Region:Global

Author(s):Dev

Product Code:KRAA2609

Pages:82

Published On:August 2025

By Type:The market is segmented into various types of retail ready packaging, including Die-Cut Display Containers, Corrugated Cardboard Boxes, Shrink Wrapped Trays, Folding Cartons, Plastic Containers, Trays, Pallets, Display Boxes, Clamshells, and Others. Among these, Die-Cut Display Containers and Corrugated Cardboard Boxes lead the market due to their versatility, cost-effectiveness, and compatibility with sustainable materials. The increasing demand for eco-friendly packaging solutions is driving growth in these segments, as both retailers and consumers prioritize recyclability and reduced environmental impact. Packaging designs that support efficient shelf stocking and product visibility are particularly favored in the food, beverage, and FMCG sectors .

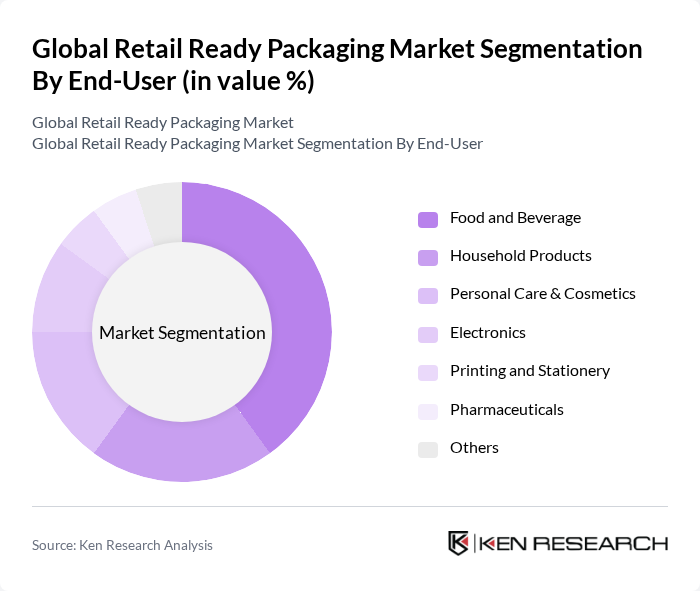

By End-User:The retail ready packaging market is segmented by end-user industries, including Food and Beverage, Household Products, Personal Care & Cosmetics, Electronics, Printing and Stationery, Pharmaceuticals, and Others. The Food and Beverage sector is the largest consumer of retail ready packaging, driven by the need for convenience, attractive presentation, and rapid shelf replenishment. The trend of on-the-go consumption and the expansion of organized retail formats are further propelling demand for innovative packaging solutions in this segment. Other end-users, such as household products and personal care, are also increasing adoption due to the benefits of branding, supply chain efficiency, and sustainability .

The Global Retail Ready Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smurfit Kappa Group, WestRock Company, International Paper Company, Amcor plc, DS Smith Plc, Mondi Group, Packaging Corporation of America, Sonoco Products Company, Sealed Air Corporation, Graphic Packaging Holding Company, Huhtamaki Oyj, Berry Global, Inc., Crown Holdings, Inc., Clondalkin Group Holdings B.V., and Tetra Pak International S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the retail ready packaging market in None appears promising, driven by ongoing innovations and consumer trends. As sustainability becomes a core focus, companies are expected to invest in eco-friendly materials and smart packaging technologies. Additionally, the rise of e-commerce will continue to shape packaging solutions, emphasizing convenience and brand differentiation. Collaborations between manufacturers and retailers will likely enhance product visibility and streamline supply chains, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Die-Cut Display Containers Corrugated Cardboard Boxes Shrink Wrapped Trays Folding Cartons Plastic Containers Trays Pallets Display Boxes Clamshells Others |

| By End-User | Food and Beverage Household Products Personal Care & Cosmetics Electronics Printing and Stationery Pharmaceuticals Others |

| By Sales Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Material | Paperboard Plastic Metal Glass Others |

| By Design | Standard Design Custom Design Eco-friendly Design Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Distribution Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 120 | Packaging Managers, Quality Assurance Specialists |

| Consumer Electronics Packaging | 90 | Product Development Managers, Supply Chain Analysts |

| Personal Care & Cosmetics Packaging | 60 | Brand Managers, Sustainability Coordinators |

| Pharmaceutical Packaging Solutions | 50 | Regulatory Affairs Managers, Production Supervisors |

| Retail Packaging Innovations | 70 | Marketing Directors, R&D Managers |

The Global Retail Ready Packaging Market is valued at approximately USD 90 billion, driven by the demand for efficient packaging solutions that enhance product visibility and streamline supply chain processes.