Region:Asia

Author(s):Geetanshi

Product Code:KRAA4173

Pages:90

Published On:January 2026

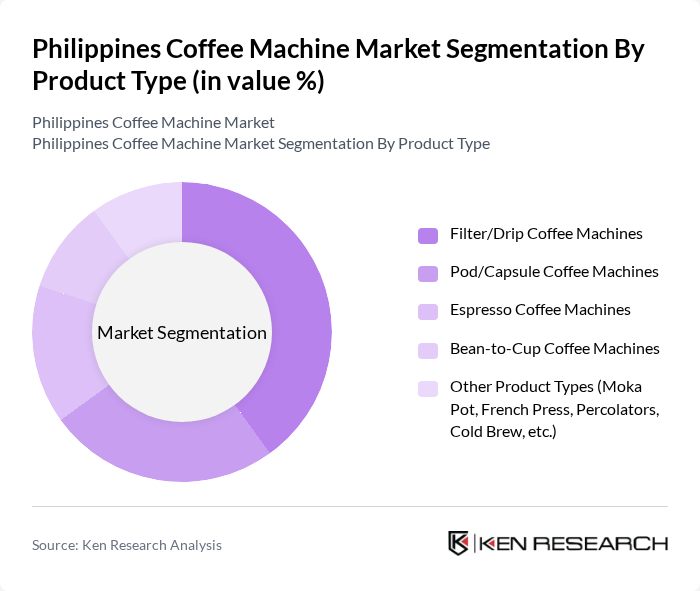

By Product Type:The coffee machine market can be segmented into various product types, including Filter/Drip Coffee Machines, Pod/Capsule Coffee Machines, Espresso Coffee Machines, Bean-to-Cup Coffee Machines, and Other Product Types such as Moka Pot, French Press, Percolators, and Cold Brew. In the Philippines, drip/filter coffee makers and capsule/pod systems are among the most widely used formats in households due to their affordability, ease of use, and availability through supermarkets, appliance stores, and online channels. Bean?to?cup and espresso machines are gaining traction, particularly in cafés, offices, and high?income households seeking café?style beverages at home, supported by the broader Asia–Pacific trend toward premium and specialty coffee equipment. The growing trend of home brewing and the influence of specialty coffee culture continue to support the expansion of these segments.

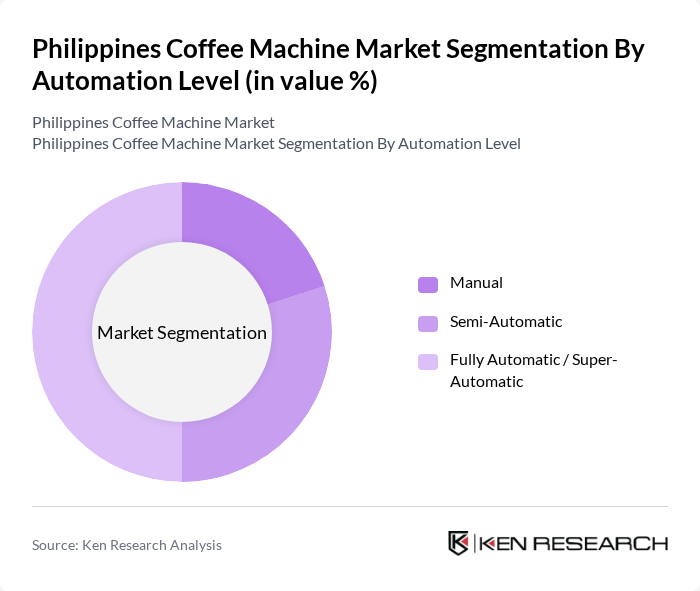

By Automation Level:The market can also be segmented based on automation levels, which include Manual, Semi-Automatic, and Fully Automatic / Super-Automatic coffee machines. Fully automatic and super?automatic machines are increasingly adopted in offices, quick?service restaurants, and premium households as consumers seek consistent quality, one?touch operation, and integrated grinding and milk?frothing functions, in line with global and regional trends toward convenience?oriented coffee appliances. Manual and semi?automatic machines remain relevant among small cafés, specialty coffee shops, and enthusiasts who value greater control over brewing parameters.

The Philippines Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips, Breville, De'Longhi, Nespresso, Cuisinart, Krups, Hamilton Beach, Black+Decker, Smeg, Gaggia, Tefal, Bialetti (Moka Pot), Rancilio, Jura, Local & Regional Brands (e.g., Kyowa, Imarflex, Hanabishi) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines coffee machine market is poised for continued growth, driven by increasing consumer interest in coffee culture and technological innovations. As more consumers seek premium coffee experiences at home, the demand for advanced brewing solutions will likely rise. Additionally, the expansion of e-commerce platforms will facilitate access to a wider range of products, enhancing market dynamics. The focus on sustainability will also shape future developments, encouraging manufacturers to innovate eco-friendly coffee machines that appeal to environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Filter/Drip Coffee Machines Pod/Capsule Coffee Machines Espresso Coffee Machines Bean-to-Cup Coffee Machines Other Product Types (Moka Pot, French Press, Percolators, Cold Brew, etc.) |

| By Automation Level | Manual Semi-Automatic Fully Automatic / Super-Automatic |

| By End-User | Residential HoReCa (Hotels, Restaurants & Cafés) Corporates & Institutions Others |

| By Application | Home Use Office & Workplace Use Cafés and Restaurants Hotels & Hospitality Others |

| By Price Range | Entry/Budget ( |

| By Brand Origin | Local Brands International Brands Private Labels |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty & Appliance Stores Online Retail (E-commerce & Marketplaces) Direct & Institutional Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Coffee Machine Users | 120 | Homeowners, Coffee Enthusiasts |

| Commercial Coffee Machine Operators | 100 | Café Owners, Restaurant Managers |

| Retail Coffee Machine Sellers | 80 | Retail Managers, Sales Representatives |

| Baristas and Coffee Shop Staff | 70 | Baristas, Shift Supervisors |

| Industry Experts and Analysts | 40 | Market Analysts, Coffee Industry Consultants |

The Philippines Coffee Machine Market is valued at approximately USD 140 million, reflecting a significant growth driven by increasing coffee consumption and the rise of home brewing and café culture among Filipinos.