Region:Asia

Author(s):Harsh Saxena

Product Code:KR1565

Pages:94

Published On:January 2026

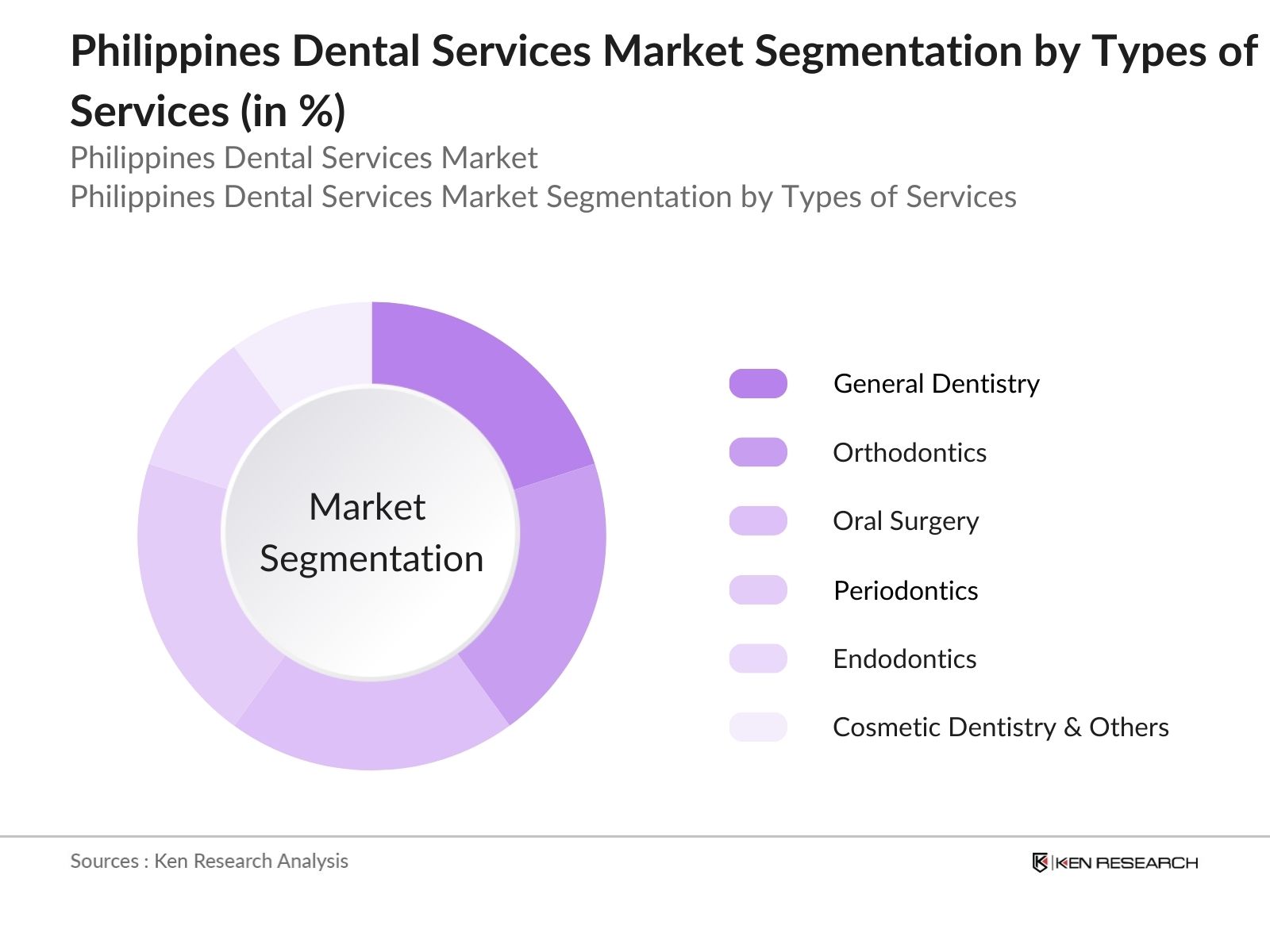

By Types of Services:The Philippines Dental Services Market is segmented into General Dentistry, Orthodontics, Oral Surgery, Periodontics, Endodontics, Cosmetic Dentistry & Others. General Dentistry continues to be the primary segment, offering foundational services such as check-ups, fillings, and preventive care. Orthodontics is a key subsegment focused on corrective procedures like braces and aligners. Oral Surgery and Endodontics cater to complex dental needs, including extractions and root canals, while Periodontics addresses gum-related issues. Cosmetic Dentistry is expanding steadily as demand rises for teeth whitening, veneers, and other aesthetic procedures.

By Revenue Division:The Philippines Dental Services Market can also be segmented by revenue sources, including Domestic Clients and International Tourists. Domestic Clients form the primary revenue base, driven by regular oral care needs and routine check-ups. International Tourists represent a growing segment, as many seek high-quality, cost-effective dental treatments abroad—particularly for procedures like implants, cosmetic enhancements, and full-mouth restorations.

The Philippines Dental Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as MetroDental, GAOC (Gan Advanced Osseointegration Center), Smile Makers Dental, Urban Smiles, and NovoDental, contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines dental services market is poised for growth, driven by increasing awareness of oral health and rising disposable incomes. The trend towards preventive care is expected to gain momentum, with more individuals seeking regular check-ups and treatments. Additionally, the integration of digital solutions and tele-dentistry will enhance service delivery, making dental care more accessible. As the market evolves, partnerships with international organizations may further improve service quality and expand offerings, addressing existing challenges and enhancing patient care.

| Segment | Sub-Segments |

|---|---|

| By Types of Services | StartFragment General Dentistry Orthodontics Oral Surgery Periodontics Endodontics Cosmetic Dentistry Prosthodontics Dental Implants Pediatric Dentistry and Others EndFragment |

| ByStartFragmentRevenue DivisionEndFragment | StartFragment Domestic International Tourist EndFragment |

| ByStartFragmentEnd UsersEndFragment | StartFragment Dental Clinics (Organised + Unorganised) Hospitals (Public + Private) EndFragment |

| ByStartFragmentDental ClinicsEndFragment | StartFragment Unorganised Organised EndFragment |

| ByStartFragmentCitiesEndFragment | StartFragment Manila Davao Cebu StartFragmentIloilo & OthersEndFragment EndFragment |

| ByStartFragmentAge Group | StartFragment 15-30 Age Group 30-55 Age Group Above 55 Age Below 15 Age EndFragment |

| ByStartFragmentGenderEndFragment | StartFragment Female Male EndFragment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Services | 120 | Dentists, Clinic Managers |

| Cosmetic Dentistry | 100 | Cosmetic Dentists, Marketing Managers |

| Pediatric Dentistry | 80 | Pediatric Dentists, Parents of Young Patients |

| Dental Hygiene Services | 70 | Dental Hygienists, Clinic Owners |

| Dental Tourism | 60 | Travel Agents, Dental Tour Coordinators |

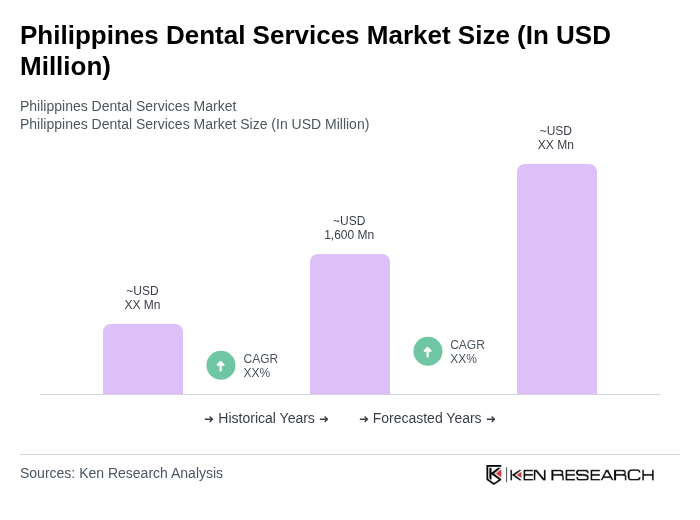

The Philippines Dental Services Market is valued at approximately USD 1,600 million, reflecting significant growth driven by increased awareness of oral health, rising disposable incomes, and advancements in dental technology.