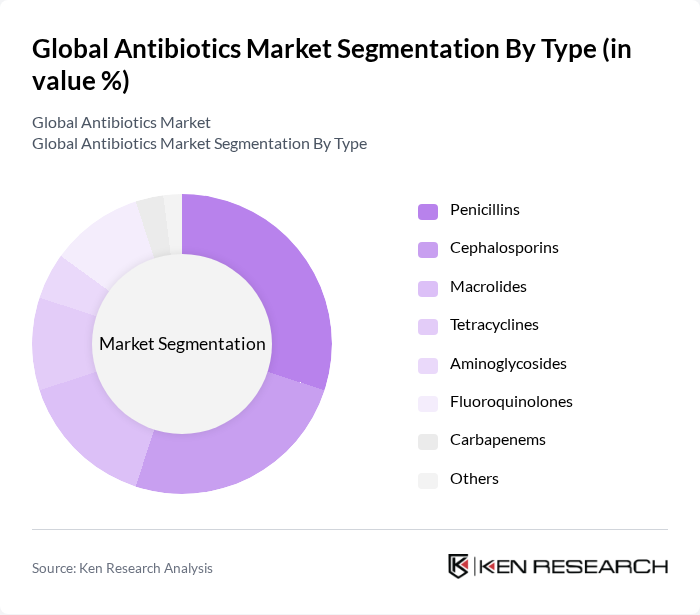

By Type:The antibiotics market is segmented into various types, including Penicillins, Cephalosporins, Macrolides, Tetracyclines, Aminoglycosides, Fluoroquinolones, Carbapenems, and Others. Among these, Penicillins and Cephalosporins are the most widely used due to their effectiveness against a broad range of bacterial infections and established clinical use. The increasing incidence of bacterial infections and the rising awareness of antibiotic treatments contribute to the dominance of these segments .

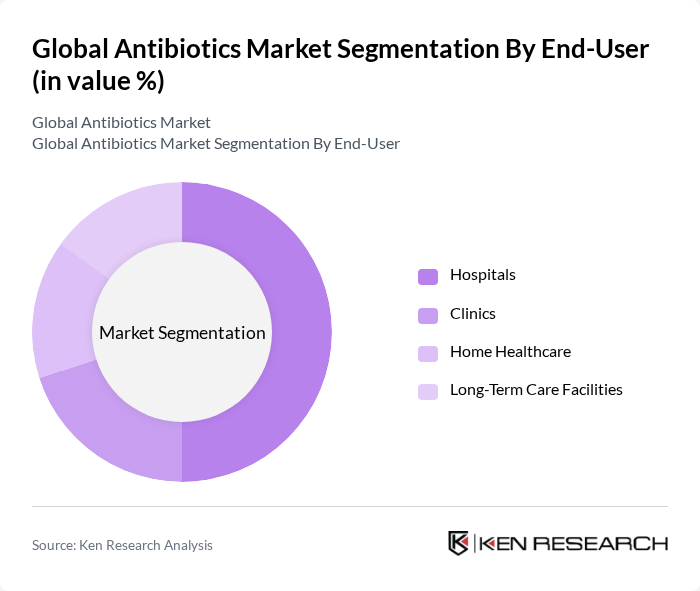

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Home Healthcare, and Long-Term Care Facilities. Hospitals are the leading end-user segment, driven by the high volume of antibiotic prescriptions for inpatients and the need for effective treatment of severe infections. The increasing number of hospital admissions due to infectious diseases further supports the growth of this segment .

The Global Antibiotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, GlaxoSmithKline plc, Novartis AG, Sanofi S.A., AstraZeneca plc, Roche Holding AG, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Abbott Laboratories, Bayer AG, AbbVie Inc., Boehringer Ingelheim GmbH, Takeda Pharmaceutical Company Limited, Aurobindo Pharma Ltd., Lupin Limited, Aspen Pharmacare Holdings Ltd., Melinta Therapeutics LLC, Armata Pharmaceuticals Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antibiotics market is poised for transformation, driven by the urgent need for innovative solutions to combat rising antibiotic resistance and the increasing prevalence of bacterial infections. As healthcare systems prioritize antibiotic stewardship and personalized medicine, the focus will shift towards developing targeted therapies. Additionally, the integration of digital health solutions will enhance antibiotic management, ensuring more effective use of existing drugs while fostering the development of novel antibiotics to address unmet medical needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Penicillins Cephalosporins Macrolides Tetracyclines Aminoglycosides Fluoroquinolones Carbapenems Others |

| By End-User | Hospitals Clinics Home Healthcare Long-Term Care Facilities |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies Wholesalers/Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Infectious Diseases Surgical Prophylaxis Dental Infections Respiratory Tract Infections Urinary Tract Infections Others |

| By Class | Broad-Spectrum Antibiotics Narrow-Spectrum Antibiotics |

| By Price Range | Low Price Medium Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Antibiotic Usage | 120 | Infectious Disease Specialists, Hospital Pharmacists |

| Outpatient Antibiotic Prescribing | 90 | General Practitioners, Family Medicine Doctors |

| Pharmaceutical Sales Insights | 60 | Sales Representatives, Market Access Managers |

| Regulatory Compliance Perspectives | 50 | Regulatory Affairs Managers, Compliance Officers |

| Consumer Awareness and Attitudes | 70 | Patients, Healthcare Advocates |

The Global Antibiotics Market is valued at approximately USD 50 billion, driven by the rising prevalence of infectious diseases, increased healthcare expenditure, and the demand for effective antibiotic treatments. This market is expected to grow further due to ongoing research and development efforts.