Region:Global

Author(s):Geetanshi

Product Code:KRAA1327

Pages:81

Published On:August 2025

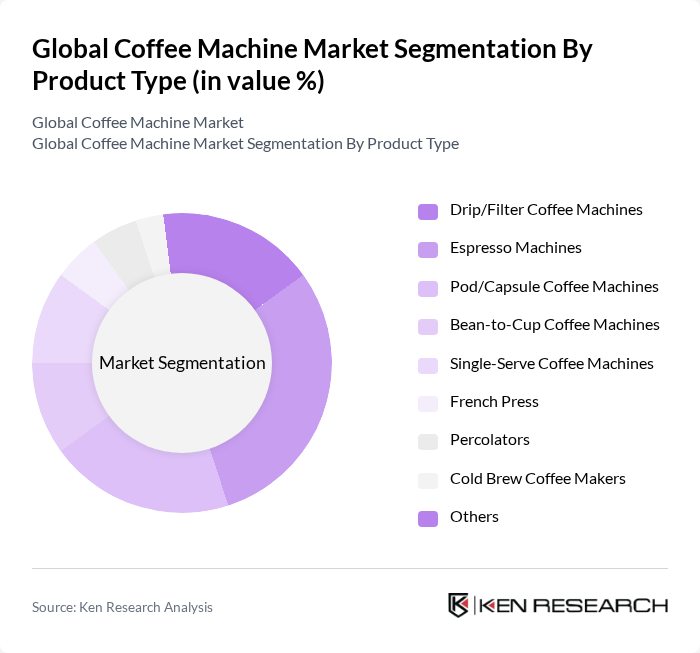

By Product Type:The product type segmentation includes various coffee machine categories that cater to different consumer preferences and usage scenarios. The subsegments are Drip/Filter Coffee Machines, Espresso Machines, Pod/Capsule Coffee Machines, Bean-to-Cup Coffee Machines, Single-Serve Coffee Machines, French Press, Percolators, Cold Brew Coffee Makers, and Others. Espresso Machines are currently leading the market due to their popularity in both residential and commercial settings, driven by the increasing demand for espresso-based beverages and the proliferation of specialty coffee shops .

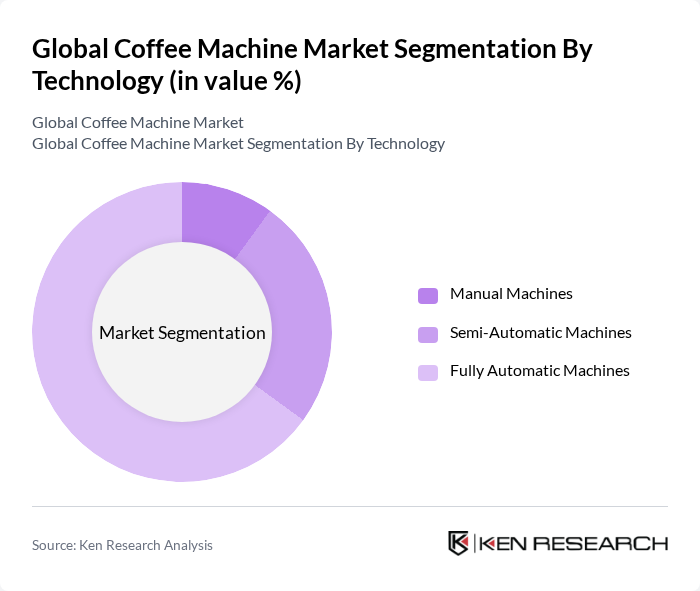

By Technology:The technology segmentation encompasses Manual Machines, Semi-Automatic Machines, and Fully Automatic Machines. Fully Automatic Machines are leading this segment due to their convenience, ease of use, and ability to deliver consistent quality, appealing to busy consumers who prefer quick and reliable coffee preparation without manual intervention. The adoption of smart and multi-functional features further accelerates the growth of this segment .

The Global Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Nespresso), JURA Elektroapparate AG, Breville Group Ltd., De'Longhi S.p.A., Koninklijke Philips N.V., Hamilton Beach Brands Holding Company, Cuisinart (Conair Corporation), Krups (Groupe SEB), Bosch (BSH Hausgeräte GmbH), Saeco (Philips), Rancilio Group S.p.A., La Marzocco S.r.l., Gaggia S.p.A., Smeg S.p.A., Tchibo GmbH, Melitta Group, Electrolux AB, Panasonic Corporation, Keurig Dr Pepper Inc., Illycaffè S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The coffee machine market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are expected to focus on eco-friendly designs and materials. Additionally, the integration of smart technology will enhance user experience, making coffee preparation more convenient. The rise of subscription services for coffee supplies will also create new revenue streams, allowing companies to engage consumers more effectively and foster brand loyalty in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drip/Filter Coffee Machines Espresso Machines Pod/Capsule Coffee Machines Bean-to-Cup Coffee Machines Single-Serve Coffee Machines French Press Percolators Cold Brew Coffee Makers Others |

| By Technology | Manual Machines Semi-Automatic Machines Fully Automatic Machines |

| By End-User | Residential Commercial |

| By Distribution Channel | Offline Retail Online Retail Direct Sales Distributors |

| By Region | North America Europe Asia Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Coffee Machine Users | 120 | Homeowners, Coffee Enthusiasts |

| Commercial Coffee Machine Operators | 90 | Café Owners, Restaurant Managers |

| Retail Coffee Machine Buyers | 60 | Retail Managers, Purchasing Agents |

| Online Coffee Machine Shoppers | 50 | E-commerce Managers, Digital Marketing Specialists |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

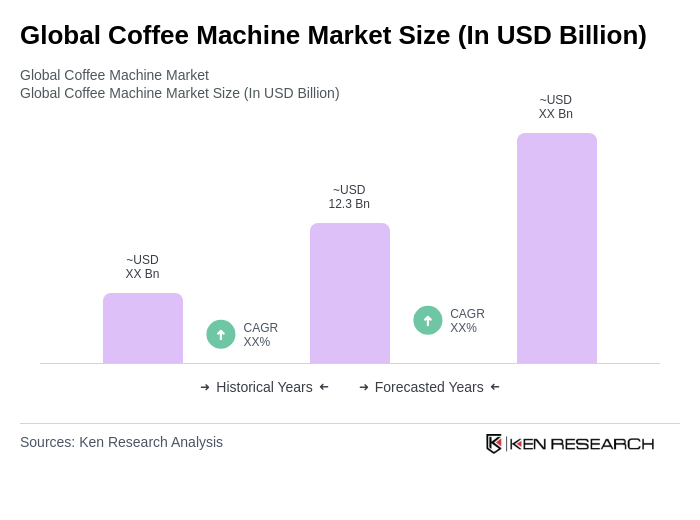

The Global Coffee Machine Market is valued at approximately USD 12.3 billion, reflecting a significant growth driven by increasing coffee consumption, the rise of specialty coffee chains, and the trend of at-home coffee brewing.