Region:Asia

Author(s):Geetanshi

Product Code:KRAB2750

Pages:92

Published On:October 2025

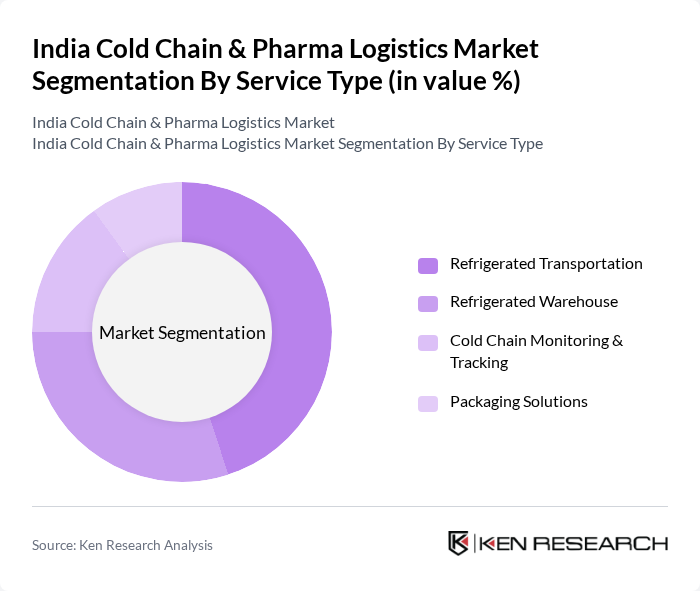

By Service Type:The service type segmentation includes various subsegments such as Refrigerated Transportation, Refrigerated Warehouse, Cold Chain Monitoring & Tracking, and Packaging Solutions. Among these, Refrigerated Transportation is the leading subsegment, driven by the increasing demand for timely delivery of temperature-sensitive pharmaceuticals and food products. The rise in e-commerce and online grocery shopping has further fueled the need for efficient refrigerated transport solutions, with transportation services commanding a significant share in healthcare cold chain logistics.

By Application:The application segmentation encompasses Vaccines, Biologics & Biosimilars, Gene Therapies, Specialty Drugs, Blood & Blood Products, and Clinical Trial Materials. Vaccines are the dominant application in this market, primarily due to the ongoing vaccination drives and the need for stringent temperature control during transportation and storage. The expansion of biosimilars, gene therapies, and specialty drugs has further increased the focus on vaccine distribution, with India's role as a major vaccine exporter strengthening this segment's market leadership.

The India Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Snowman Logistics Ltd., Gati Ltd., Blue Dart Express Ltd., Mahindra Logistics Ltd., TCI Cold Chain Solutions, DHL Supply Chain India, Allcargo Logistics Ltd., Future Supply Chain Solutions Ltd., Delhivery Ltd., Aegis Logistics Ltd., Kuehne + Nagel India Pvt. Ltd., FedEx India, UPS Supply Chain Solutions India, DB Schenker India Pvt. Ltd., Cold Chain Technologies India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cold chain and pharma logistics market appears promising, driven by technological advancements and increasing investments in infrastructure. The integration of IoT and automation is expected to enhance operational efficiency, while government initiatives will likely continue to support the expansion of cold chain networks. As consumer awareness of product safety grows, companies will need to adapt to these trends to remain competitive and meet the evolving demands of the market.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Refrigerated Transportation Refrigerated Warehouse Cold Chain Monitoring & Tracking Packaging Solutions |

| By Application | Vaccines Biologics & Biosimilars Gene Therapies Specialty Drugs Blood & Blood Products Clinical Trial Materials |

| By Temperature Type | Frozen (-15°C to -25°C) Chilled (2°C to 8°C) Controlled Room Temperature (15°C to 25°C) Ultra-Low Temperature (-70°C to -80°C) |

| By Technology | Dry Ice Gel Packs Eutectic Plates Liquid Nitrogen Phase Change Materials |

| By End-User | Pharmaceutical Companies Biotechnology Companies Research Institutions Hospitals & Healthcare Providers Government Health Agencies |

| By Region | North India (Delhi, Punjab, Haryana, Uttar Pradesh) West India (Maharashtra, Gujarat, Rajasthan) South India (Karnataka, Tamil Nadu, Telangana, Andhra Pradesh) East India (West Bengal, Odisha, Jharkhand) |

| By Distribution Channel | Direct Distribution Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Integrated Logistics Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 120 | Logistics Managers, Supply Chain Executives |

| Temperature-Controlled Storage Solutions | 85 | Facility Managers, Operations Directors |

| Distribution Network Optimization | 75 | Transport Managers, Distribution Analysts |

| Regulatory Compliance in Pharma Logistics | 65 | Quality Assurance Managers, Compliance Officers |

| Emerging Technologies in Cold Chain | 80 | IT Managers, Innovation Leads |

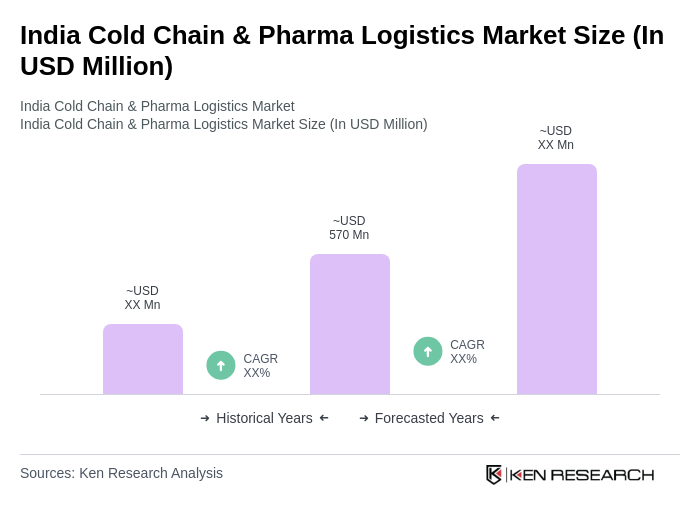

The India Cold Chain & Pharma Logistics Market is valued at approximately USD 570 million, driven by the increasing demand for temperature-sensitive pharmaceuticals and advancements in cold chain technology.