Region:Global

Author(s):Geetanshi

Product Code:KRAA2806

Pages:89

Published On:August 2025

By Type:The polymer stabilizers market is segmented into antioxidants, UV stabilizers, heat stabilizers, light stabilizers, processing stabilizers, and others. Antioxidants are the most dominant sub-segment, owing to their essential role in preventing oxidative degradation in polymers, which is critical for maintaining product quality and extending the lifespan of polymer materials. The rising demand for durable and high-performance polymers in automotive and packaging applications continues to drive the growth of this sub-segment .

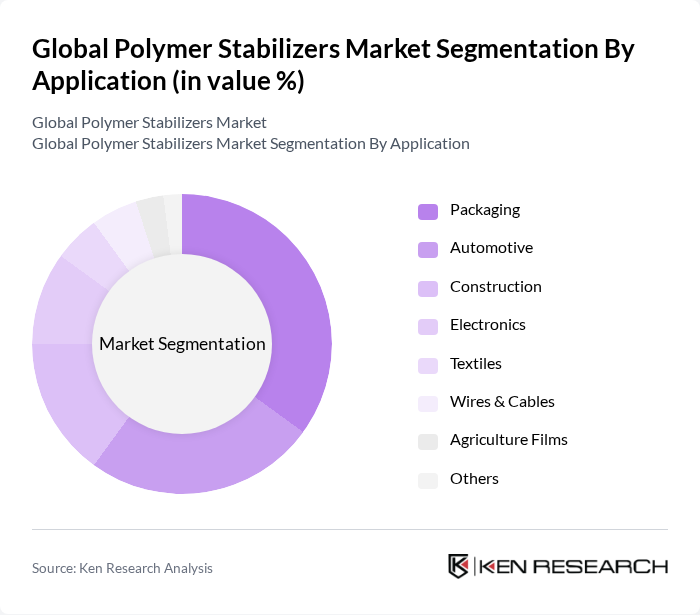

By Application:The applications of polymer stabilizers span packaging, automotive, construction, electronics, textiles, wires & cables, agriculture films, and others. The packaging sector remains the leading application area, driven by the growing demand for flexible, durable, and sustainable packaging solutions. The increased focus on sustainability and the need for longer-lasting packaging materials further enhance the demand for effective stabilizers in this segment .

The Global Polymer Stabilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Evonik Industries AG, Solvay S.A., LANXESS AG, Dow Inc., Eastman Chemical Company, Huntsman Corporation, LyondellBasell Industries N.V., ADEKA Corporation, Songwon Industrial Co., Ltd., Mitsubishi Chemical Group Corporation, Milliken & Company, SABIC, Akzo Nobel N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polymer stabilizers market appears promising, driven by increasing demand for sustainable and high-performance materials. As industries prioritize eco-friendly solutions, the shift towards bio-based stabilizers is expected to gain momentum. Additionally, the integration of smart technologies in polymer production will enhance product customization, catering to specific industry needs. These trends indicate a dynamic market landscape, where innovation and sustainability will play crucial roles in shaping future developments and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Antioxidants UV Stabilizers Heat Stabilizers Light Stabilizers Processing Stabilizers Others |

| By Application | Packaging Automotive Construction Electronics Textiles Wires & Cables Agriculture Films Others |

| By End-User | Consumer Goods Industrial Healthcare Agriculture Electrical & Electronics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America United States Canada Mexico Europe Germany United Kingdom France Italy Spain Russia Rest of Europe Asia-Pacific China India Japan South Korea ASEAN Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East & Africa GCC South Africa Rest of Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Granules Powders Liquids Pastilles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polymer Applications | 100 | Product Development Managers, Quality Assurance Engineers |

| Packaging Industry Stabilizers | 60 | Procurement Managers, Packaging Engineers |

| Construction Material Additives | 50 | Construction Project Managers, Material Scientists |

| Consumer Goods Polymer Usage | 70 | Brand Managers, Product Line Directors |

| Specialty Chemical Distributors | 40 | Sales Managers, Distribution Network Coordinators |

The Global Polymer Stabilizers Market is valued at approximately USD 5.6 billion, driven by the increasing demand for high-performance polymers in various industries, including automotive, packaging, and construction.