Region:Global

Author(s):Shubham

Product Code:KRAA2670

Pages:94

Published On:August 2025

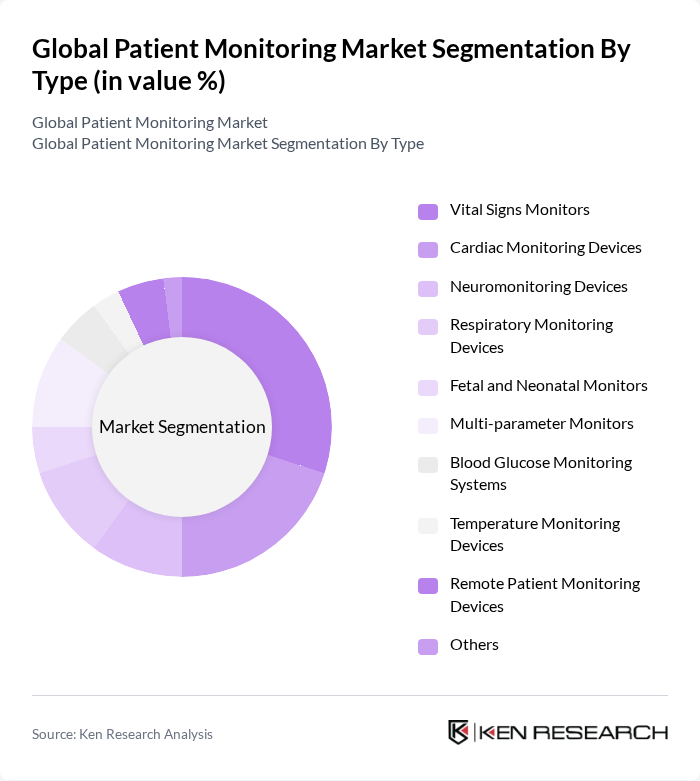

By Type:The market is segmented into various types of monitoring devices, including vital signs monitors, cardiac monitoring devices, neuromonitoring devices, respiratory monitoring devices, fetal and neonatal monitors, multi-parameter monitors, blood glucose monitoring systems, temperature monitoring devices, remote patient monitoring devices, and others. Among these,vital signs monitorsare leading the market due to their essential role in continuous patient assessment and the growing demand for real-time health data in clinical and home settings. The adoption of multi-parameter and remote patient monitoring devices is also rising, driven by the shift toward decentralized and home-based care, as well as the increasing need for early detection and management of chronic conditions.

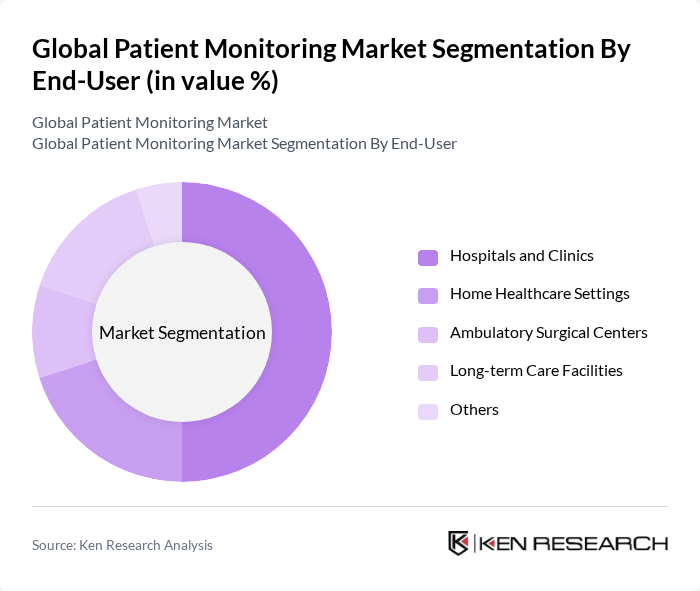

By End-User:The end-user segmentation includes hospitals and clinics, home healthcare settings, ambulatory surgical centers, long-term care facilities, and others.Hospitals and clinicsdominate this segment due to the high volume of patients requiring continuous monitoring and the increasing adoption of advanced monitoring technologies in these settings. The shift towards outpatient care and home healthcare is also gaining traction, driven by patient preferences, cost-effectiveness, and the expansion of telehealth and remote monitoring programs. Long-term care facilities and ambulatory surgical centers are increasingly integrating connected monitoring solutions to enhance patient safety and workflow efficiency.

The Global Patient Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, GE Healthcare, Siemens Healthineers, Medtronic, Abbott Laboratories, Honeywell Life Sciences, Nihon Kohden Corporation, Mindray Medical International Limited, Zoll Medical Corporation, Biotronik SE & Co. KG, Boston Scientific Corporation, Welch Allyn (Hillrom), Dräger Medical, OSI Systems, Inc., F. Hoffmann-La Roche Ltd, Smiths Medical, Johnson & Johnson, LifeWatch AG, Masimo Corporation, OMRON Healthcare, Inc., Vitls, Inc., CareValidate, American Telecare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the patient monitoring market in future is poised for significant transformation, driven by technological advancements and changing healthcare dynamics. The integration of artificial intelligence and machine learning into monitoring systems is expected to enhance predictive analytics, improving patient outcomes. Additionally, the shift towards value-based care will further emphasize the importance of continuous monitoring, leading to increased investments in innovative solutions that prioritize patient engagement and health management.

| Segment | Sub-Segments |

|---|---|

| By Type | Vital Signs Monitors Cardiac Monitoring Devices Neuromonitoring Devices Respiratory Monitoring Devices Fetal and Neonatal Monitors Multi-parameter Monitors Blood Glucose Monitoring Systems Temperature Monitoring Devices Remote Patient Monitoring Devices Others |

| By End-User | Hospitals and Clinics Home Healthcare Settings Ambulatory Surgical Centers Long-term Care Facilities Others |

| By Application | Cardiology Neurology Respiratory Fetal and Neonatal Weight Management and Fitness Monitoring Pediatrics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Wired Monitoring Systems Wireless Monitoring Systems Cloud-based Monitoring Systems Wearable Monitoring Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Patient Monitoring Systems | 120 | Clinical Directors, IT Managers |

| Home Healthcare Monitoring Devices | 90 | Home Health Aides, Care Coordinators |

| Wearable Health Technology | 60 | Product Managers, Health Tech Innovators |

| Remote Patient Monitoring Solutions | 50 | Telehealth Coordinators, Healthcare IT Specialists |

| Chronic Disease Management Tools | 70 | Chronic Care Managers, Patient Advocates |

The Global Patient Monitoring Market is valued at approximately USD 52 billion, driven by the increasing prevalence of chronic diseases, an aging population, and advancements in digital health technology that enhance patient care and monitoring capabilities.