Region:Asia

Author(s):Rebecca

Product Code:KRAB2045

Pages:95

Published On:January 2026

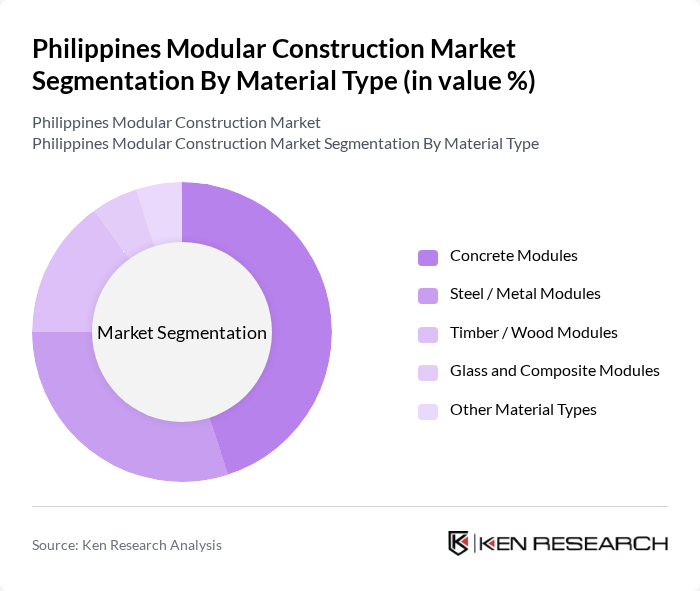

By Material Type:The material type segmentation includes various subsegments such as Concrete Modules, Steel / Metal Modules, Timber / Wood Modules, Glass and Composite Modules, and Other Material Types. Concrete and other cement-based systems currently account for a substantial share of modular and prefabricated structures in the Philippines, particularly in residential and low- to mid-rise commercial applications, due to their durability, fire resistance, and familiarity among local contractors. Steel / Metal Modules are also gaining traction, especially for commercial, industrial, and worker accommodations because of their strength-to-weight ratio, speed of assembly, and suitability for repetitive, standardized layouts. The demand for Timber / Wood Modules is gradually rising, mainly in resort, low-rise residential, and eco-tourism projects, supported by global sustainability trends and interest in lower-embodied-carbon materials, though availability of certified structural timber remains a constraint. Glass and Composite Modules are favored in façade systems and premium commercial or hospitality developments for aesthetic and performance benefits, while Other Material Types include hybrid systems that combine concrete, steel, and lightweight panels to improve constructability and thermal performance.

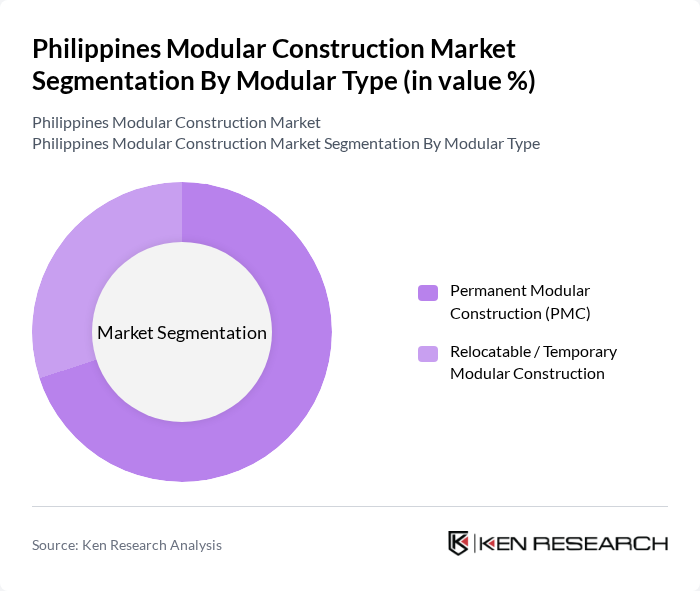

By Modular Type:The modular type segmentation consists of Permanent Modular Construction (PMC) and Relocatable / Temporary Modular Construction. Permanent Modular Construction is dominating the market, aligned with the strong role of the residential segment and growing use in hotels, dormitories, mid-rise offices, and social infrastructure, where factory-produced volumetric units are installed as part of the permanent building fabric. This type of construction allows for significant time savings, lower site disruption, and better cost predictability, making it a preferred choice for developers facing tight schedules and high urban land costs. Relocatable / Temporary Modular Construction is also gaining popularity, particularly in education, healthcare, disaster-relief housing, site offices, and temporary worker accommodations, where rapid deployment, ease of dismantling, and redeployment to other locations are critical decision factors.

The Philippines Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smarthouse Corporation, Prefab Philippines, Toh Builders, Inc., Karmod Prefabricated Building Technologies, Revolution Precrafted, Meinhardt Philippines, Inc., EEI Corporation, Megawide Construction Corporation, DMCI Homes, Ayala Land, Inc., Megaworld Corporation, Robinsons Land Corporation, Vista Land & Lifescapes, Inc., SM Prime Holdings, Inc., Filinvest Land, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines modular construction market is poised for significant growth, driven by urbanization, housing demands, and sustainability initiatives. As the government continues to invest in infrastructure and affordable housing projects, the adoption of modular construction is expected to rise. Innovations in design and technology will further enhance the efficiency and appeal of modular solutions. In future, the integration of smart technologies and eco-friendly materials will likely redefine construction practices, positioning modular construction as a key player in the industry.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Concrete Modules Steel / Metal Modules Timber / Wood Modules Glass and Composite Modules Other Material Types |

| By Modular Type | Permanent Modular Construction (PMC) Relocatable / Temporary Modular Construction |

| By Application | Residential Commercial (Offices, Retail, Hospitality) Industrial & Logistics Facilities Social Infrastructure (Education, Healthcare) Others |

| By End-User | Real Estate Developers Industrial & Logistics Operators Government & Public Sector NGOs & Development Agencies Others |

| By Region | Luzon Visayas Mindanao |

| By Technology & Construction System | D Panels & Precast Systems D Volumetric / Modular Units Hybrid Modular Construction Bathroom / Kitchen Pods & Micro-Modules |

| By Funding & Contracting Model | Private Sector Investment Government-Funded Projects Public-Private Partnerships (PPP) Foreign Direct Investment (FDI) & Development Finance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Construction | 120 | Homeowners, Real Estate Developers |

| Commercial Modular Projects | 90 | Project Managers, Architects |

| Industrial Modular Solutions | 75 | Facility Managers, Operations Directors |

| Government Infrastructure Initiatives | 60 | Policy Makers, Urban Planners |

| Modular Construction Technology Providers | 95 | Product Managers, Technical Directors |

The Philippines Modular Construction Market is valued at approximately USD 120 million, driven by urbanization, housing demand, and the need for efficient construction methods. This market is expected to grow significantly as developers seek cost-effective solutions.