Region:Asia

Author(s):Rebecca

Product Code:KRAB2048

Pages:94

Published On:January 2026

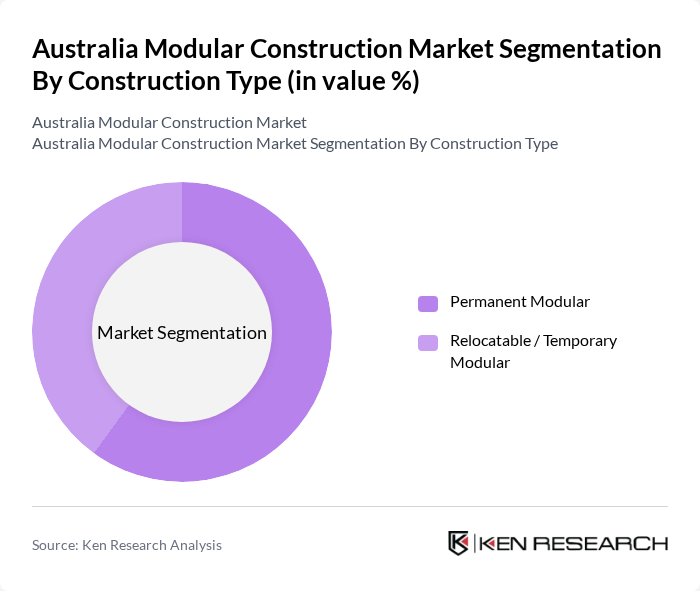

By Construction Type:The construction type segmentation includes Permanent Modular and Relocatable / Temporary Modular, in line with industry classifications. Permanent modular construction is gaining traction due to its durability, ability to meet the full requirements of the National Construction Code, and suitability for residential, commercial, and institutional buildings over their full design life. Relocatable modular solutions are favored for their flexibility and quick deployment in projects such as mining camps, education facilities, temporary health and emergency accommodation, and site amenities.

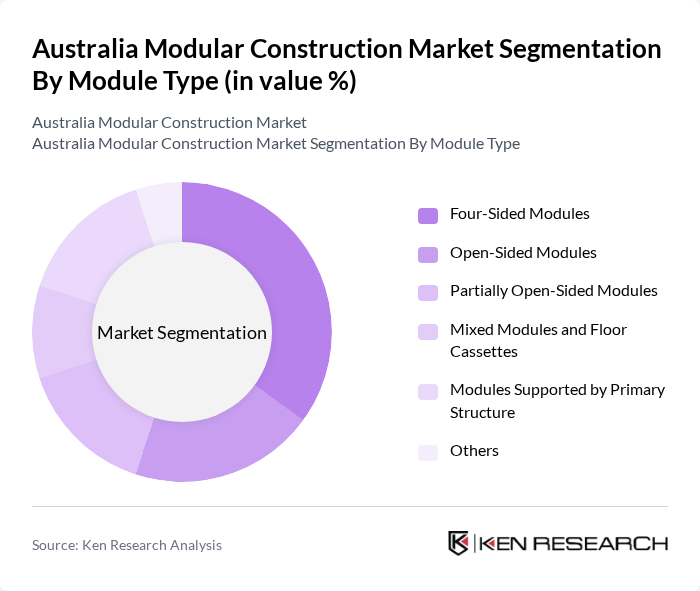

By Module Type:The module type segmentation encompasses Four-Sided Modules, Open-Sided Modules, Partially Open-Sided Modules, Mixed Modules and Floor Cassettes, Modules Supported by Primary Structure, and Others, which reflects standard global modular building typologies. Four-sided modules are the most popular due to their structural integrity, ability to be fully volumetric units, and versatility in applications ranging from residential and hospitality to education and healthcare.

The Australia Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Modscape, Prebuilt, Ecoliv, Ausco Modular, Fleetwood Australia, Hickory Group, BGC Modular, Karmod, Z-Modular, Modular Building Systems, SIPS Industries, BGC Construction, Lendlease, Laing O'Rourke, Built Environs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the modular construction market in Australia appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As cities expand, the need for rapid, efficient housing solutions will intensify. Additionally, advancements in technology will continue to enhance the efficiency and appeal of modular construction. Stakeholders are likely to focus on integrating smart technologies and sustainable practices, positioning the industry for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Construction Type | Permanent Modular Relocatable / Temporary Modular |

| By Module Type | Four-Sided Modules Open-Sided Modules Partially Open-Sided Modules Mixed Modules and Floor Cassettes Modules Supported by Primary Structure Others |

| By Material | Steel Concrete Wood / Timber Plastic and Composites Others |

| By Application / End Use | Residential Commercial Education Retail Hospitality Healthcare Industrial & Infrastructure Others |

| By Region | New South Wales & Australian Capital Territory Victoria & Tasmania Queensland South Australia & Northern Territory Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Construction | 120 | Architects, Home Builders, Project Managers |

| Commercial Modular Solutions | 90 | Construction Executives, Facility Managers |

| Industrial Modular Applications | 70 | Manufacturing Managers, Operations Directors |

| Regulatory and Compliance Insights | 50 | Policy Makers, Compliance Officers |

| Sustainability Practices in Modular Construction | 60 | Sustainability Consultants, Environmental Engineers |

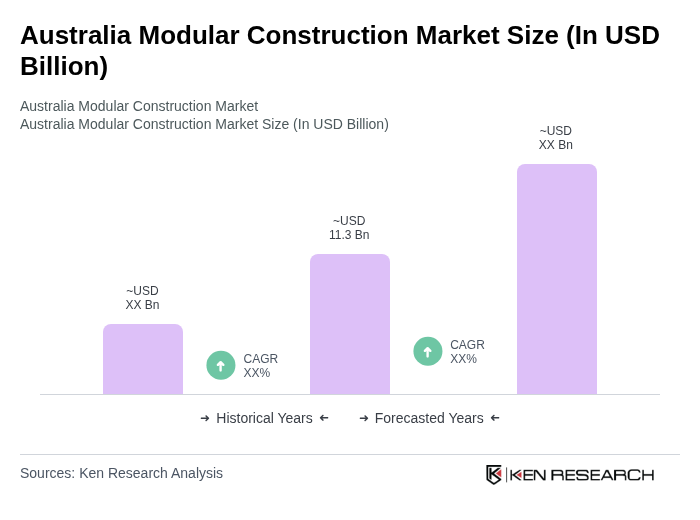

The Australia Modular Construction Market is valued at approximately USD 11.3 billion, driven by the increasing demand for affordable housing, rapid urbanization, and the need for sustainable construction practices.