Kuwait Coffee Machine Market Overview

- The Kuwait Coffee Machine Market is valued at USD 30 million, based on a five-year historical analysis of the household coffee machines segment and broader small-appliance spending patterns in the country. This growth is primarily driven by the increasing coffee consumption culture, rising disposable incomes, and the growing trend of home brewing among consumers, in line with the rapid expansion of specialty coffee and café culture across the Middle East. The market has seen a significant shift towards premium and specialty coffee machines, particularly capsule/pod systems and automatic espresso machines, reflecting a broader global trend towards quality, customization, and convenience in coffee preparation.

- Kuwait City is the dominant hub in the coffee machine market, attributed to its high population density, concentration of higher-income households, and urban lifestyle that fosters frequent coffee consumption. Other notable areas include Hawalli and Salmiya, where a blend of expatriate communities and local preferences drives demand for diverse coffee machine options and premium brands. The presence of numerous cafes, specialty coffee shops, and restaurants in these districts further enhances the market's growth, as consumers seek to replicate café-quality beverages at home and in offices.

- In recent years, the Kuwaiti government has implemented regulations to promote energy-efficient appliances, including coffee machines. The core framework is provided by the Ministerial Resolution No. 1 of 2018 on the Application of Mandatory Energy Efficiency Labels and Minimum Energy Performance Standards for Electrical Appliances issued by the Public Authority for Industry and the Ministry of Electricity and Water, which sets performance and labelling requirements for a range of household electrical products and aligns Kuwait with Gulf Standards Organization (GSO) efficiency standards. This initiative encourages manufacturers and importers to supply products that meet specified energy consumption thresholds and carry approved energy labels, thereby enhancing sustainability, reducing electricity demand, and making compliance with energy-efficiency norms increasingly important for coffee machine market participants.

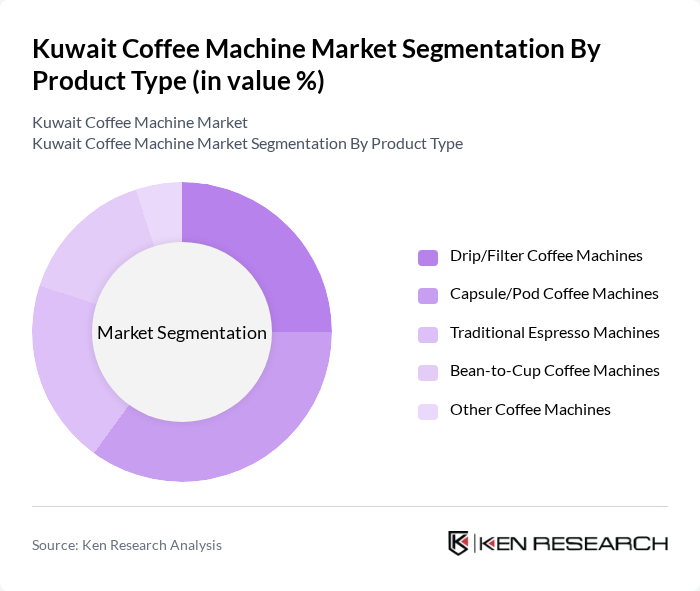

Kuwait Coffee Machine Market Segmentation

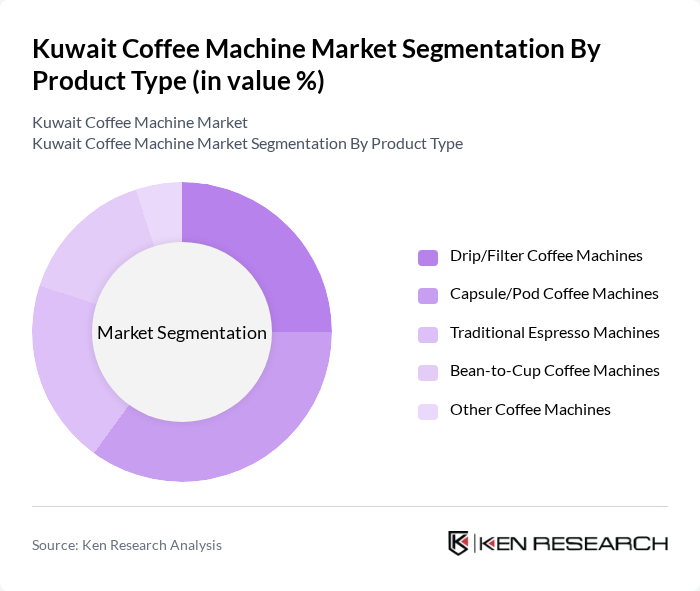

By Product Type:The coffee machine market can be segmented into various product types, including Drip/Filter Coffee Machines, Capsule/Pod Coffee Machines, Traditional Espresso Machines, Bean-to-Cup Coffee Machines, and Other Coffee Machines, in line with global and regional categorization. Among these, Capsule/Pod Coffee Machines are gaining significant traction due to their convenience, portion-controlled servings, wide variety of flavors, and minimal preparation time, appealing to busy consumers who prefer quick coffee solutions, especially in urban households and small offices. Traditional Espresso Machines also hold a strong position, particularly among coffee enthusiasts and specialty cafés who value the control, quality, and experience of brewing coffee manually or semi-manually, while bean-to-cup automatic machines are increasingly adopted by premium home users and offices seeking barista-style beverages with one-touch operation.

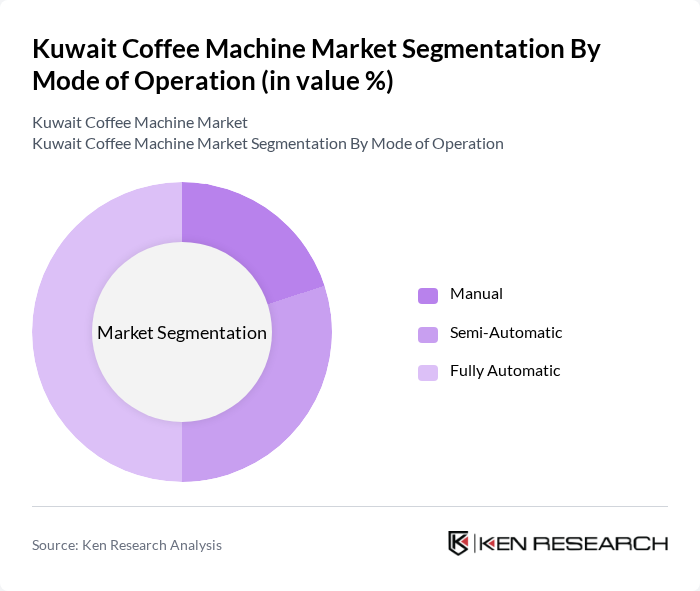

By Mode of Operation:The market can also be segmented based on the mode of operation, which includes Manual, Semi-Automatic, and Fully Automatic coffee machines, consistent with international market classifications. Fully Automatic machines are leading the market due to their user-friendly features, integrated grinding and brewing functions, programmable settings, and ability to deliver consistent quality with minimal effort. This trend is driven by the increasing demand for convenience and efficiency among consumers, particularly in urban areas where time is a premium and among offices that seek to provide café-style beverages to employees with minimal training or supervision.

Kuwait Coffee Machine Market Competitive Landscape

The Kuwait Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nespresso, Breville, De'Longhi, Philips, Krups, Cuisinart, Hamilton Beach, Saeco, Smeg, Rancilio, Gaggia, Jura, Miele, Tchibo, Melitta contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global competitive landscape in which premium capsule systems, fully automatic espresso machines, and multifunctional drip/espresso combinations are key growth platforms.

Kuwait Coffee Machine Market Industry Analysis

Growth Drivers

- Increasing Coffee Consumption:Coffee consumption in Kuwait has seen a significant rise, with an average per capita consumption of 2.6 kg annually in future. This figure is projected to increase by 5% in future, driven by a growing coffee culture and lifestyle changes. The increasing number of coffee drinkers, particularly among the youth, is contributing to this trend. As coffee becomes a staple beverage, the demand for coffee machines is expected to rise correspondingly, creating a robust market environment.

- Rise in Specialty Coffee Shops:The number of specialty coffee shops in Kuwait has surged, with over 160 new establishments opening in future alone. This growth is indicative of a shift towards premium coffee experiences, which has led to increased demand for high-quality coffee machines. Specialty shops often require advanced brewing equipment to meet customer expectations, thus driving the market for sophisticated coffee machines. The trend is expected to continue, further bolstering the market in future.

- Technological Advancements in Coffee Machines:The coffee machine market is witnessing rapid technological advancements, with smart coffee machines gaining traction. In future, approximately 35% of coffee machines sold in Kuwait featured IoT capabilities, allowing for remote operation and customization. This trend is expected to grow, as consumers increasingly seek convenience and personalization in their coffee-making experience. The integration of technology is anticipated to enhance the appeal of coffee machines, driving sales in the coming year.

Market Challenges

- High Initial Investment Costs:The high initial investment required for quality coffee machines poses a significant challenge for both consumers and businesses. Premium coffee machines can range from KWD 250 to KWD 1,600, which may deter potential buyers, especially in a market where price sensitivity is prevalent. This financial barrier can limit market penetration and slow down the adoption of advanced coffee machines, impacting overall market growth in future.

- Limited Local Manufacturing:Kuwait's coffee machine market heavily relies on imports, with over 75% of machines being sourced from abroad. This dependence on foreign manufacturers can lead to supply chain vulnerabilities and increased costs due to import tariffs. Additionally, the lack of local manufacturing capabilities limits the market's ability to respond quickly to consumer demands and preferences, posing a challenge for growth in the competitive landscape.

Kuwait Coffee Machine Market Future Outlook

The Kuwait coffee machine market is poised for significant growth, driven by evolving consumer preferences and technological innovations. As coffee culture continues to flourish, the demand for high-quality, technologically advanced machines is expected to rise. Additionally, the increasing popularity of home brewing and specialty coffee shops will further stimulate market dynamics. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, positioning themselves favorably in the market landscape through future and beyond.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Kuwait presents a significant opportunity for coffee machine sales. With online retail sales projected to reach KWD 1.2 billion in future, companies can leverage digital platforms to reach a broader audience. This shift allows for enhanced customer engagement and convenience, potentially increasing market penetration for coffee machines.

- Increasing Demand for Smart Coffee Machines:The demand for smart coffee machines is on the rise, with sales expected to increase by 25% in future. Consumers are increasingly seeking machines that offer connectivity and customization features. This trend presents an opportunity for manufacturers to innovate and cater to tech-savvy consumers, enhancing their product offerings and capturing a larger market share.