Region:Global

Author(s):Rebecca

Product Code:KRAA2467

Pages:84

Published On:August 2025

By Type:The edible films and coatings market can be segmented into protein-based films, polysaccharide-based films, lipid-based films, composite films, starch-based films, and others. Protein-based films are gaining traction due to their excellent barrier properties, biodegradability, and ability to incorporate functional additives such as antimicrobials and antioxidants, making them a preferred choice for food preservation. Polysaccharide-based films are widely used in bakery and dairy sectors for their versatility, transparency, and capacity to enhance product shelf life. Lipid-based films are valued for their moisture barrier properties, while composite and starch-based films are increasingly used in applications requiring tailored mechanical and barrier characteristics .

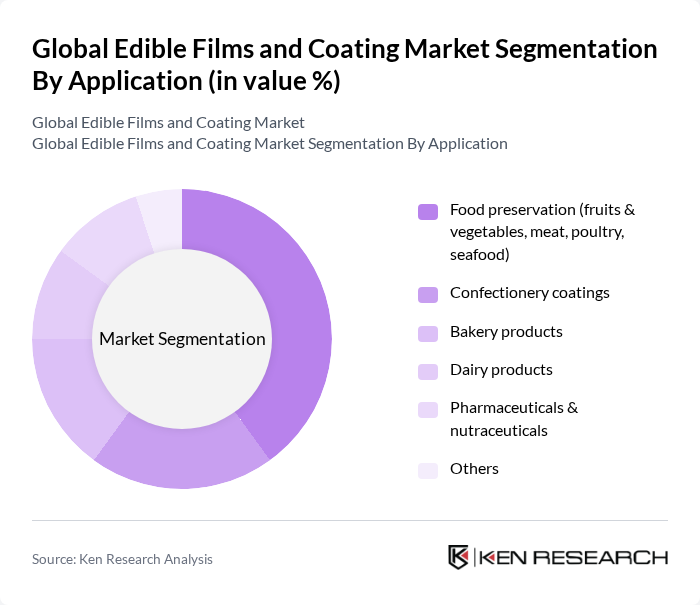

By Application:The applications of edible films and coatings are diverse, including food preservation (fruits & vegetables, meat, poultry, seafood), confectionery coatings, bakery products, dairy products, pharmaceuticals & nutraceuticals, and others. Food preservation remains the dominant segment, driven by the need to extend shelf life, maintain product quality, and reduce food waste. The bakery and dairy sectors also show significant demand due to the need for freshness and product differentiation. In addition, the pharmaceutical and nutraceutical sectors are adopting edible coatings for controlled release and improved product stability .

The Global Edible Films and Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingredion Incorporated, Tate & Lyle PLC, DuPont de Nemours, Inc., Kerry Group PLC, Cargill, Incorporated, NatureWorks LLC, BioCare Copenhagen A/S, Watson Foods Company, Inc., JRF Technology, Inc., AEP Industries Inc., Innovia Films Ltd., FFP Packaging Solutions Ltd., Aqualife S.A., ACG Worldwide, Tipa Corp., Mantrose-Haeuser Co., Inc., MonoSol, LLC, Nagase & Co., Ltd., Koninklijke DSM N.V., Pace International LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the edible films and coatings market in None appears promising, driven by increasing consumer demand for sustainable and safe food packaging solutions. As technological advancements continue to emerge, manufacturers are likely to innovate further, enhancing the functionality and appeal of edible films. Additionally, the growing trend towards plant-based diets and organic products will likely create new avenues for market expansion, particularly in the food and pharmaceutical sectors, fostering a more sustainable packaging landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein-based films Polysaccharide-based films Lipid-based films Composite films Starch-based films Others |

| By Application | Food preservation (fruits & vegetables, meat, poultry, seafood) Confectionery coatings Bakery products Dairy products Pharmaceuticals & nutraceuticals Others |

| By End-User | Food manufacturers Retailers Food service providers Households Others |

| By Distribution Channel | Online retail Supermarkets and hypermarkets Specialty stores Direct sales (B2B) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Flexible packaging Rigid packaging Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Packaging | 100 | Product Managers, Quality Assurance Specialists |

| Bakery and Confectionery Applications | 70 | Packaging Engineers, R&D Managers |

| Meat and Poultry Packaging | 60 | Supply Chain Managers, Food Safety Officers |

| Fruits and Vegetables Coating | 50 | Procurement Managers, Sustainability Coordinators |

| Consumer Insights on Edible Films | 80 | Marketing Managers, Consumer Behavior Analysts |

The Global Edible Films and Coating Market is valued at approximately USD 3.0 billion, driven by the demand for sustainable packaging solutions and advancements in technology that enhance the functionality of edible films and coatings.