Bahrain Modular Construction Market Overview

- The Bahrain Modular Construction Market is valued at USD 160 million, based on a five-year historical analysis and its share within the broader Bahrain construction market, which has been estimated in the low single?billion?USD range in recent years. This growth is primarily driven by the increasing demand for efficient construction methods, urbanization, labor productivity constraints, and government initiatives aimed at promoting sustainable building practices and industrialized construction. Prefabricated and modular systems are gaining traction as part of Bahrain’s wider construction sector due to their ability to shorten schedules, reduce on?site labor requirements, and improve quality control. The market has seen a gradual rise in modular construction projects, particularly in residential, commercial, and social?infrastructure applications, as stakeholders seek to reduce construction time and costs while meeting green?building and housing targets.

- Key demand clusters for modular and prefabricated solutions are concentrated in Bahrain's capital, Manama, which serves as a hub for construction activities due to its strategic location, concentration of commercial real estate, and ongoing economic development initiatives under the national diversification agenda. Additionally, cities like Muharraq and Riffa are also significant contributors, supported by airport?adjacent logistics and tourism projects in Muharraq and large housing and community developments in new suburban areas around Riffa, all of which increasingly evaluate modular options to accelerate delivery and manage costs.

- Regulatory and policy support for more industrialized and sustainable construction in Bahrain is guided by instruments such as the Bahrain Building Regulations issued by the Ministry of Works, Municipalities Affairs and Urban Planning and updated in 2019, which set technical requirements for structural safety, fire protection, and energy performance that apply equally to factory?made components and off?site systems. In addition, the National Energy Efficiency Action Plan and related green?building guidelines, implemented by the Sustainable Energy Authority from 2017 onward, encourage the use of resource?efficient building methods and materials, indirectly supporting the adoption of modular construction for public and private projects.

Bahrain Modular Construction Market Segmentation

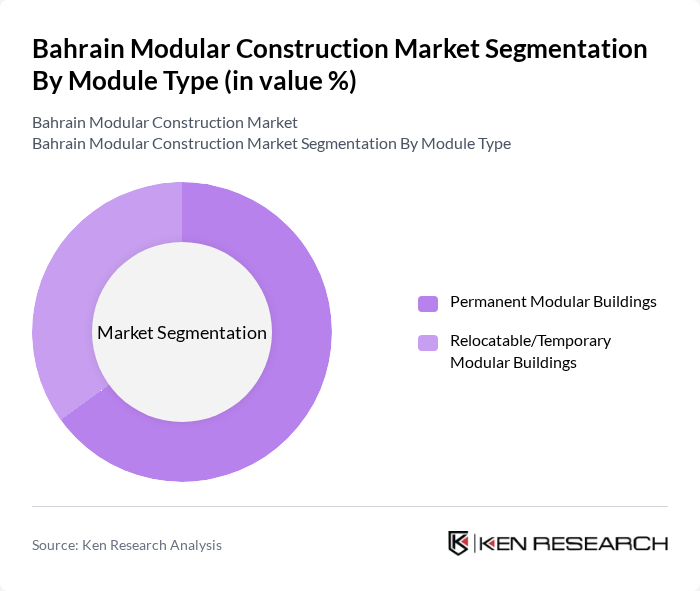

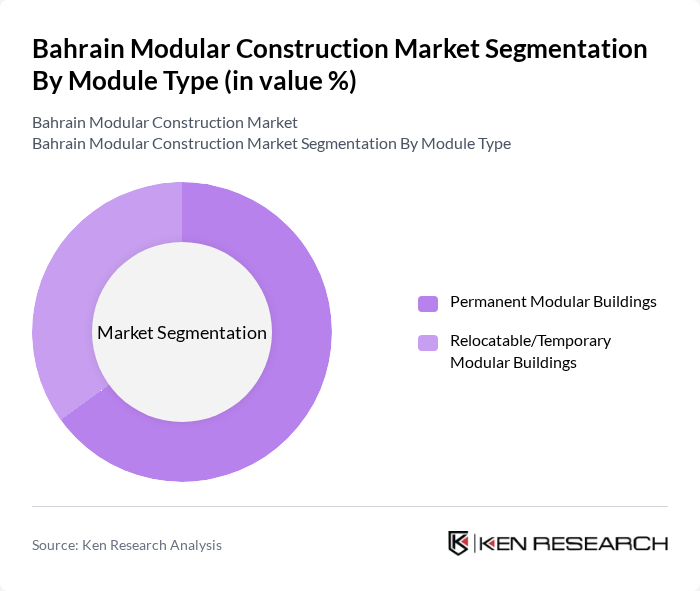

By Module Type:The market is segmented into Permanent Modular Buildings and Relocatable/Temporary Modular Buildings. Permanent Modular Buildings are gaining traction due to their durability, ability to meet conventional building?code requirements, and suitability for long-term uses such as housing, offices, schools, and healthcare facilities. Relocatable/Temporary Modular Buildings are preferred for their flexibility, quick deployment, and reusability in applications such as worker accommodation, site offices, and temporary commercial or social?infrastructure needs, especially in fast?tracked infrastructure and industrial projects across the Middle East.

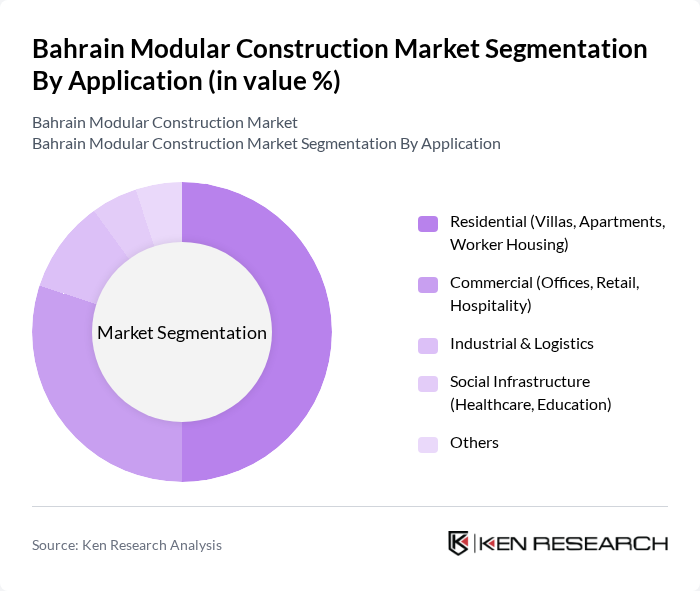

By Application:The market is segmented into Residential (Villas, Apartments, Worker Housing), Commercial (Offices, Retail, Hospitality), Industrial & Logistics, Social Infrastructure (Healthcare, Education), and Others. The Residential segment is currently leading the market, supported by government housing programs under Bahrain’s long?term development vision and rising demand for affordable and mid?income housing solutions, where modular units help accelerate delivery and control lifecycle costs. The Commercial segment is also expanding as developers and occupiers in offices, retail, and hospitality increasingly evaluate modular construction to shorten time-to-market, standardize quality across portfolios, and integrate more sustainable building practices.

Bahrain Modular Construction Market Competitive Landscape

The Bahrain Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Modular International, Kooheji Contractors, Nass Contracting Co., Almoayyed Contracting Group, Cebarco Bahrain, Midal Contracting, Al Ghanah Group, Poullaides Construction Company, Dadabhai Construction, KBR, Inc., Larsen & Toubro (L&T) – Middle East, Laing O’Rourke Middle East, Red Sea International Company, Algeco (Modulaire Group), Speed House Group contribute to innovation, geographic expansion, and service delivery in this space.

Bahrain Modular Construction Market Industry Analysis

Growth Drivers

- Increased Demand for Sustainable Construction:The Bahrain construction sector is witnessing a significant shift towards sustainable practices, driven by a 30% increase in green building projects from 2022 to 2023. The government aims to reduce carbon emissions by 30% by 2030, aligning with global sustainability goals. This trend is supported by the World Bank's report indicating that sustainable construction can reduce energy consumption by up to 50%, making modular construction an attractive option for developers and investors.

- Government Initiatives and Investments:The Bahraini government has allocated approximately $1.5 billion for infrastructure development in the future, focusing on modular construction to expedite project timelines. This investment is part of the Economic Vision 2030, which aims to diversify the economy and enhance public services. Additionally, the government is providing incentives for modular construction firms, including tax breaks and streamlined permitting processes, which are expected to boost market growth significantly.

- Technological Advancements in Construction:The integration of advanced technologies in modular construction is revolutionizing the industry in Bahrain. In future, it is projected that 40% of construction firms will adopt Building Information Modeling (BIM) and prefabrication techniques, leading to a 25% reduction in construction time. The use of robotics and automation is also increasing, enhancing productivity and safety on construction sites, thereby attracting more investments into the modular construction sector.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the modular construction market in Bahrain is the high initial investment required, which can reach up to $200 per square meter. This cost is often a barrier for small to medium-sized enterprises looking to enter the market. Additionally, the upfront costs associated with advanced technologies and materials can deter potential investors, limiting the overall growth of the sector.

- Limited Skilled Labor:The modular construction industry in Bahrain is currently facing a shortage of skilled labor, with an estimated 15% gap in the workforce needed to meet the growing demand. This shortage is exacerbated by the rapid technological advancements that require specialized training. As a result, construction timelines may be extended, and project costs could increase, posing a significant challenge to the industry's growth and efficiency.

Bahrain Modular Construction Market Future Outlook

The future of the modular construction market in Bahrain appears promising, driven by increasing urbanization and a strong push for sustainable building practices. As the government continues to invest in infrastructure and smart technologies, the adoption of modular construction is expected to rise. Furthermore, collaboration with international firms will likely enhance local capabilities, leading to innovative solutions that address both environmental and economic challenges in the construction sector.

Market Opportunities

- Expansion of Infrastructure Projects:With the government planning to invest $1.5 billion in infrastructure in the future, there is a significant opportunity for modular construction firms to participate in large-scale projects. This investment will likely create demand for efficient building solutions, allowing companies to showcase their capabilities in delivering timely and cost-effective construction.

- Adoption of Smart Building Technologies:The integration of smart technologies in modular construction presents a lucrative opportunity. As Bahrain aims to enhance energy efficiency, the demand for smart buildings is expected to grow. Companies that can offer innovative solutions, such as IoT-enabled systems, will be well-positioned to capture market share and meet the evolving needs of consumers and businesses alike.