Region:Global

Author(s):Rebecca

Product Code:KRAC0184

Pages:83

Published On:August 2025

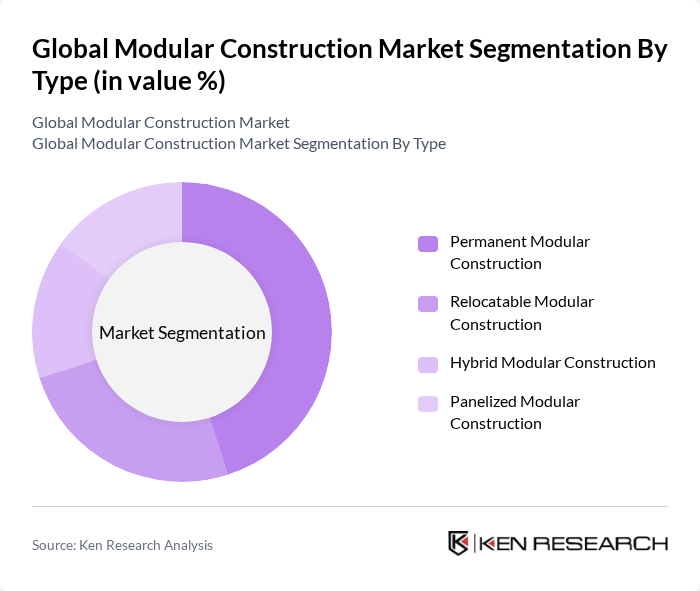

By Type:The modular construction market can be segmented into four main types: Permanent Modular Construction, Relocatable Modular Construction, Hybrid Modular Construction, and Panelized Modular Construction. Each type serves different needs and applications. Permanent Modular Construction is the most widely adopted, favored for its durability, structural integrity, and suitability for long-term and multi-story projects. Relocatable Modular Construction is used for temporary or portable structures, such as classrooms and site offices. Hybrid Modular Construction combines modular and traditional methods to optimize flexibility and cost. Panelized Modular Construction involves prefabricated panels assembled on-site, offering speed and design versatility .

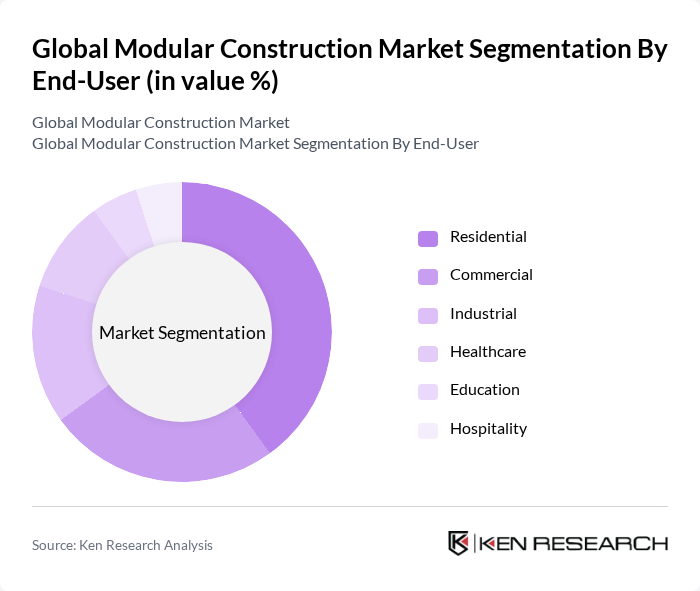

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Healthcare, Education, and Hospitality sectors. The Residential segment leads the market, driven by rising demand for affordable and rapid housing solutions, especially in urban areas. The Commercial segment follows, supported by the need for flexible office spaces and retail environments. Industrial, Healthcare, Education, and Hospitality segments are also adopting modular solutions for their speed, scalability, and cost-effectiveness .

The Global Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as ModulusTech, Katerra, Skanska, Turner Construction Company, Laing O'Rourke, Factory_OS, Guerdon Modular Buildings, Z Modular, BMarko Structures, Modular Building Institute, Volumetric Building Companies (VBC), Prefab Logic, Blokable, Axiom Modular Solutions, Modulaire Group, Sekisui House Ltd., Red Sea International, Bouygues Construction, Premier Modular Limited, KLEUSBERG GmbH & Co KG, DuBox, Wernick Group, CIMC Modular Building Systems Holdings Co., Ltd. (CIMC-MBS), Riko Hiše d.o.o, Lendlease Corporation, and Hickory Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of modular construction appears promising, driven by increasing urbanization and the urgent need for sustainable building practices. As cities expand, the demand for efficient housing solutions will likely rise, pushing developers to adopt modular methods. Additionally, advancements in technology will continue to enhance the efficiency and appeal of modular construction, making it a preferred choice for both residential and commercial projects. The focus on sustainability will further propel this trend, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Modular Construction Relocatable Modular Construction Hybrid Modular Construction Panelized Modular Construction |

| By End-User | Residential Commercial Industrial Healthcare Education Hospitality |

| By Application | Healthcare Facilities Educational Institutions Hospitality Retail Spaces Offices Data Centers |

| By Construction Method | Off-Site Construction On-Site Assembly |

| By Material Used | Steel Wood Concrete Composite Materials |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Construction | 120 | Project Managers, Architects, Home Builders |

| Commercial Modular Projects | 90 | Construction Managers, Real Estate Developers |

| Industrial Modular Solutions | 60 | Facility Managers, Operations Directors |

| Modular Housing Innovations | 50 | Urban Planners, Sustainability Consultants |

| Government Infrastructure Initiatives | 70 | Policy Makers, Infrastructure Analysts |

The Global Modular Construction Market is valued at approximately USD 105 billion, driven by the increasing demand for affordable housing, advanced construction technologies, and the need for faster project delivery. This market is expected to grow significantly in the coming years.