Region:Asia

Author(s):Geetanshi

Product Code:KRAA4176

Pages:95

Published On:January 2026

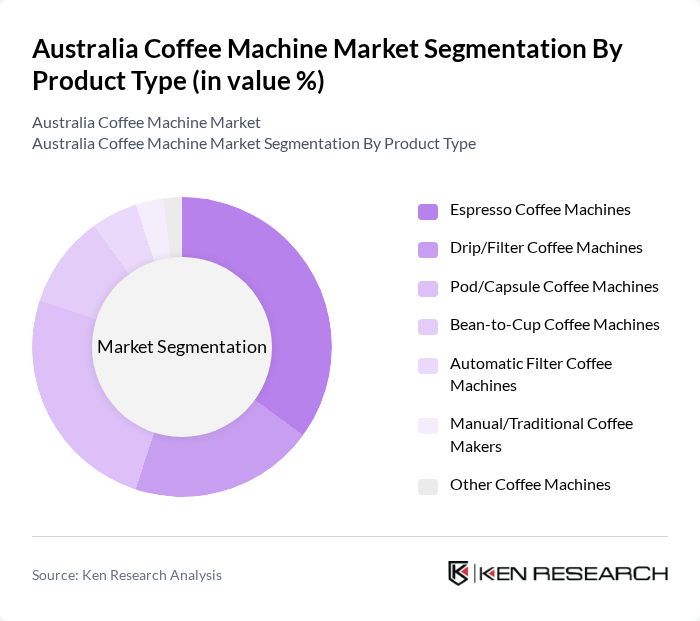

By Product Type:The product type segmentation includes various coffee machine categories that cater to different consumer preferences and usage scenarios. The subsegments are Espresso Coffee Machines, Drip/Filter Coffee Machines, Pod/Capsule Coffee Machines, Bean-to-Cup Coffee Machines, Automatic Filter Coffee Machines, Manual/Traditional Coffee Makers, and Other Coffee Machines. Among these, Espresso Coffee Machines are particularly popular due to their ability to produce high-quality coffee quickly and support milk-based beverages such as cappuccinos and lattes, appealing to both home users and commercial establishments. The trend towards specialty coffee and café-style drinks at home has further fueled the demand for espresso and bean-to-cup machines, while pod/capsule systems also remain in strong demand due to their convenience, flavor variety, and single-serve portion control for busy consumers.

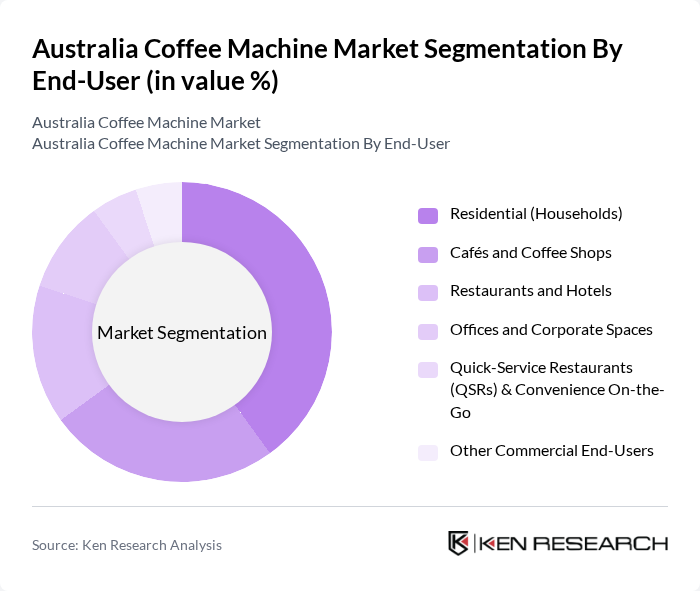

By End-User:The end-user segmentation encompasses various consumer categories, including Residential (Households), Cafés and Coffee Shops, Restaurants and Hotels, Offices and Corporate Spaces, Quick-Service Restaurants (QSRs) & Convenience On-the-Go, and Other Commercial End-Users. The residential segment is currently leading the market, driven by the increasing trend of home brewing, the desire for high-quality café-style coffee experiences at home, and growing adoption of compact single-serve and capsule machines suited to apartment living. The rise in remote and hybrid working has also contributed to the growth of coffee machines in home settings, as consumers invest in premium, automated, and multi-functional equipment to replicate specialty coffee beverages while reducing time and expenditure at cafés.

The Australia Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Breville Group Limited, Sunbeam Australia (GUD Holdings Limited), De'Longhi Australia Pty Ltd, Nestlé Nespresso Australia Pty Ltd, Philips Domestic Appliances Australia, Caffitaly System S.p.A., Gaggia (Philips / Gaggia Milano), Rancilio Group S.p.A., JURA Australia Pty Ltd, Hamilton Beach Brands, Inc., Krups (Groupe SEB), Tefal (Groupe SEB), Smeg Australia Pty Ltd, Miele Australia Pty Ltd, and other emerging local and regional players contribute to innovation, geographic expansion, and service delivery in this space.

The Australia coffee machine market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As more Australians embrace home brewing, the demand for innovative coffee machines is expected to rise. Additionally, the increasing focus on sustainability will likely influence product development, with manufacturers prioritizing eco-friendly materials and energy-efficient designs. The integration of smart technology will further enhance user experience, positioning the market for robust expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Espresso Coffee Machines Drip/Filter Coffee Machines Pod/Capsule Coffee Machines Bean-to-Cup Coffee Machines Automatic Filter Coffee Machines Manual/Traditional Coffee Makers Other Coffee Machines |

| By End-User | Residential (Households) Cafés and Coffee Shops Restaurants and Hotels Offices and Corporate Spaces Quick-Service Restaurants (QSRs) & Convenience On-the-Go Other Commercial End-Users |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Rest of Australia |

| By Application | Home Use Office & Workplace Use Café and Restaurant Operations Hospitality, Events and Catering |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Mode of Operation | Manual Semi-Automatic Fully Automatic Super-Automatic |

| By Distribution Channel | Online Retail Multi-Branded Stores Specialty Stores Other Offline Channels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Coffee Machine Users | 120 | Café Owners, Restaurant Managers |

| Home Coffee Machine Consumers | 100 | Homeowners, Coffee Enthusiasts |

| Retail Coffee Machine Sellers | 80 | Retail Managers, Sales Representatives |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

| Barista Training Institutions | 40 | Instructors, Training Coordinators |

The Australia Coffee Machine Market is valued at approximately USD 210 million, reflecting a significant growth trend driven by increasing coffee consumption, the rise of specialty coffee shops, and a growing preference for home brewing among consumers.