Region:Central and South America

Author(s):Rebecca

Product Code:KRAB2858

Pages:92

Published On:October 2025

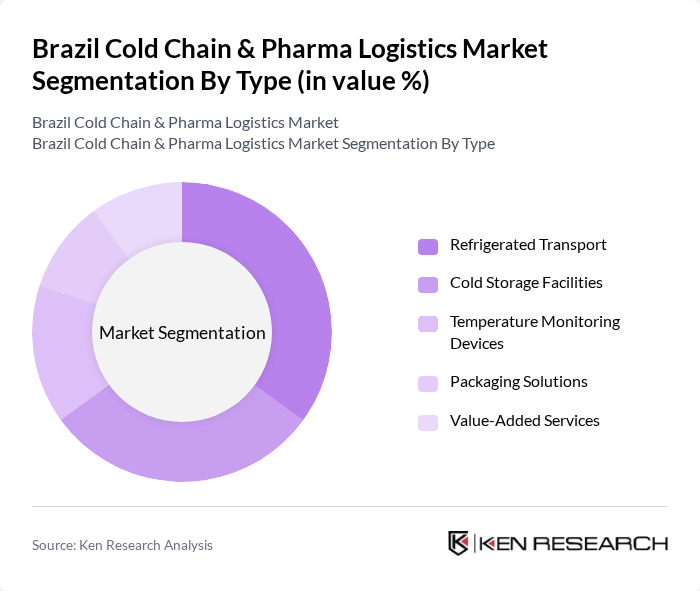

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature Monitoring Devices, Packaging Solutions, and Value-Added Services. Each of these segments plays a crucial role in maintaining the integrity of temperature-sensitive products throughout the supply chain, with storage facilities representing the largest revenue-generating segment while transportation services demonstrate the fastest growth trajectory driven by e-commerce expansion and last-mile delivery requirements.

The Refrigerated Transport segment is currently dominating the market due to the increasing need for efficient and reliable transportation of temperature-sensitive pharmaceuticals. This segment benefits from advancements in logistics technology, which enhance tracking and monitoring capabilities, ensuring that products remain within required temperature ranges during transit. The growing demand for home delivery of medications and the expansion of e-commerce in the pharmaceutical sector further bolster this segment's growth, particularly as Brazil's beef export recovery and pharmaceutical distribution networks require sophisticated temperature-controlled transportation solutions.

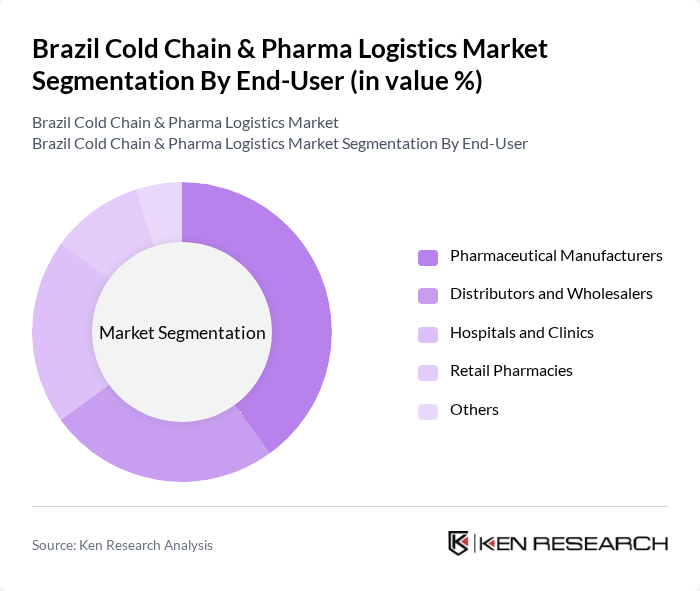

By End-User:The market is segmented by end-users, including Pharmaceutical Manufacturers, Distributors and Wholesalers, Hospitals and Clinics, Retail Pharmacies, and Others. Each end-user category has unique requirements and contributes differently to the overall market dynamics, with pharmaceutical manufacturers leading demand due to stringent regulatory compliance requirements and the growing biopharmaceutical sector in Brazil.

The Pharmaceutical Manufacturers segment leads the market, driven by the need for stringent temperature control during the production and distribution of drugs. This segment is characterized by high investments in cold chain logistics to ensure compliance with regulatory standards and maintain product efficacy. The increasing number of pharmaceutical companies in Brazil and the growing focus on biopharmaceuticals further enhance the demand from this segment, supported by Brazil's position as a key pharmaceutical manufacturing hub in Latin America and the expansion of temperature-sensitive drug categories including vaccines and biologics.

The Brazil Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, FedEx Logistics, UPS Healthcare, Agility Logistics, Friozem Armazéns Frigoríficos, SuperFrio Armazéns Gerais, Comfrio Soluções Logísticas, Localfrio, Lineage Logistics, Americold, Brasfrigo, Arfrio Armazéns Gerais Frigoríficos, Ransa Comercial S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's cold chain and pharma logistics market appears promising, driven by technological advancements and increasing regulatory support. The adoption of IoT solutions for real-time monitoring is expected to enhance operational efficiency and reduce waste. Additionally, as the government continues to invest in healthcare infrastructure, logistics providers will likely expand their services to underserved regions, ensuring broader access to temperature-sensitive pharmaceuticals. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature Monitoring Devices Packaging Solutions Value-Added Services |

| By End-User | Pharmaceutical Manufacturers Distributors and Wholesalers Hospitals and Clinics Retail Pharmacies Others |

| By Distribution Mode | Road Transport Air Transport Sea Transport Rail Transport Others |

| By Application | Vaccines Blood Products Biologics Pharmaceuticals Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Regulatory Compliance | ANVISA Compliance ISO Standards Good Distribution Practices (GDP) Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Directors, Supply Chain Managers |

| Cold Chain Technology Providers | 60 | Product Managers, Technical Directors |

| Healthcare Facility Supply Chain | 50 | Procurement Officers, Operations Managers |

| Regulatory Compliance in Pharma Logistics | 40 | Compliance Officers, Quality Assurance Managers |

| Vaccine Distribution Networks | 50 | Public Health Officials, Logistics Coordinators |

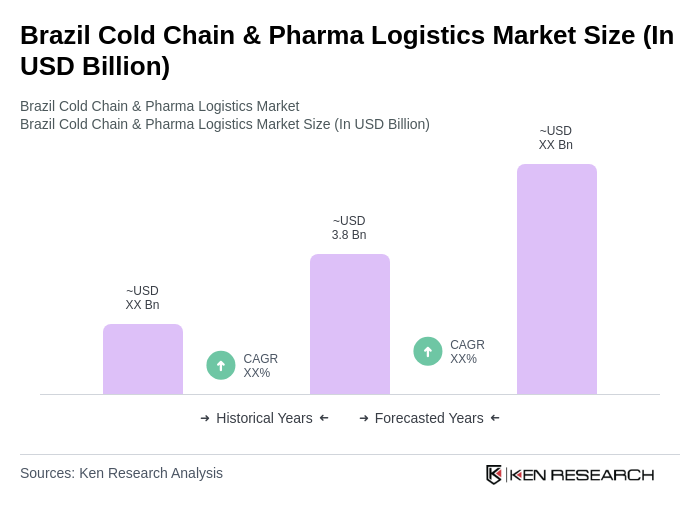

The Brazil Cold Chain & Pharma Logistics Market is valued at approximately USD 3.8 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals and advancements in logistics technology that enhance operational efficiency and supply chain visibility.