Region:Global

Author(s):Shubham

Product Code:KRAA3147

Pages:89

Published On:August 2025

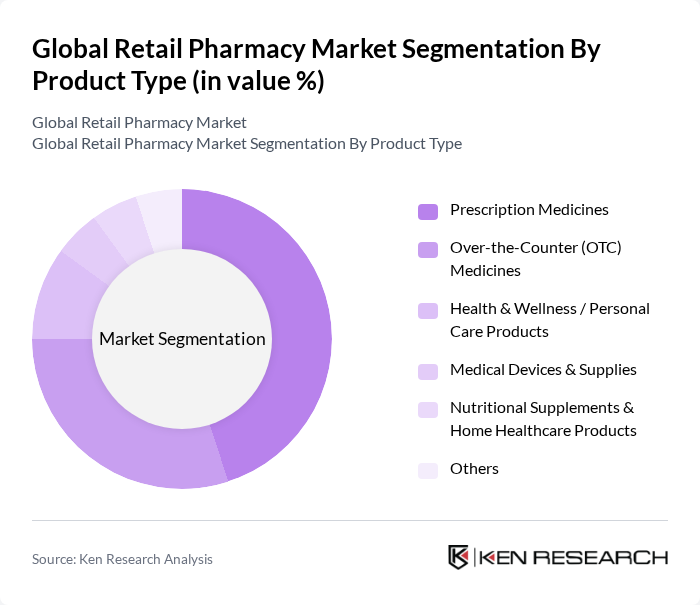

By Product Type:The product type segmentation includes various categories such as Prescription Medicines, Over-the-Counter (OTC) Medicines, Health & Wellness / Personal Care Products, Medical Devices & Supplies, Nutritional Supplements & Home Healthcare Products, and Others. Among these, Prescription Medicines dominate the market due to the increasing prevalence of chronic diseases, the growing aging population, and the rising demand for specialty and chronic care drugs. OTC Medicines also show significant growth as consumers increasingly prefer self-medication for minor ailments, supported by greater health awareness and expanded product offerings in wellness and preventive care .

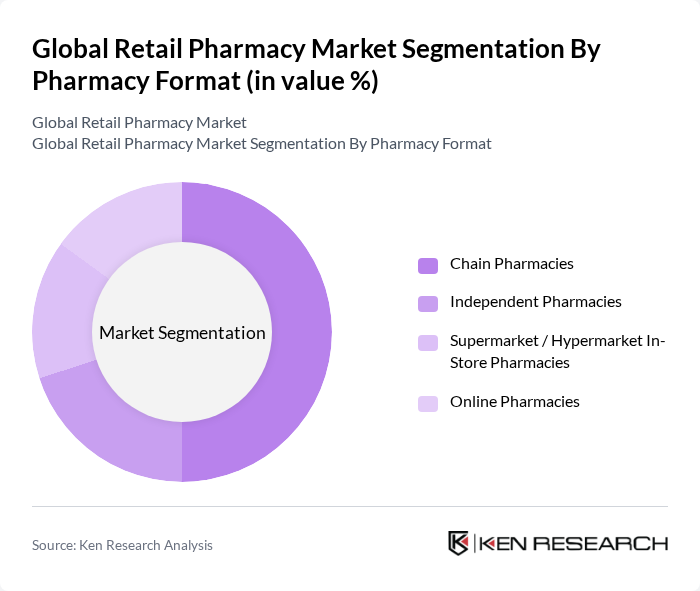

By Pharmacy Format:The pharmacy format segmentation includes Chain Pharmacies, Independent Pharmacies, Supermarket / Hypermarket In-Store Pharmacies, and Online Pharmacies. Chain Pharmacies lead the market due to their extensive networks, economies of scale, and ability to offer competitive pricing and comprehensive healthcare services. The rise of Online Pharmacies is also notable, driven by the convenience of e-commerce, increased digital adoption, and changing consumer preferences towards remote and contactless shopping experiences. Supermarket and hypermarket in-store pharmacies continue to expand, leveraging high footfall and integrated retail offerings .

The Global Retail Pharmacy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Walgreens Boots Alliance, Inc., CVS Health Corporation, Rite Aid Corporation, Walmart Inc., Cigna Corporation (Express Scripts), McKesson Corporation, Cardinal Health, Inc., AmerisourceBergen Corporation (Cencora, Inc.), Boots UK Limited, Apollo Pharmacy (Apollo Hospitals Enterprise Ltd.), MedPlus Health Services Ltd., JD Health International Inc., Matsumoto Kiyoshi Holdings Co., Ltd., DocMorris AG (formerly Zur Rose Group AG), PharmEasy (API Holdings Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the retail pharmacy market is poised for transformation, driven by technological advancements and evolving consumer preferences. As digital health solutions become more integrated into pharmacy services, pharmacies will enhance patient engagement and streamline operations. Additionally, the increasing focus on preventive healthcare will encourage pharmacies to expand their roles in health management, offering services beyond traditional dispensing, thus positioning themselves as essential healthcare partners in the community.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Medicines Over-the-Counter (OTC) Medicines Health & Wellness / Personal Care Products Medical Devices & Supplies Nutritional Supplements & Home Healthcare Products Others |

| By Pharmacy Format | Chain Pharmacies Independent Pharmacies Supermarket / Hypermarket In-Store Pharmacies Online Pharmacies |

| By End-User | Individual Consumers Healthcare Institutions Corporate Clients |

| By Region | North America Europe Asia-Pacific South America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Pharmacy Operations | 100 | Pharmacy Owners, Store Managers |

| Consumer Health Trends | 80 | Healthcare Professionals, Pharmacists |

| Prescription Drug Sales | 90 | Pharmacy Technicians, Sales Representatives |

| OTC Product Insights | 60 | Consumers, Market Researchers |

| Health Supplement Market | 50 | Nutritionists, Retail Buyers |

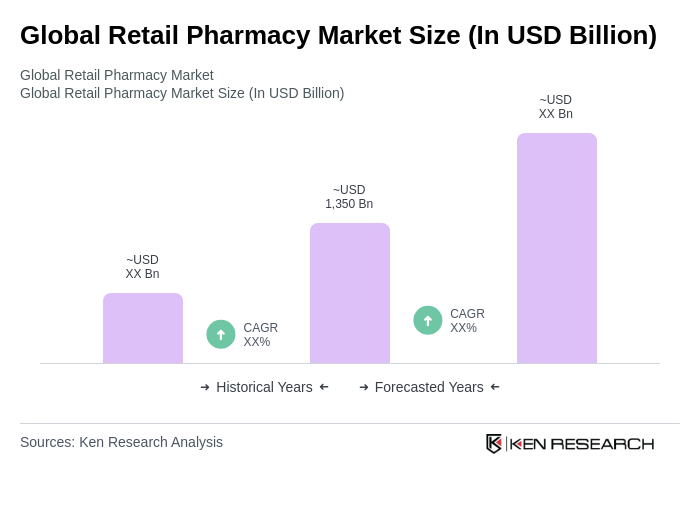

The Global Retail Pharmacy Market is valued at approximately USD 1,350 billion, driven by factors such as the increasing demand for prescription medications, the rise in chronic diseases, and the growing trend of self-medication among consumers.