Global Returnable Transport Packaging Market Overview

- The Global Returnable Transport Packaging Market was valued at approximatelyUSD 122 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for sustainable packaging solutions, rising e-commerce activities, and the need for efficient supply chain management. The shift towards reusable packaging is further accelerated by regulatory mandates, circular economy initiatives, and consumer preferences for eco-friendly products. The adoption of smart technologies such as RFID and IoT tracking is also enhancing operational efficiency and asset management in the sector.

- Key players in this market include the United States, Germany, and China, which dominate due to their robust manufacturing sectors, advanced logistics infrastructure, and significant investments in sustainable practices. The presence of major automotive, food & beverage, and consumer goods companies in these regions further strengthens their market position, as they increasingly adopt returnable transport packaging to optimize operations and reduce waste. Asia-Pacific leads the market by revenue share, driven by rapid industrialization and government support for sustainable packaging, while Europe and North America remain major innovation hubs.

- In 2023, the European Union implemented thePackaging and Packaging Waste Directive (Directive (EU) 2018/852), issued by the European Parliament and Council, which mandates that all packaging placed on the market must be reusable or recyclable by 2030. This regulation aims to reduce packaging waste and promote a circular economy, significantly impacting the returnable transport packaging market by compelling companies to adopt sustainable and reusable packaging solutions. The Directive covers operational requirements for design, labeling, and recovery, with compliance monitored by national authorities.

Global Returnable Transport Packaging Market Segmentation

By Type:The returnable transport packaging market is segmented into various types, including pallets, containers, crates, dunnage, bulk bins, returnable totes, drums & barrels, racks, reusable sacks, and others. Among these,palletsandcontainersare the most widely used due to their versatility, durability, and efficiency in handling goods across industries such as automotive, food & beverage, and retail. The demand for these types is driven by their ability to reduce waste, lower transportation costs, and support closed-loop logistics. The integration of smart tracking technologies is further enhancing the utility and management of these packaging formats.

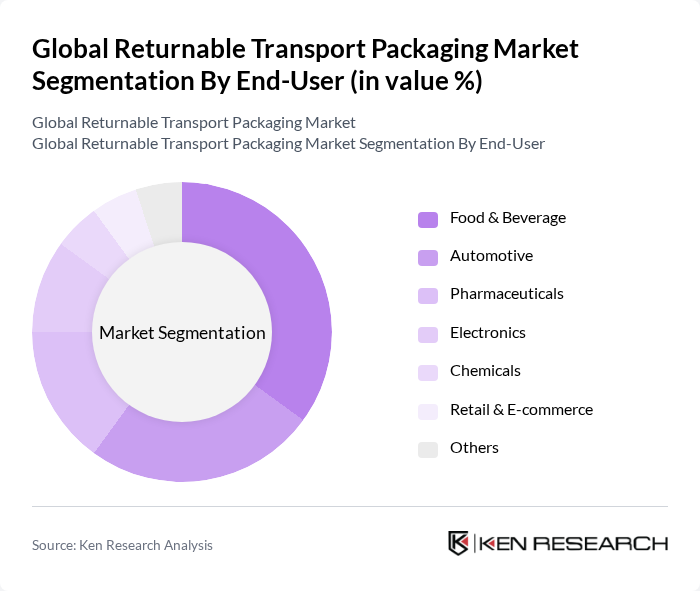

By End-User:The end-user segmentation includes food & beverage, automotive, pharmaceuticals, electronics, chemicals, retail & e-commerce, and others. Thefood & beveragesector is the largest consumer of returnable transport packaging, driven by strict food safety regulations, traceability requirements, and the need for efficient, hygienic logistics. Theautomotiveindustry is another major contributor, leveraging reusable packaging to streamline supply chains, reduce costs, and support sustainability goals. Electronics and pharmaceuticals are also rapidly adopting RTP solutions to ensure product integrity and regulatory compliance.

Global Returnable Transport Packaging Market Competitive Landscape

The Global Returnable Transport Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schoeller Allibert, IFCO Systems, Brambles Limited, Toyota Tsusho Corporation, ORBIS Corporation, Rehrig Pacific Company, A.P. Moller - Maersk, Kuehne + Nagel, CHEP, SSI Schaefer, DS Smith, Smurfit Kappa Group, Mondi Group, Stora Enso, Menasha Corporation, Greif, Inc., Mauser Packaging Solutions, Berry Global, Inc., Schuetz GmbH & Co. KGaA, Myers Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Returnable Transport Packaging Market Industry Analysis

Growth Drivers

- Increased Focus on Sustainability:The global push for sustainability is driving the returnable transport packaging market. In future, the global green packaging market is projected to reach $500 billion, with a significant portion attributed to reusable packaging solutions. Companies are increasingly adopting sustainable practices, with 70% of consumers willing to pay more for eco-friendly products. This trend is supported by government initiatives aimed at reducing plastic waste, further propelling the demand for returnable transport packaging solutions.

- Rising Demand for Cost-Effective Logistics Solutions:The logistics sector is under pressure to reduce costs while maintaining efficiency. In future, the global logistics market is expected to exceed $10 trillion, with returnable transport packaging offering significant savings. By utilizing reusable packaging, companies can reduce shipping costs by up to 30% and minimize waste disposal expenses. This financial incentive is driving businesses to adopt returnable transport packaging as a viable solution to enhance their logistics operations.

- Expansion of E-commerce and Retail Sectors:The e-commerce sector is projected to reach $6 trillion in sales in future, significantly impacting packaging needs. As online shopping grows, the demand for efficient and sustainable packaging solutions increases. Retailers are seeking returnable transport packaging to streamline their supply chains and reduce environmental impact. This shift is evident, with 60% of retailers planning to implement reusable packaging solutions to meet consumer expectations for sustainability and efficiency.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the returnable transport packaging market is the high initial investment required for implementation. Companies may need to invest significantly in infrastructure and training, with estimates suggesting that initial costs can range from $100,000 to $1 million depending on the scale of operations. This financial barrier can deter smaller businesses from adopting returnable solutions, limiting market growth potential.

- Limited Awareness Among End-Users:Despite the benefits of returnable transport packaging, there remains a significant knowledge gap among end-users. A survey indicated that over 40% of businesses are unaware of the advantages of reusable packaging. This lack of awareness can hinder adoption rates, as companies may not fully understand the long-term cost savings and environmental benefits associated with returnable transport solutions, impacting overall market growth.

Global Returnable Transport Packaging Market Future Outlook

The future of the returnable transport packaging market appears promising, driven by increasing consumer demand for sustainable practices and the ongoing expansion of e-commerce. As companies prioritize cost-effective logistics solutions, the adoption of returnable packaging is expected to rise. Innovations in biodegradable materials and smart packaging technologies will further enhance market dynamics, enabling businesses to meet regulatory requirements and consumer expectations. The integration of IoT in packaging will also facilitate better tracking and efficiency in supply chains, shaping the future landscape of the industry.

Market Opportunities

- Growth in Emerging Markets:Emerging markets present significant opportunities for the returnable transport packaging sector. With a projected GDP growth rate of 5% in regions like Southeast Asia, businesses are increasingly investing in sustainable packaging solutions. This growth is driven by rising consumer awareness and government initiatives promoting eco-friendly practices, creating a favorable environment for returnable packaging adoption.

- Innovations in Biodegradable Materials:The development of biodegradable materials is a key opportunity for the returnable transport packaging market. In future, the biodegradable packaging market is expected to reach $300 billion, driven by innovations that enhance material performance. Companies investing in these materials can differentiate themselves in the market, appealing to environmentally conscious consumers and aligning with global sustainability goals.