Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4175

Pages:80

Published On:January 2026

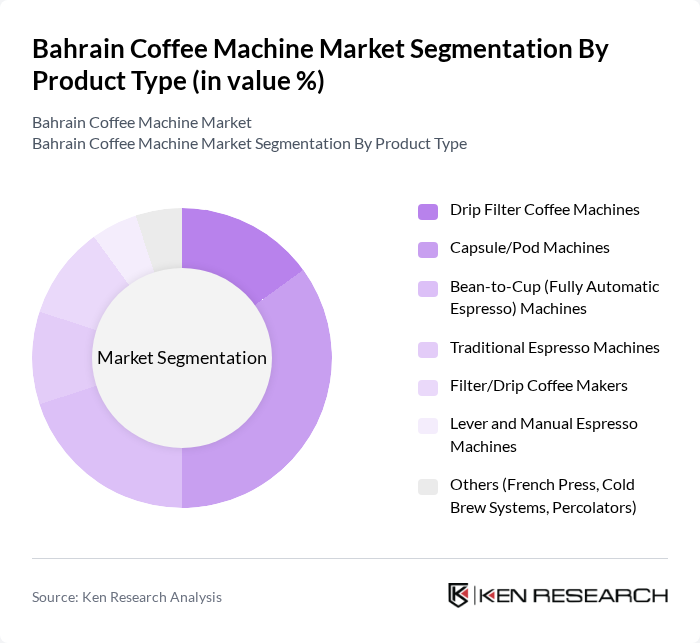

By Product Type:The product type segmentation includes various coffee machine categories that cater to different consumer preferences and usage scenarios. The subsegments are Drip Filter Coffee Machines, Capsule/Pod Machines, Bean-to-Cup (Fully Automatic Espresso) Machines, Traditional Espresso Machines, Filter/Drip Coffee Makers, Lever and Manual Espresso Machines, and Others (French Press, Cold Brew Systems, Percolators). Capsule/Pod Machines are gaining significant traction due to their convenience, portion-controlled servings, and wide availability of branded coffee capsules, appealing especially to busy urban consumers and expatriates who prefer quick and consistent coffee solutions.

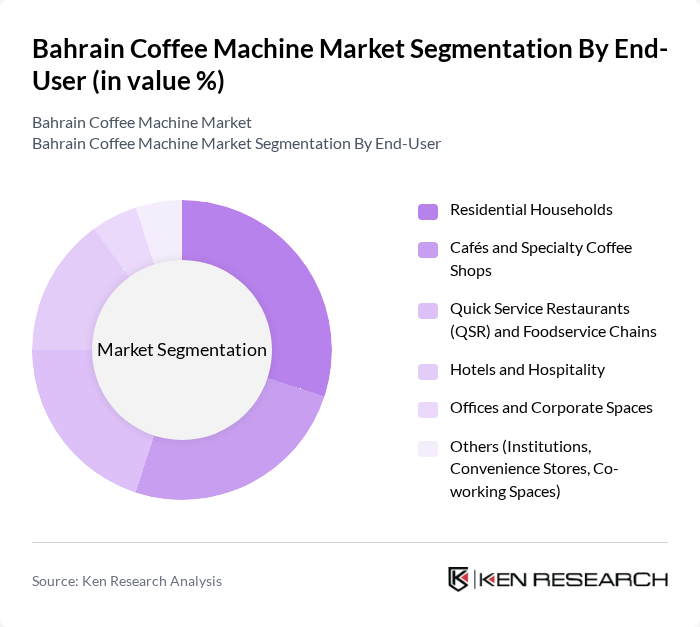

By End-User:The end-user segmentation encompasses various consumer categories, including Residential Households, Cafés and Specialty Coffee Shops, Quick Service Restaurants (QSR) and Foodservice Chains, Hotels and Hospitality, Offices and Corporate Spaces, and Others (Institutions, Convenience Stores, Co-working Spaces). The residential segment is witnessing a surge in demand as more households invest in coffee machines for personal use, driven by growing coffee culture, higher disposable incomes, and a shift toward at-home café experiences supported by e-commerce and modern retail channels. Commercial end-users, particularly cafés, hotels, and QSR chains, are focusing on reliable, high-capacity espresso and bean-to-cup machines to meet rising expectations for specialty beverages and consistent quality.

The Bahrain Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nespresso, De'Longhi, Philips, Krups, Bosch, Saeco (Philips), Cuisinart, Hamilton Beach, Smeg, Rancilio, Gaggia, Jura, Miele, La Marzocco, and other regional and local brands contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain coffee machine market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, more consumers are likely to invest in premium coffee machines, enhancing their home brewing experiences. Additionally, the increasing popularity of specialty coffee shops will further stimulate demand for high-quality machines. With a focus on sustainability and innovation, the market is expected to adapt to changing consumer needs, paving the way for new product developments and market entrants.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drip Filter Coffee Machines Capsule/Pod Machines Bean-to-Cup (Fully Automatic Espresso) Machines Traditional Espresso Machines Filter/Drip Coffee Makers Lever and Manual Espresso Machines Others (French Press, Cold Brew Systems, Percolators) |

| By End-User | Residential Households Cafés and Specialty Coffee Shops Quick Service Restaurants (QSR) and Foodservice Chains Hotels and Hospitality Offices and Corporate Spaces Others (Institutions, Convenience Stores, Co-working Spaces) |

| By Sales Channel | Offline – Specialist Stores & Showrooms Offline – Hypermarkets & Supermarkets Offline – Consumer Electronics & Appliance Retailers Online – E-commerce Marketplaces Online – Brand Webstores & Direct-to-Consumer B2B & Institutional Sales |

| By Technology / Mode of Operation | Manual Semi-Automatic Fully Automatic Super-automatic & Smart/Connected Machines (IoT-enabled) Others |

| By Price Range | Entry-level / Economy (< BHD 50) Mid-range (BHD 50–200) Premium (BHD 200–500) Luxury / Professional (> BHD 500) |

| By Installation Type | Countertop Machines Built-in / Integrated Machines Freestanding Commercial Machines |

| By Beverage Type Capability | Espresso-only Machines Multi-beverage (Espresso-based, Americano, Cappuccino, Latte, etc.) Filter Coffee-only Machines Specialty & Customizable Recipe Machines |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Machine Sales | 90 | Retail Managers, Sales Executives |

| Consumer Preferences in Coffee Machines | 120 | Coffee Enthusiasts, General Consumers |

| Commercial Coffee Machine Usage | 100 | Café Owners, Restaurant Managers |

| Market Trends and Innovations | 80 | Industry Experts, Product Developers |

| Distribution Channels for Coffee Machines | 70 | Distributors, Supply Chain Managers |

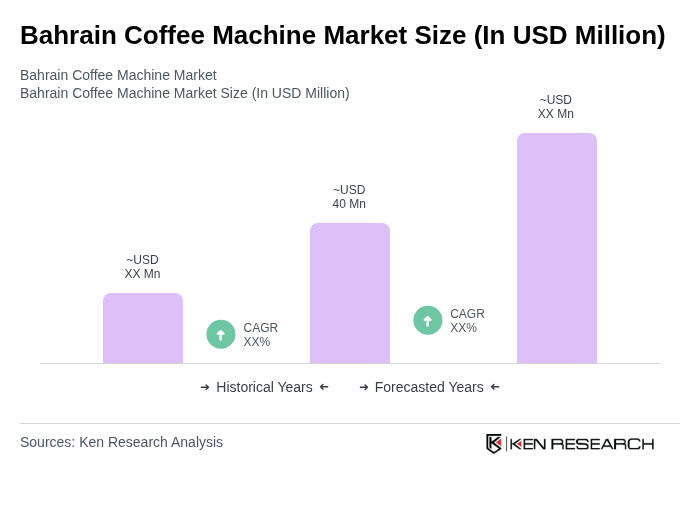

The Bahrain Coffee Machine Market is valued at approximately USD 40 million, reflecting a growing trend in coffee consumption and the increasing popularity of premium coffee machines among consumers in the region.