Region:Global

Author(s):Geetanshi

Product Code:KRAA2767

Pages:81

Published On:August 2025

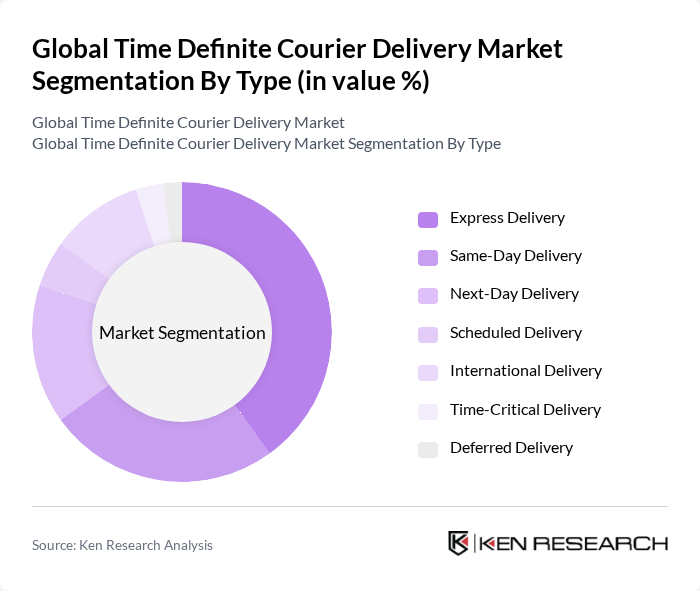

By Type:The market is segmented into various types of delivery services, includingExpress Delivery, Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, International Delivery, Time-Critical Delivery, and Deferred Delivery. Each of these sub-segments caters to different customer needs and preferences, with Express Delivery being the most sought after due to its speed and reliability. Express Delivery is distinguished by guaranteed timeframes and advanced tracking, while Same-Day and Next-Day Delivery are increasingly popular for urban and e-commerce shipments. Scheduled and Deferred Delivery options serve business clients with flexible logistics requirements .

TheExpress Deliverysub-segment dominates the market due to the increasing consumer demand for rapid delivery services, particularly in urban areas. This trend is driven by the growth of e-commerce, where customers expect their orders to arrive within hours. The convenience and reliability of express services have made them the preferred choice for both businesses and consumers, leading to a significant market share. Companies are investing heavily in logistics technology, including AI-driven route optimization and automated fulfillment, to enhance their express delivery capabilities .

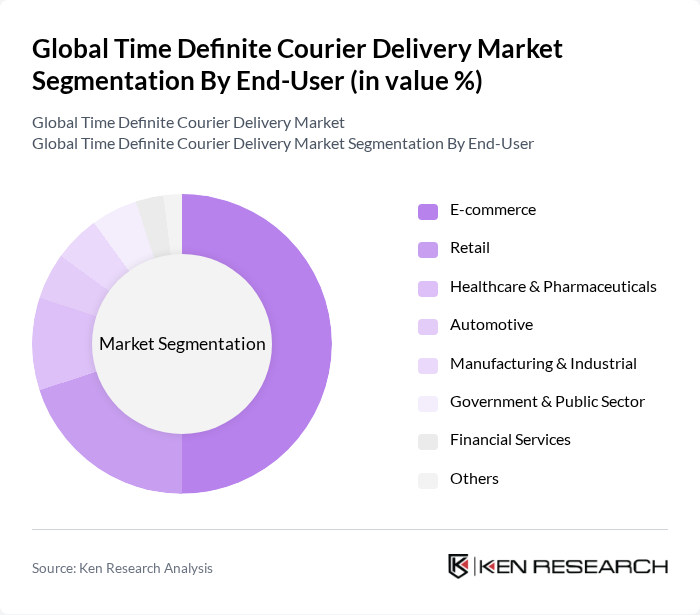

By End-User:The market is segmented by end-user industries, includingE-commerce, Retail, Healthcare & Pharmaceuticals, Automotive, Manufacturing & Industrial, Government & Public Sector, Financial Services, and Others. The E-commerce sector is the largest end-user, driving demand for time-definite courier services due to the need for fast and reliable delivery options. Healthcare & Pharmaceuticals require stringent delivery timelines for temperature-sensitive and critical shipments, while Automotive and Manufacturing segments utilize time-definite services for just-in-time inventory and production support .

TheE-commercesector is the leading end-user of time-definite courier services, accounting for a substantial market share. This dominance is attributed to the rapid growth of online shopping, where consumers expect quick delivery times. Retailers are increasingly relying on courier services to meet customer expectations for fast shipping, which has led to a surge in demand for time-definite delivery options. The convenience of online shopping combined with efficient delivery services has solidified E-commerce's position as the primary driver of market growth. Healthcare & Pharmaceuticals also show strong adoption due to the need for temperature-controlled and urgent deliveries .

The Global Time Definite Courier Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Express, FedEx Corporation, UPS (United Parcel Service), TNT Express, Aramex, DB Schenker, XPO Logistics, DPDgroup (GeoPost), YRC Worldwide (now Yellow Corporation), GLS (General Logistics Systems), Blue Dart Express, Japan Post Holdings, Royal Mail Group, Canada Post Corporation, La Poste (Groupe La Poste), C.H. Robinson Worldwide, SF Express, Yamato Holdings, Singapore Post, Australia Post contribute to innovation, geographic expansion, and service delivery in this space.

The future of the time definite courier delivery market appears promising, driven by the ongoing digital transformation and the increasing emphasis on customer-centric services. As e-commerce continues to expand, companies are likely to invest in innovative delivery solutions, including automated systems and enhanced tracking technologies. Furthermore, the growing focus on sustainability will push logistics providers to adopt eco-friendly practices, ensuring compliance with evolving regulations while meeting consumer demand for responsible delivery options.

| Segment | Sub-Segments |

|---|---|

| By Type | Express Delivery Same-Day Delivery Next-Day Delivery Scheduled Delivery International Delivery Time-Critical Delivery Deferred Delivery |

| By End-User | E-commerce Retail Healthcare & Pharmaceuticals Automotive Manufacturing & Industrial Government & Public Sector Financial Services Others |

| By Delivery Mode | Ground Delivery Air Delivery Sea Delivery Rail Delivery Drone Delivery Others |

| By Package Size | Small Packages (up to 2kg) Medium Packages (2-20kg) Large Packages (20-70kg) Oversized Packages (>70kg) |

| By Pricing Model | Flat Rate Pricing Variable Pricing (Distance/Weight-Based) Subscription-Based Pricing Dynamic Pricing Others |

| By Customer Type | B2B (Business-to-Business) B2C (Business-to-Consumer) C2C (Consumer-to-Consumer) Others |

| By Service Level | Standard Service Premium Service Economy Service Value-Added Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Courier Services | 120 | Operations Managers, Logistics Coordinators |

| International Express Delivery | 90 | Export Managers, Supply Chain Analysts |

| Last-Mile Delivery Solutions | 60 | Last-Mile Managers, Delivery Fleet Supervisors |

| Healthcare Logistics | 50 | Pharmaceutical Supply Chain Managers, Compliance Officers |

| E-commerce Fulfillment Services | 70 | eCommerce Operations Managers, Customer Experience Directors |

The Global Time Definite Courier Delivery Market is valued at approximately USD 117 billion, driven by the increasing demand for fast and reliable delivery services, particularly in the e-commerce sector.