Region:Asia

Author(s):Geetanshi

Product Code:KRAA4177

Pages:81

Published On:January 2026

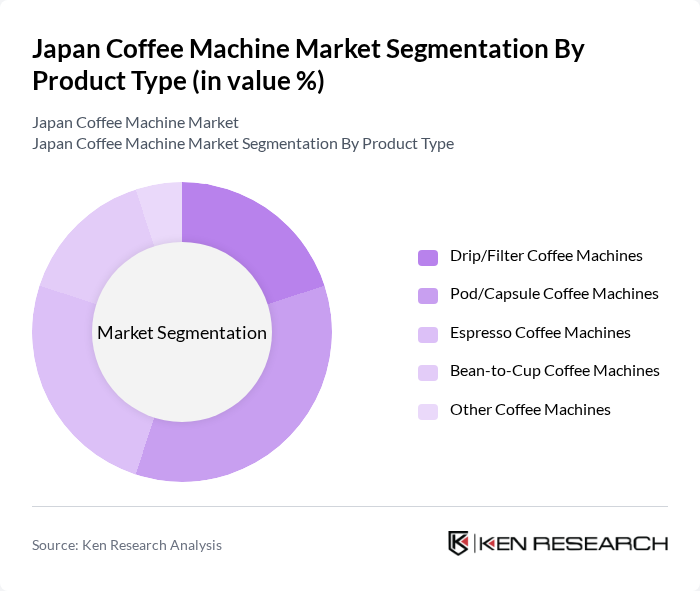

By Product Type:The product type segmentation includes various coffee machine categories that cater to different consumer preferences and usage scenarios. The subsegments are Drip/Filter Coffee Machines, Pod/Capsule Coffee Machines, Espresso Coffee Machines, Bean-to-Cup Coffee Machines, and Other Coffee Machines. Among these, Pod/Capsule Coffee Machines have gained significant popularity due to their convenience, portion control, and variety of flavors, appealing to busy consumers and office environments where quick, consistent, and low-maintenance coffee solutions are preferred.

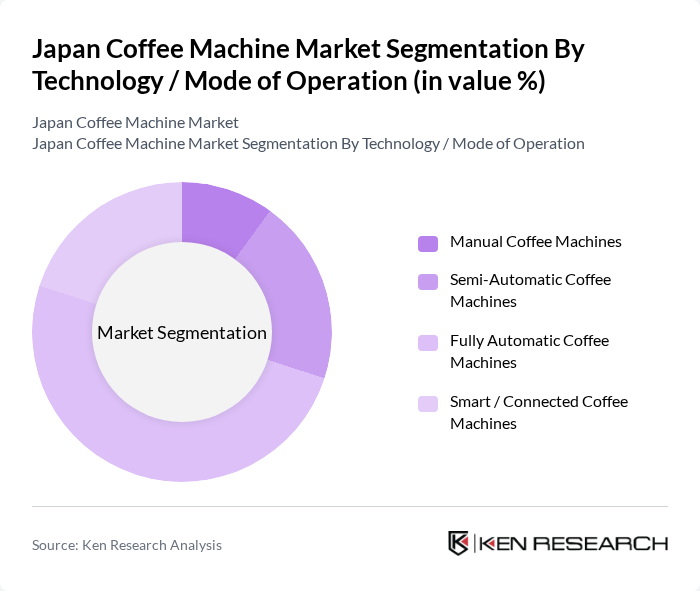

By Technology / Mode of Operation:This segmentation focuses on the operational technology of coffee machines, which includes Manual Coffee Machines, Semi-Automatic Coffee Machines, Fully Automatic Coffee Machines, and Smart/Connected Coffee Machines. Fully Automatic Coffee Machines are currently leading the market due to their ease of use, integrated grinding and brewing functions, and ability to deliver consistent quality, catering to both home users and commercial establishments such as offices, hotels, and cafés looking for efficiency, menu variety, and reduced skill dependency.

The Japan Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, De'Longhi S.p.A., Breville Group Limited, Nespresso (Nestlé S.A.), Krups (Groupe SEB), Philips (Koninklijke Philips N.V.), HARIO Co., Ltd., Melitta Group, Cuisinart (Conair Corporation), Mr. Coffee (Newell Brands), Gaggia Milano (Gruppo Cimbali), JURA Elektroapparate AG, Smeg S.p.A., Tchibo GmbH, UCC Ueshima Coffee Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan coffee machine market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As the trend towards home brewing intensifies, manufacturers are likely to focus on developing innovative, user-friendly machines that cater to the growing demand for specialty coffee. Additionally, sustainability initiatives will play a crucial role, as consumers increasingly seek eco-friendly products, influencing future product development and marketing strategies in the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drip/Filter Coffee Machines Pod/Capsule Coffee Machines Espresso Coffee Machines Bean-to-Cup Coffee Machines Other Coffee Machines |

| By Technology / Mode of Operation | Manual Coffee Machines Semi-Automatic Coffee Machines Fully Automatic Coffee Machines Smart / Connected Coffee Machines |

| By End-User | Residential Households Hotels, Restaurants & Cafés (HoReCa) Offices & Corporate Spaces Other Commercial & Institutional Users |

| By Price Range | Economy (Entry-Level) Mid-Range Premium Luxury |

| By Distribution Channel | Online Retail (E-commerce & Marketplaces) Specialty Stores & Brand Outlets Consumer Electronics & Department Stores Other Offline Channels |

| By Key Features | Programmable & Auto-Brewing Functions Integrated Grinder Milk Frothing / Latte & Cappuccino Functions Energy-Saving & Eco-Friendly Features Smart App Connectivity & IoT Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Coffee Machine Users | 150 | Homeowners, Coffee Enthusiasts |

| Commercial Coffee Machine Operators | 100 | Café Owners, Restaurant Managers |

| Retail Distributors of Coffee Machines | 80 | Retail Managers, Sales Representatives |

| Online Coffee Machine Buyers | 120 | eCommerce Shoppers, Digital Marketing Managers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

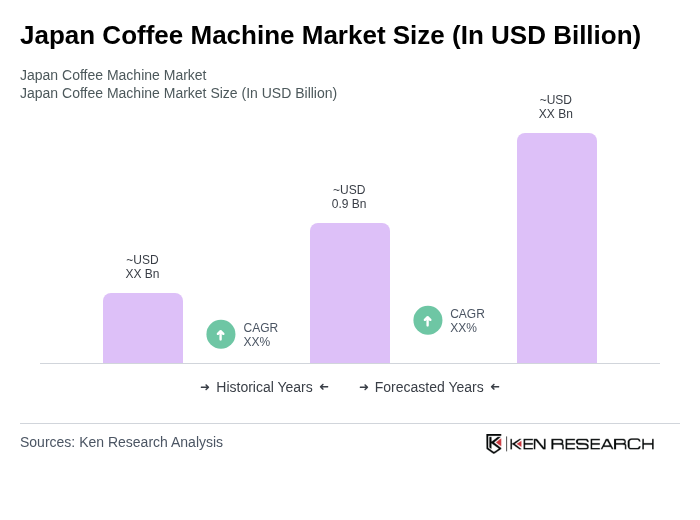

The Japan Coffee Machine Market is valued at approximately USD 0.9 billion, reflecting a significant growth trend driven by increasing coffee consumption, the rise of specialty coffee shops, and a growing preference for home brewing among consumers.