Region:Global

Author(s):Dev

Product Code:KRAA2532

Pages:84

Published On:August 2025

By Type:

By End-User:

The Global Protective Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sealed Air Corporation, Pregis LLC, Amcor plc, Sonoco Products Company, Smurfit Kappa Group plc, WestRock Company, International Paper Company, Huhtamaki Oyj, DS Smith Plc, Mondi Group, Berry Global Inc., Novolex Holdings, LLC, Dunmore Corporation, ProAmpac LLC, Intertape Polymer Group Inc. (IPG), Pro-Pac Packaging Limited, Dow Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The protective packaging market is poised for transformative growth, driven by increasing consumer demand for sustainable and innovative solutions. As companies adapt to stringent environmental regulations, the shift towards biodegradable and recyclable materials will gain momentum. Additionally, the integration of smart technologies in packaging will enhance product safety and consumer engagement. These trends indicate a dynamic landscape where businesses must innovate continuously to meet evolving market demands and regulatory challenges, ensuring long-term viability and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Foam Packaging Bubble Wrap Paper-Based Packaging Molded Pulp Packaging Corrugated Boxes Protective Mailers Air Pillows & Cushioning Others |

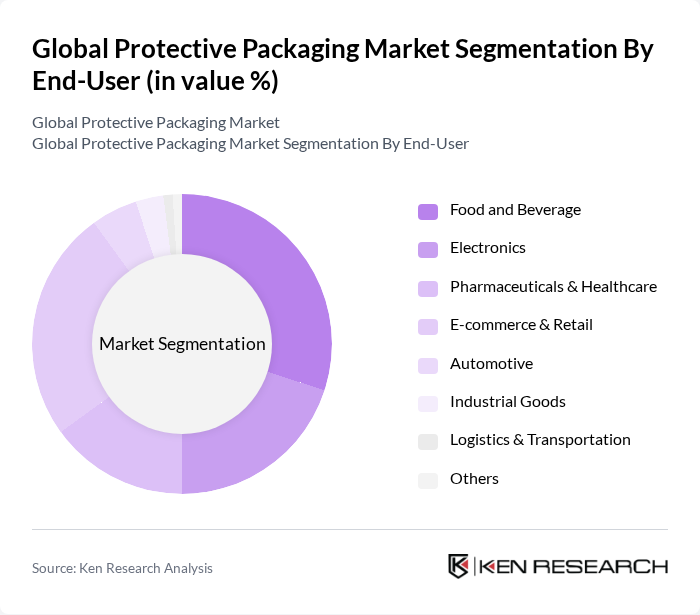

| By End-User | Food and Beverage Electronics Pharmaceuticals & Healthcare E-commerce & Retail Automotive Industrial Goods Logistics & Transportation Others |

| By Material | Plastic (Polyethylene, Polypropylene, etc.) Paper & Paperboard Molded Fiber Foam (EPS, EPE, PUR, etc.) Biodegradable Materials Others |

| By Application | Shipping & Logistics Packaging Retail Packaging Industrial Packaging Medical & Pharmaceutical Packaging Electronics Packaging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Southeast Asia, Rest of APAC) Latin America (Brazil, Rest of LATAM) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Engineers, Quality Assurance Managers |

| Pharmaceutical Packaging Solutions | 60 | Regulatory Affairs Specialists, Product Development Managers |

| E-commerce Protective Packaging | 80 | Logistics Coordinators, Supply Chain Analysts |

| Industrial Packaging Applications | 50 | Operations Managers, Procurement Specialists |

| Consumer Electronics Packaging | 40 | Product Managers, Packaging Designers |

The Global Protective Packaging Market is valued at approximately USD 35 billion, driven by the increasing demand for safe packaging solutions across various industries, including e-commerce, food and beverage, electronics, and pharmaceuticals.