Region:Global

Author(s):Geetanshi

Product Code:KRAD1275

Pages:81

Published On:November 2025

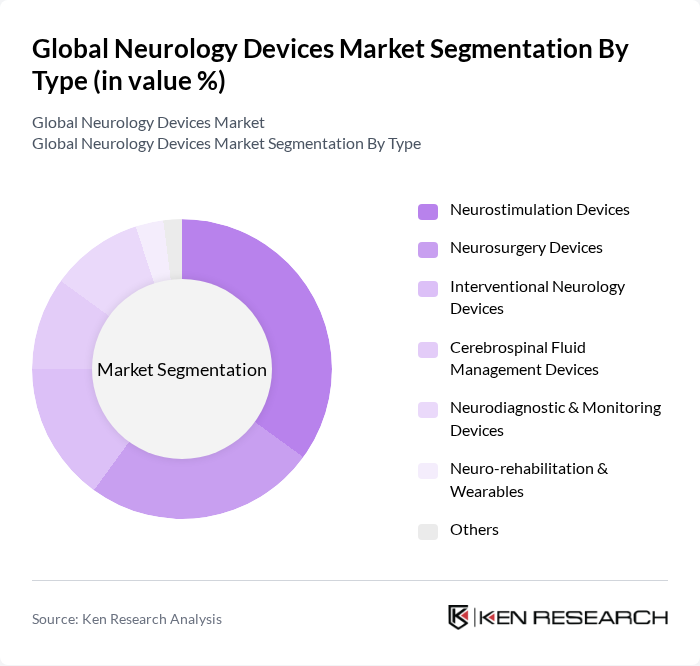

By Type:The neurology devices market can be segmented into various types, including Neurostimulation Devices, Neurosurgery Devices, Interventional Neurology Devices, Cerebrospinal Fluid Management Devices, Neurodiagnostic & Monitoring Devices, Neuro-rehabilitation & Wearables, and Others. Among these, Neurostimulation Devices are currently leading the market due to their effectiveness in treating chronic pain, epilepsy, Parkinson’s disease, and movement disorders. The increasing adoption of these devices in clinical settings, coupled with technological advancements such as closed-loop stimulation and minimally invasive procedures, has significantly contributed to their dominance.

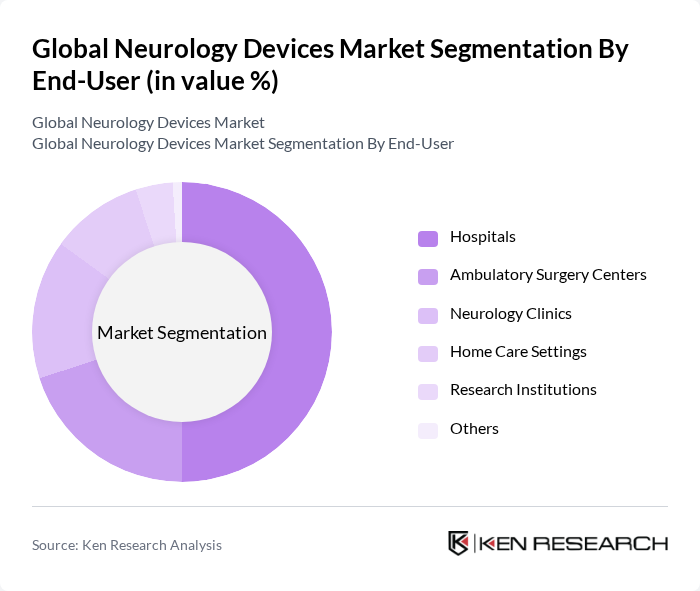

By End-User:The end-user segmentation of the neurology devices market includes Hospitals, Ambulatory Surgery Centers, Neurology Clinics, Home Care Settings, Research Institutions, and Others. Hospitals are the leading end-user segment, primarily due to their comprehensive facilities and resources for advanced neurological treatments. The increasing number of hospital admissions for neurological disorders and the availability of specialized care, favorable reimbursement policies, and rapid adoption of cutting-edge technologies contribute to the dominance of this segment.

The Global Neurology Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V. (Philips Healthcare), NeuroPace, Inc., Natus Medical Incorporated, Elekta AB, Stryker Corporation, Zynex, Inc., NeuroSigma, Inc., Synapse Biomedical Inc., Axonics, Inc., LivaNova PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the neurology devices market in None appears promising, driven by technological advancements and an increasing focus on patient-centric solutions. As healthcare systems adapt to the growing prevalence of neurological disorders, the integration of AI and telemedicine is expected to enhance diagnostic and treatment capabilities. Additionally, the shift towards minimally invasive procedures will likely improve patient outcomes, making neurology devices more accessible and effective in managing neurological conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Neurostimulation Devices Neurosurgery Devices Interventional Neurology Devices Cerebrospinal Fluid Management Devices Neurodiagnostic & Monitoring Devices Neuro-rehabilitation & Wearables Others |

| By End-User | Hospitals Ambulatory Surgery Centers Neurology Clinics Home Care Settings Research Institutions Others |

| By Application | Stroke Management Epilepsy Treatment Parkinson's Disease Management Chronic Pain & Movement Disorders Neuro-degenerative Diseases Traumatic Brain & Spinal Injuries Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | MRI Technology CT Scanning Technology PET Scanning Technology EEG Technology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Pricing Model | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurostimulation Devices | 100 | Neurologists, Pain Management Specialists |

| Neuroimaging Equipment | 80 | Radiologists, Medical Imaging Technologists |

| Surgical Instruments for Neurology | 70 | Neurosurgeons, Operating Room Managers |

| Wearable Neurology Devices | 50 | Clinical Researchers, Product Development Managers |

| Rehabilitation Devices | 90 | Physical Therapists, Rehabilitation Specialists |

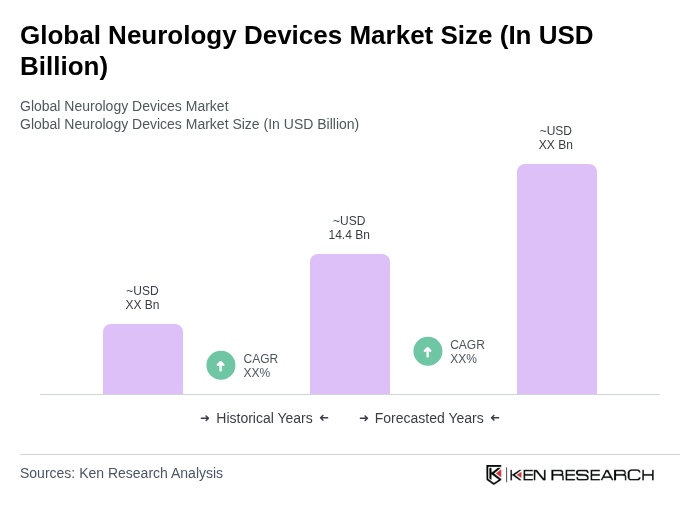

The Global Neurology Devices Market is valued at approximately USD 14.4 billion, driven by the rising prevalence of neurological disorders and advancements in technology, particularly in neurostimulation and wearable monitoring devices.