Region:Global

Author(s):Shubham

Product Code:KRAA3210

Pages:84

Published On:August 2025

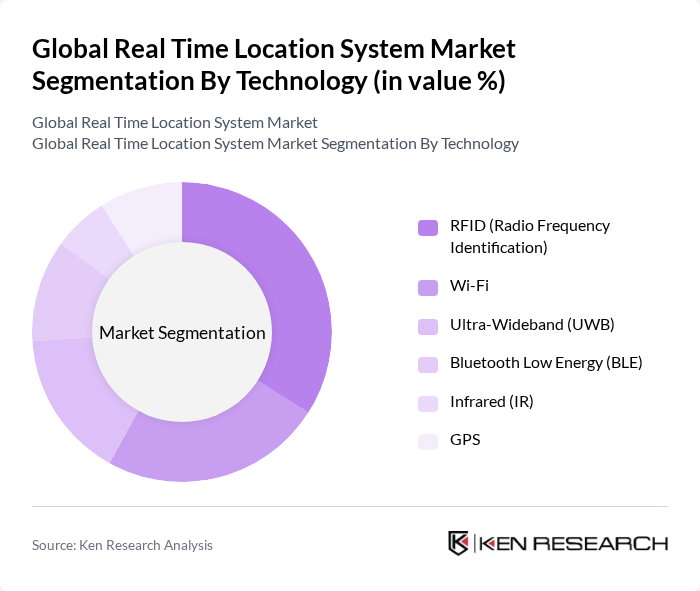

By Technology:The technology segment of the Real Time Location System market includes RFID (Radio Frequency Identification), Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), Infrared, and GPS.RFID technology leads the marketdue to its widespread application in asset tracking and inventory management, particularly in healthcare, manufacturing, and logistics. The growing need for real-time visibility in supply chains and the ability to track assets without line-of-sight are key factors driving RFID adoption. Wi-Fi and BLE are also gaining traction, especially in indoor positioning systems, but RFID remains dominant because of its cost-effectiveness and reliability.

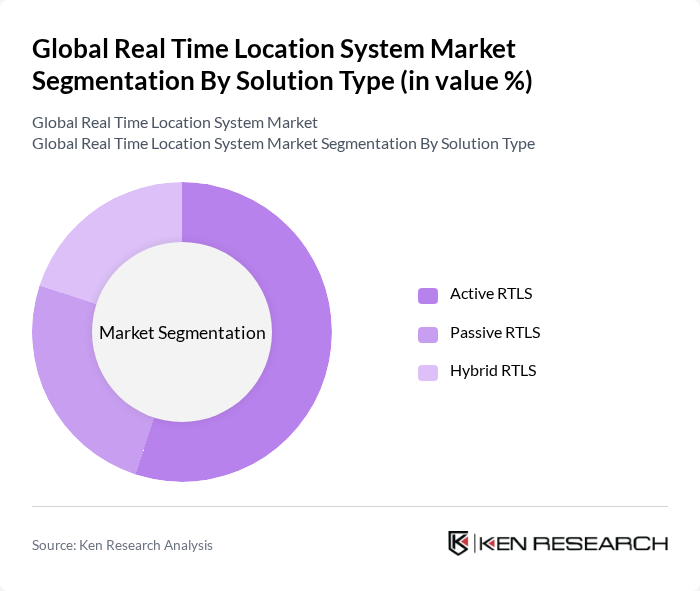

By Solution Type:The solution type segment encompasses Active RTLS, Passive RTLS, and Hybrid RTLS.Active RTLS is currently the leading solution type, favored for its ability to provide continuous, real-time location updates, which is critical for asset and personnel tracking in sectors such as healthcare and manufacturing. Passive RTLS, while less expensive, does not offer the same level of real-time data, limiting its use in high-demand environments. Hybrid RTLS solutions are emerging as a flexible option, combining the strengths of both active and passive systems, but are still in the early stages of market penetration.

The Global Real Time Location System market is characterized by a dynamic mix of regional and international players. Leading participants such as Zebra Technologies Corporation, Siemens AG, Cisco Systems, Inc., Ubisense Group plc, Decawave Ltd. (now part of Qorvo, Inc.), Impinj, Inc., Sonitor Technologies, Inc., Awarepoint Corporation, CenTrak, Inc., Savi Technology, Inc., AiRISTA Flow, Inc., Ekahau, Inc., Mojix, Inc., Identec Solutions AG, Stanley Healthcare (Stanley Black & Decker, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the RTLS market appears promising, driven by technological advancements and increasing integration with AI and machine learning. As organizations prioritize real-time data analytics, the demand for RTLS solutions is expected to rise, particularly in sectors like healthcare and logistics. Furthermore, the expansion of cloud-based services will facilitate easier access to RTLS technologies, enabling businesses to leverage data for enhanced decision-making and operational efficiency, ultimately transforming industry practices.

| Segment | Sub-Segments |

|---|---|

| By Technology | RFID (Radio Frequency Identification) Wi-Fi Bluetooth Low Energy (BLE) Ultra-Wideband (UWB) Infrared GPS |

| By Solution Type | Active RTLS Passive RTLS Hybrid RTLS |

| By End-User Industry | Healthcare Manufacturing Transportation & Logistics Retail Government & Defense Sports & Entertainment |

| By Application | Asset Tracking & Management Personnel/Staff Tracking Inventory Management Fleet Management Workflow & Process Automation |

| By Component | Hardware (Tags, Readers, Sensors) Software (Location Analytics, Integration) Services (Consulting, Deployment, Support) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare RTLS Implementation | 100 | Healthcare Administrators, IT Managers |

| Retail Asset Tracking | 60 | Store Managers, Supply Chain Analysts |

| Manufacturing Process Optimization | 50 | Operations Managers, Production Supervisors |

| Logistics and Supply Chain Management | 70 | Logistics Coordinators, Warehouse Managers |

| Smart Building Solutions | 40 | Facility Managers, Building Automation Specialists |

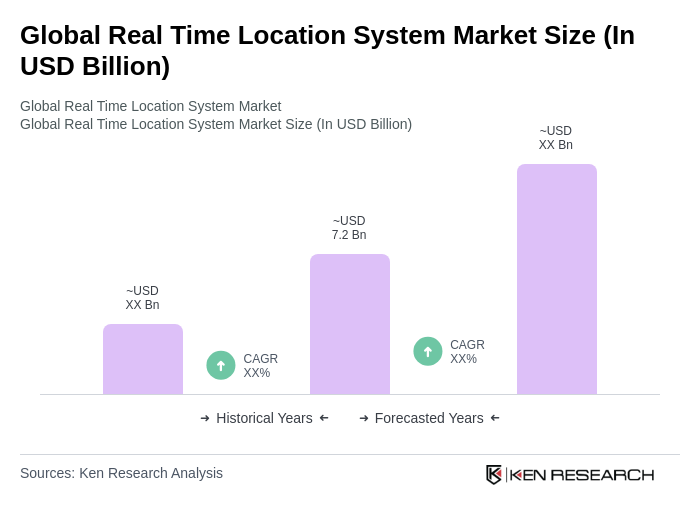

The Global Real Time Location System market is valued at approximately USD 15 billion, driven by the increasing demand for asset tracking and management solutions across various industries, including healthcare, manufacturing, logistics, and retail.