Region:Global

Author(s):Geetanshi

Product Code:KRAA4178

Pages:91

Published On:January 2026

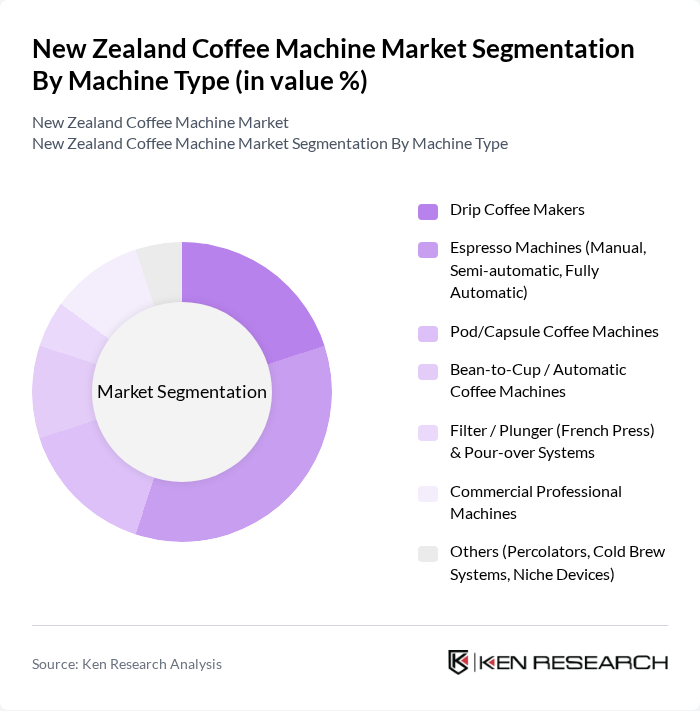

By Machine Type:The coffee machine market is segmented into various types, including Drip Coffee Makers, Espresso Machines (Manual, Semi-automatic, Fully Automatic), Pod/Capsule Coffee Machines, Bean-to-Cup / Automatic Coffee Machines, Filter / Plunger (French Press) & Pour-over Systems, Commercial Professional Machines, and Others (Percolators, Cold Brew Systems, Niche Devices). This segmentation aligns with the typical categorisation of domestic coffee appliances in international market studies, which distinguish between drip, espresso, capsule, bean-to-cup, and manual brewing systems. Among these, Espresso Machines are currently dominating the market in value terms due to their popularity in both residential and commercial settings, driven by the increasing demand for high-quality espresso-based beverages and fully automatic solutions that replicate café-style drinks at home and in on-trade locations.

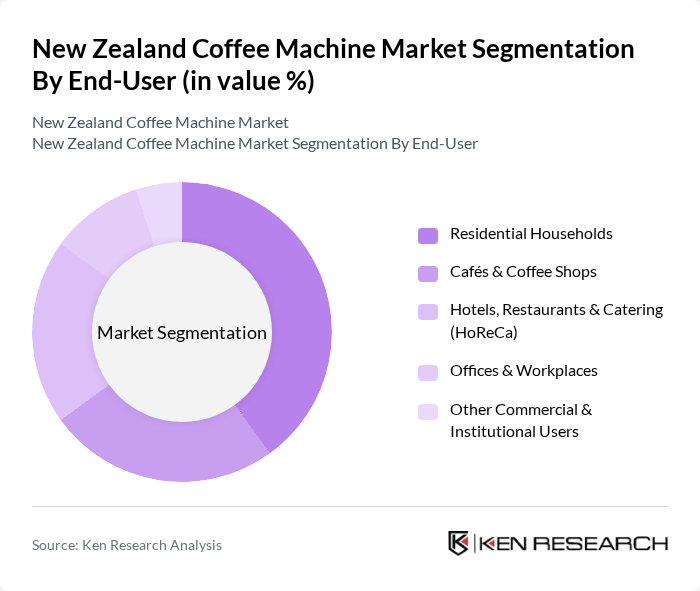

By End-User:The market is segmented by end-users, including Residential Households, Cafés & Coffee Shops, Hotels, Restaurants & Catering (HoReCa), Offices & Workplaces, and Other Commercial & Institutional Users. This structure is consistent with global coffee machine market segmentation, which differentiates between residential and a broad commercial/HoReCa and office base. The Residential Households segment is currently the largest in unit demand and an increasingly important contributor in value terms, driven by the growing trend of home brewing, the diffusion of capsule and fully automatic machines, and the rising number of coffee enthusiasts investing in quality machines for personal use.

The New Zealand Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Breville Group, Sunbeam Products, De'Longhi Group, Nestlé Nespresso, Philips Domestic Appliances, Caffitaly System, Gaggia Milano, Rancilio Group, Jura Elektroapparate, Hamilton Beach Brands, Krups (Groupe SEB), Smeg, Miele, Bosch (BSH Hausgeräte), Tefal (Groupe SEB) contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global coffee machine competitive landscape in which these brands are key suppliers across residential and commercial segments.

The New Zealand coffee machine market is poised for continued growth, driven by evolving consumer preferences and technological innovations. As more consumers embrace home brewing, the demand for high-quality, user-friendly machines is expected to rise. Additionally, sustainability trends will likely influence purchasing decisions, with eco-friendly machines gaining traction. The integration of smart technology will further enhance user experiences, making coffee preparation more convenient and personalized, thus shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Machine Type | Drip Coffee Makers Espresso Machines (Manual, Semi-automatic, Fully Automatic) Pod/Capsule Coffee Machines Bean-to-Cup / Automatic Coffee Machines Filter / Plunger (French Press) & Pour-over Systems Commercial Professional Machines Others (Percolators, Cold Brew Systems, Niche Devices) |

| By End-User | Residential Households Cafés & Coffee Shops Hotels, Restaurants & Catering (HoReCa) Offices & Workplaces Other Commercial & Institutional Users |

| By Price Range | Entry-Level / Budget (< NZD 300) Mid-Range (NZD 300–999) Premium (NZD 1,000–2,499) Luxury / Professional (? NZD 2,500) Others |

| By Brand Ownership | Global Brands Regional / Australasian Brands Private Labels (Retailer & Importer Brands) Others |

| By Distribution Channel | Specialist Appliance & Electronics Retailers Mass Retail & Hypermarkets Online & E-commerce Platforms Direct-to-Consumer & Brand Stores Others (Coffee Roasters, Trade Distributors) |

| By Key Features & Technology | Manual / Non-Programmable Machines Programmable & Automatic Settings Built-in Grinder Milk Frother / Steam Wand Smart / Connected Machines (App or IoT Enabled) Energy-efficient & Eco-Design Models Others |

| By Installation & Usage Location | Countertop Machines Built-in / Integrated Kitchen Systems Self-service & Vending-type Coffee Machines Portable & Travel Coffee Makers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Coffee Machine Users | 150 | Homeowners, Coffee Enthusiasts |

| Café Owners and Managers | 120 | Café Owners, Operations Managers |

| Retail Sales Representatives | 90 | Sales Associates, Store Managers |

| Baristas and Coffee Professionals | 80 | Baristas, Coffee Trainers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The New Zealand Coffee Machine Market is valued at approximately NZD 60 million, reflecting a steady growth trajectory driven by increasing coffee consumption, rising disposable incomes, and a trend towards home brewing among consumers.