Kuwait Antibiotics Market Overview

- The Kuwait Antibiotics Market is valued at USD 45 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of bacterial and other infectious diseases, rising healthcare expenditure, and the growing awareness of evidence?based antibiotic treatments among healthcare professionals and patients. The market has seen a steady demand for various antibiotic classes supported by rising imports and improving access to medicines, reflecting the ongoing need for effective treatment options in the healthcare sector.

- Kuwait City is the dominant hub in the Kuwait Antibiotics Market due to its advanced healthcare infrastructure, including a concentration of public and private hospitals, specialist centers and clinics that facilitate the distribution and consumption of antibiotics. Additionally, the presence of key pharmaceutical manufacturers, distributors and academic institutions such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Kuwait Pharmaceutical Industries (KPI), and Kuwait University – Faculty of Pharmacy in the city contributes to its market leadership, ensuring a steady supply of antibiotic products and supporting clinical use and research to meet local healthcare needs.

- In 2023, the Kuwaiti government reinforced national measures mandating stricter controls on antibiotic prescriptions to combat antimicrobial resistance, aligned with the National Action Plan for Combating Antimicrobial Resistance in the State of Kuwait issued by the Ministry of Health in 2018. This framework requires healthcare providers to follow standardized treatment guidelines, restrict over?the?counter antibiotic dispensing, and document indications for antibiotic use, ensuring that antibiotics are prescribed only when clinically necessary and appropriate. The initiative supports antibiotic stewardship programs in hospitals and primary care, promotes responsible antibiotic use, and enhances patient safety across the healthcare system through surveillance, infection?prevention measures, and professional education.

Kuwait Antibiotics Market Segmentation

By Drug Class:The market is segmented into various drug classes, including Penicillins, Cephalosporins, Macrolides, Tetracyclines, Aminoglycosides, Fluoroquinolones, Sulfonamides, and Others, consistent with global antibiotic classification. Among these, Penicillins and Cephalosporins are among the most widely used classes in clinical practice due to their established safety profiles and effectiveness against a broad range of community?acquired and hospital?acquired bacterial infections such as respiratory, skin, and urinary tract infections. Increasing incidence of respiratory and skin infections, along with protocol?driven use of beta?lactam antibiotics as first?line therapy, continues to support the strong demand for these drug classes, making them key segments in the Kuwait antibiotics market.

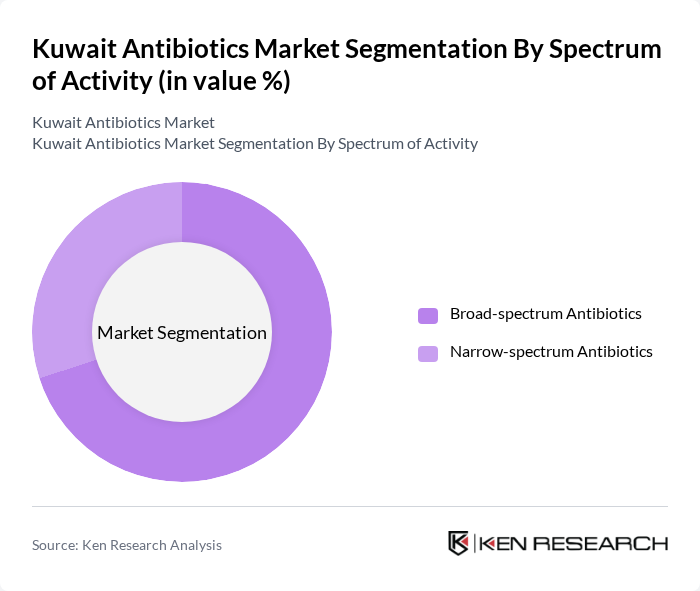

By Spectrum of Activity:The market is categorized into Broad-spectrum and Narrow-spectrum Antibiotics. Broad-spectrum antibiotics remain widely used because they can target a wide range of gram?positive and gram?negative bacteria and are frequently selected for empirical treatment in severe or undifferentiated infections. However, in Kuwait there is a strategic shift under stewardship programs toward more targeted, narrow?spectrum agents where possible, in order to limit resistance development and preserve broad?spectrum options for high?risk or multidrug?resistant cases. The increasing recognition of multidrug?resistant organisms and use of diagnostics to guide therapy is gradually increasing the role of narrow?spectrum therapies while broad?spectrum antibiotics continue to hold a substantial share of overall use.

Kuwait Antibiotics Market Competitive Landscape

The Kuwait Antibiotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Kuwait Pharmaceutical Industries (KPI), Gulf Pharmaceutical Industries PSC (Julphar), Pharmazone, Al Mulla Group – Healthcare & Pharmaceutical Division, Ali Abdulwahab Al Mutawa Commercial Co. (Healthcare Division), YIACO Medical Company, Al Salam International Hospital, Kuwait University – Faculty of Pharmacy, Kuwait Institute for Scientific Research (KISR), Ministry of Health – Kuwait (Central Medical Stores), Dar Al Shifa Hospital, Taiba Hospital, New Mowasat Hospital, Royale Hayat Hospital contribute to innovation, geographic expansion, formulary management, and service delivery in this space through manufacturing, import and distribution of antibiotic products, as well as stewardship, training and clinical use.

Kuwait Antibiotics Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Bacterial Infections:The rise in bacterial infections in Kuwait is significant, with the Ministry of Health reporting over 30,000 cases of bacterial infections annually. This surge is attributed to factors such as urbanization and lifestyle changes. The increasing incidence of antibiotic-resistant bacteria further exacerbates the situation, necessitating the development and use of effective antibiotics. As healthcare providers respond to this growing challenge, the demand for antibiotics is expected to rise, driving market growth.

- Rising Healthcare Expenditure:Kuwait's healthcare expenditure is projected to reach approximately USD 8.9 billion in future, reflecting a commitment to improving health services. This increase in spending is driven by government initiatives aimed at enhancing healthcare infrastructure and access to medications. As healthcare budgets expand, more resources are allocated to antibiotic procurement and research, fostering a conducive environment for market growth. Enhanced funding also supports the development of innovative antibiotic therapies to combat resistant strains.

- Growing Awareness of Antibiotic Resistance:The Kuwaiti government and healthcare organizations are increasingly focusing on antibiotic resistance, with campaigns aimed at educating the public and healthcare professionals. In future, initiatives are expected to increase awareness among a substantial share of the population regarding responsible antibiotic use. This heightened awareness is likely to drive demand for new antibiotics and stewardship programs, as healthcare providers seek effective solutions to combat resistant infections, thereby stimulating market growth.

Market Challenges

- High Cost of Antibiotic Development:The development of new antibiotics is a costly endeavor, with estimates suggesting that it can exceed USD 1 billion per drug. This financial burden is a significant barrier for pharmaceutical companies, particularly in Kuwait, where the market is relatively small. The high costs associated with research, clinical trials, and regulatory approvals can deter investment in antibiotic innovation, limiting the availability of new treatments and hindering market growth.

- Stringent Regulatory Requirements:The regulatory landscape for antibiotics in Kuwait is complex, with stringent requirements imposed by the Ministry of Health. These regulations can delay the approval process for new antibiotics, often extending timelines by several years. In future, the average approval time for new antibiotics is expected to remain lengthy, which can discourage pharmaceutical companies from pursuing antibiotic development, ultimately impacting market dynamics and innovation.

Kuwait Antibiotics Market Future Outlook

The future of the Kuwait antibiotics market appears promising, driven by increasing healthcare investments and a growing focus on combating antibiotic resistance. As the government enhances healthcare infrastructure, the accessibility of antibiotics is expected to improve. Additionally, the rise of telemedicine and digital health solutions will facilitate better patient management and adherence to antibiotic therapies. These trends indicate a shift towards more effective treatment protocols, fostering a more resilient healthcare system in Kuwait.

Market Opportunities

- Development of Novel Antibiotics:There is a significant opportunity for pharmaceutical companies to invest in the development of novel antibiotics targeting resistant strains. With the increasing prevalence of multi-drug resistant infections, innovative solutions are essential. Collaborations with research institutions can enhance R&D efforts, potentially leading to breakthroughs that address urgent healthcare needs in Kuwait.

- Expansion into Emerging Markets:Kuwaiti pharmaceutical companies have the potential to expand their reach into emerging markets in the Middle East and North Africa. By leveraging their expertise in antibiotic production, they can tap into new customer bases. This expansion can lead to increased revenues and market share, while also contributing to global efforts in combating antibiotic resistance through improved access to essential medications.